PNC Bank 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

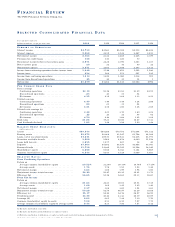

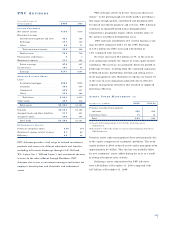

PN C RE A L ES T A T E FI N A N C E

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Net interest income . . . . . . . . . . . . . . $115 $112

Noninterest income

Net commercial mortgage banking . 68 64

Other . . . . . . . . . . . . . . . . . . . . . . 37 36

Total noninterest income . . . . . . 105 100

Total revenue . . . . . . . . . . . . . . . . 220 212

Provision for credit losses . . . . . . . . . (7) (5)

Noninterest expense . . . . . . . . . . . . . 139 126

Pretax earnings . . . . . . . . . . . . . . . 88 91

Income taxes . . . . . . . . . . . . . . . . . . 617

Earnings . . . . . . . . . . . . . . . . . . . . $82 $74

AV E R A G E BA L A N C E SH E E T

Loans

Commercial – real estate related . . $1,970 $2,156

Commercial real estate . . . . . . . . . 2,424 2,515

Total loans . . . . . . . . . . . . . . . . 4,394 4,671

C o m m e rcial mortgages held for sale . . 174 1 2 4

Other assets . . . . . . . . . . . . . . . . . . . 938 759

Total assets . . . . . . . . . . . . . . . . . . $5,506 $5,554

Deposits . . . . . . . . . . . . . . . . . . . . . $288 $315

Assigned funds and other liabilities . . 4,834 4,848

Assigned capital . . . . . . . . . . . . . . . . 384 391

Total funds . . . . . . . . . . . . . . . . . . $5,506 $5,554

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . . 21% 19%

Noninterest income to total revenue . . 48 47

Efficiency . . . . . . . . . . . . . . . . . . . . . 51 47

PNC Real Estate Finance provides credit, capital markets,

treasury management, commercial mortgage loan servicing

and other products and services to developers, owners and

investors in commercial real estate. PNC’s commercial real

estate financial services platform includes Midland Loan

Services, Inc. (“Midland”), one of the largest national ser-

vicers of commercial mortgage loans, and Columbia Housing

Partners, LP, a national syndicator of affordable housing

equity, among other businesses.

On October 27, 2000, Midland acquired Univest, a pri-

vately held provider of technology and data management

services to the commercial real estate finance industry. The

combined company created one of the nation’s leading

providers of Web-enabled loan servicing and asset admini-

stration solutions for commercial real estate portfolio

lenders, financial institutions and commercial

mortgage-backed securities.

Over the past three years, PNC Real Estate Finance

has been strategically shifting to a more balanced and valu-

able revenue stream by focusing on real estate processing

businesses, including commercial loan servicing. During

2000, 48% of total revenue was generated by fee-based

activities.

PNC Real Estate Finance made the decision to exit the

cyclical mortgage warehouse lending business and certain

non-strategic commercial real estate portfolios at the end of

1999. These activities are excluded from business results in

both periods presented. Management continues to evaluate

opportunities to reduce lending exposure and improve the

risk/return characteristics of this business.

PNC Real Estate Finance contributed 6% of total busi-

ness earnings for both 2000 and 1999. Earnings increased

$8 million or 11% in the year-to-year comparison primarily

due to growth in commercial mortgage servicing and the

affordable housing business. Average loans decreased

6% reflecting management’s strategy to reduce balance

sheet leverage.

Total revenue was $220 million for 2000 compared

with $212 million in the prior year. Increases in treasury

management and commercial mortgage servicing fees were

partially offset by lower commercial mortgage-backed

securitization gains.

The provision for credit losses positively impacted

earnings in 2000 and 1999 due to net recoveries in both

years. Management does not expect to be in a net recovery

position in 2001. See Credit Risk in the Risk Management

section of this Financial Review for additional information

regarding credit risk.

N o n i n t e rest expense was $139 million and the effic i e n c y

ratio was 51% for 2000 compared with $126 million and

47%, respectively, in 1999. The increases were primarily

due to non-cash losses on affordable housing equity invest-

ments and investments in technology to support the loan

servicing platform. The increase in non-cash losses on low

income housing investments was more than offset by related

income tax credits.

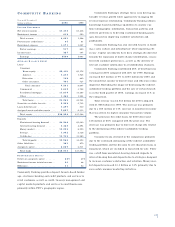

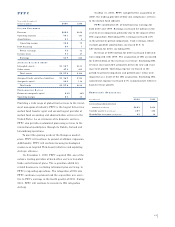

CO M M E R C I A L MO R T G A G E SE RV I C I N G PO R T F O L I O

Year ended December 31

In billions 2000 1999

January 1 . . . . . . . . . . . . . . . . . . . . $45 $39

Acquisitions/additions . . . . . . . . . . . 17 17

R e p a y m e n t s / t r a n s f e r s . . . . . . . . . . . . (8) (11)

December 31 . . . . . . . . . . . . . . . $54 $45

39