PNC Bank 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This Financial Review should be read in conjunction with

The PNC Financial Services Group, Inc. and subsidiaries’

(“Corporation” or “ PNC” ) Consolidated Financial State-

ments and Statistical Information included herein. For

information regarding business risks, see the Risk Manage-

ment and Risk Factors sections in this Financial Review.

Also, see the Forward-Looking Statements section in this

Financial Review for other factors that could cause actual

results to differ materially from forward-looking statements

or historical performance.

OV E RV I E W

TH E PNC FI N A N C I A L SE RV I C E S GR O U P, IN C .

The Corporation is one of the largest diversified financial

services companies in the United States, operating commu-

nity banking, corporate banking, real estate finance, asset-

based lending, wealth management, asset management and

global fund services businesses. The Corporation provides

certain products and services nationally and others in PNC’s

primary geographic markets in Pennsylvania, New Jersey,

Delaware, Ohio and Kentucky. The Corporation also pro-

vides certain products and services internationally.

Financial services organizations today are challenged

to demonstrate that they can generate sustainable and con-

sistent earnings growth in an increasingly competitive and

volatile environment. PNC has responded to these chal-

lenges by aggressively pursuing strategies designed to

achieve more consistent results. These strategies include

repositioning leverage-based businesses and improving the

earnings stream by building a diverse group of higher-

valuation businesses. Increasing contributions from growth

businesses, including asset management and processing and

the fee-based segments within PNC’s banking franchise, have

strengthened the Corporation’s revenue and earnings mix. In

addition, the Corporation seeks to enhance consolidated

value by leveraging technology, information, branding, mar-

keting and financial resources across all businesses.

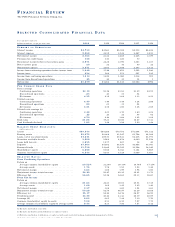

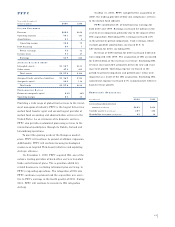

As a result of these strategies, PNC’s financial charac-

teristics have changed significantly over the past five years.

N o n i n t e r est income grew 23% annualized during this time

period while net interest income decreased by appro x i m a t e l y

$300 million and total assets declined by $3.4 billion.

N o n i n t e rest income to total revenue increased from 36% in

1996 to 59% in 2000. The loan to deposit ratio impro v e d

f r om 113% to 106% as a result of exiting lower- r e t u r n lend-

ing businesses, while growing the deposit franchise. Over

this period, re t u rn on average common shareholders’ equity

i m p roved from 17% to 22% .

As part of this transition, the Corporation implemented

a number of initiatives designed to improve the risk/return

characteristics of its lending businesses. These included the

sale of the credit card business and exiting or downsizing

certain non-strategic lending businesses.

On October 2, 2000, PNC announced that it reached a

definitive agreement to sell its residential mortgage banking

business. The capital made available by the sale will be

redeployed in a number of ways, which may include repur-

chasing common stock, continuing to reduce balance sheet

leverage, reducing debt and making targeted investments in

higher-growth businesses. The amount of capital available

for redeployment and the income statement impact of the

sale will depend on fair market values and other factors,

and will not be determined until final settlement. The trans-

action closed on January 31, 2001.

PNC also expanded its fee-based services by acquiring

Investor Services Group (“ISG”) in December 1999. The

combination of ISG with PFPC, the Corporation’s global

fund services subsidiary, created one of the nation’s leading

full-service processors for pooled investment products.

Other strategic acquisitions during 2000 included

Automated Business Development Corp. (“ABD”), the lead-

ing provider of blue sky compliance services to the mutual

fund industry, Univest Financial Group LLC (“Univest” ), a

privately held provider of technology and data management

services to the commercial real estate finance industry, and

the origination and servicing business of U.B. Vehicle

Leasing Inc.

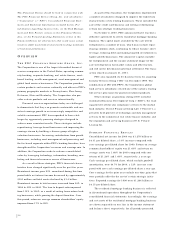

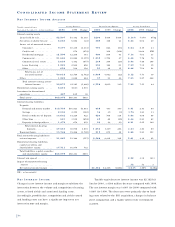

SU M M A R Y FI N A N C I A L RE S U LT S

Consolidated net income for 2000 was $1.279 billion or

$4.31 per diluted share, a 10% increase compared with

core earnings per diluted share for 1999. Return on average

common shareholders’ equity was 21.63% and return on

average assets was 1.68% for 2000 compared with core

returns of 21.24% and 1.60% , respectively, a year ago.

Cash earnings per diluted share, which exclude goodwill

amortization, were $4.70 for 2000, a 12% increase com-

pared with core cash earnings per diluted share a year ago.

Core earnings for the prior year exclude one-time gains that

were partially offset by the cost of certain strategic initia-

tives. Reported earnings for 1999 were $1.264 billion or

$4.15 per diluted share.

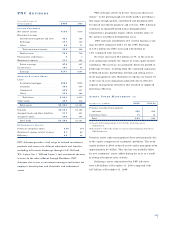

The residential mortgage banking business is reflected

in discontinued operations throughout the Corporation’s

consolidated financial statements. Accordingly, the earnings

and net assets of the residential mortgage banking business

are shown separately on one line in the income statement

and balance sheet, respectively, for all periods presented.

34