PNC Bank 2000 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

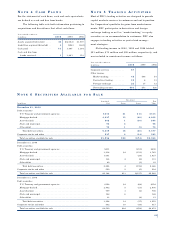

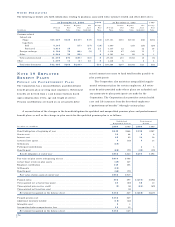

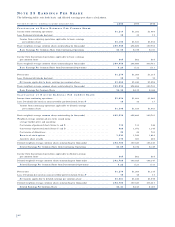

NO T E 9 AL L O WA N C E F O R

CR E D I T LO S S E S

Changes in the allowance for credit losses were as follows:

In millions 2000 1999 1998

January 1 . . . . . . . . . . . . . . . . . $674 $753 $972

Charge-offs . . . . . . . . . . . . . . . . (186) (216) (524)

Recoveries . . . . . . . . . . . . . . . . 51 55 77

Net charge-offs . . . . . . . . . . . (135) (161) (447)

Provision for credit losses . . . . . 136 163 225

Sale of credit card business . . . (81)

Acquisitions . . . . . . . . . . . . . . . 3

December 31 . . . . . . . . . . . . $675 $674 $753

Impaired loans totaling $316 million and $241 million at

December 31, 2000 and 1999, respectively, had a corre-

sponding specific allowance for credit losses of $76 million

and $60 million. The average balance of impaired loans was

$277 million in 2000, $243 million in 1999, and $223 mil-

lion in 1998. There was no interest income recognized on

impaired loans in 2000 and 1999. Interest income recog-

nized on impaired loans in 1998 was $1 million.

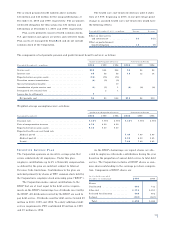

NO T E 1 0 PR E M I S E S , E Q U I P M E N T

A N D LE A S E H O L D IM P R O V E M E N T S

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were

as follows:

December 31 - in millions 2000 1999

Land . . . . . . . . . . . . . . . . . . . . . . $86 $83

Buildings . . . . . . . . . . . . . . . . . . . . 456 427

Equipment . . . . . . . . . . . . . . . . . . . 1,373 1,338

Leasehold improvements . . . . . . . . . 190 208

Total . . . . . . . . . . . . . . . . . . . . . . 2,105 2,056

Accumulated depreciation and

amortization . . . . . . . . . . . . . . . . (1,069) (1,154)

Net book value . . . . . . . . . . . . . . $1,036 $902

Depreciation and amortization expense on premises, equip-

ment and leasehold improvements totaled $149 million in

2000, $204 million in 1999 and $149 million in 1998.

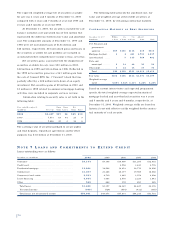

Certain facilities and equipment are leased under

agreements expiring at various dates through the year 2071.

Substantially all such leases are accounted for as operating

leases. Rental expense on such leases amounted to

$148 million in 2000, $132 million in 1999 and $101 mil-

lion in 1998.

At December 31, 2000 and 1999, required minimum

annual rentals due on noncancelable leases having terms in

excess of one year aggregated $684 million and $749 mil-

lion, respectively. Minimum annual rentals for each of the

years 2001 through 2005 are $106 million, $97 million,

$89 million, $77 million and $66 million, respectively.

During 1999, PNC made the decision to sell various

branches and office buildings. Buildings that were designat-

ed for sale, but not sold during 1999 are classified as held

for sale. Initial write-downs were recorded in noninterest

expense and generally reflected the difference between book

value and appraised value less selling costs. Write-downs

totaled $35 million and subsequent net gains from disposals

totaled $8 million in 1999.

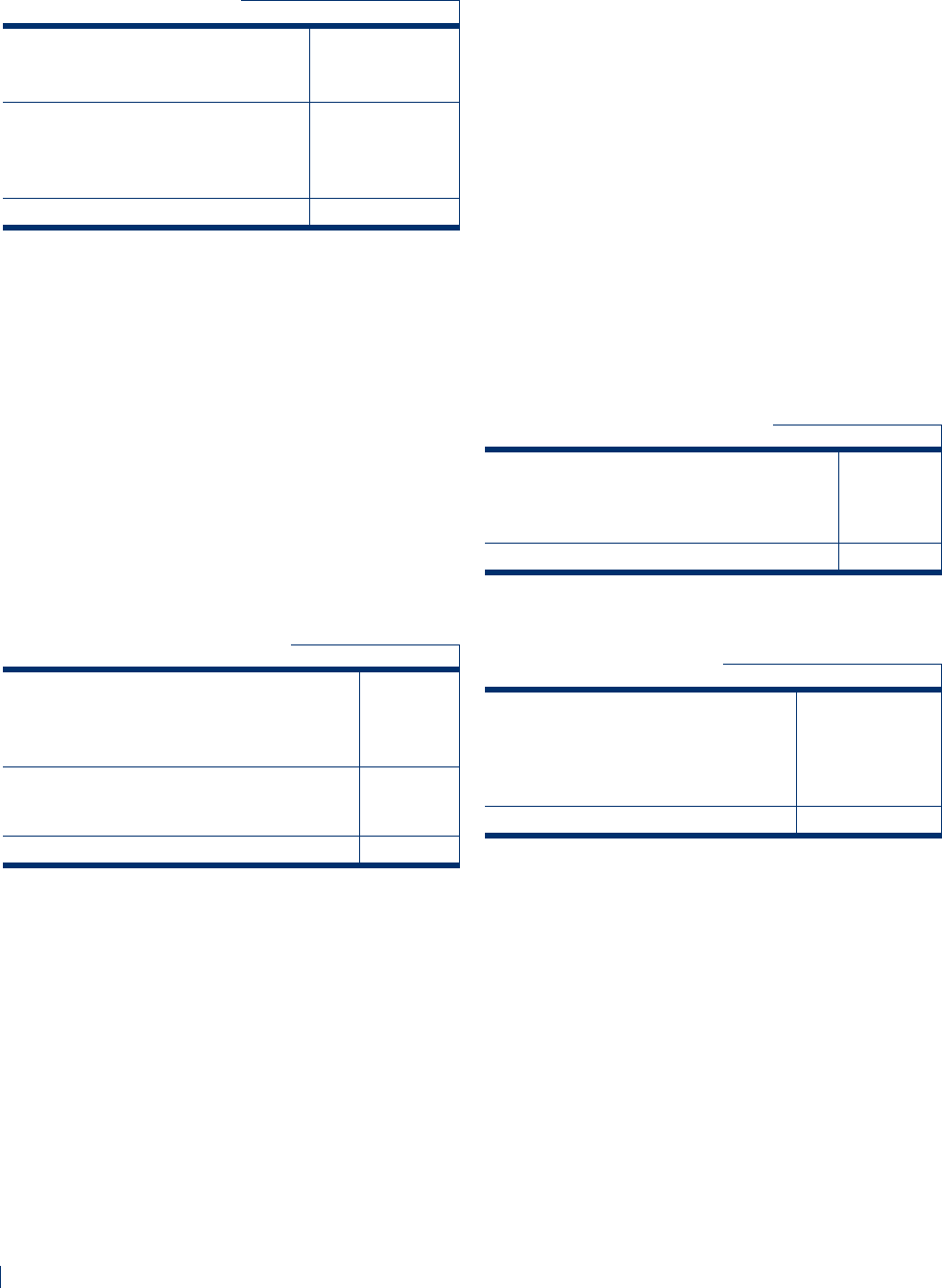

NO T E 1 1 GO O D W I L L A N D OT H E R

AM O R T I Z A B L E AS S E T S

Goodwill and other amortizable assets, net of amortization,

consisted of the following:

December 31 - in millions 2000 1999

Goodwill . . . . . . . . . . . . . . . . . . . . . $2,155 $2,222

Customer-related intangibles . . . . . . 157 165

Commercial mortgage

servicing rights . . . . . . . . . . . . . . 156 125

Total . . . . . . . . . . . . . . . . . . . . . . $2,468 $2,512

Amortization of goodwill and other amortizable assets was

as follows:

Year ended December 31 - in millions 2000 1999 1998

Goodwill . . . . . . . . . . . . . . . . . $116 $80 $67

Purchased credit cards . . . . . . . 6 36

Commercial mortgage

servicing rights . . . . . . . . . . . 18 20 12

Other . . . . . . . . . . . . . . . . . . (6) 6 7

Total . . . . . . . . . . . . . . . . . . $128 $112 $122

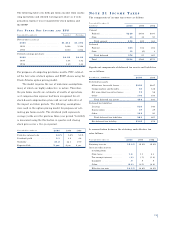

NO T E 1 2 SE C U R I T I Z AT I O N S

During 2000, the Corporation securitized commercial mort-

gage loans totaling $865 million and recorded a pretax gain

of $13 million. The Corporation retained servicing rights in

the securitized loans, all of which were sold and removed

from the balance sheet as a part of the securitization, and

recorded servicing rights of $7 million. The servicing rights

were valued based on expected future cash flows consider-

ing a 10% discount rate and an 8% prepayment rate on

mortgages with a weighted-average life of 10 years. Cash

received from securitization trusts totaled $877 million.