PNC Bank 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ne of the country’s fastest growing

asset-based lenders, PNC Business

Credit provides secured financing

products and services to middle market

customers on a national basis.

PNC Business Credit enables

clients to leverage the value of their

assets and cash flow to achieve both

short- and long-term goals.

Led by a seasoned management

team and with a marketing presence in

some of the nation’s fastest growing

regions, in 2000 PNC Business Credit

posted record earnings for the third

consecutive year — and it has grown

to become one of the nation’s top 10

asset-based lenders.

Since its inception in 1997,

PNC Business Credit has generated

consistently high returns in this primarily

leverage-based business.

Driving this success is PNC

Business Credit’s emphasis on risk

management practices. To mitigate risk,

PNC Business Credit conducts extensive

due diligence on prospective clients, and

it has implemented a systemic approach

to monitoring collateral.

In addition, Business Credit has

developed an intense focus on cross-sell-

ing to its clients PNC’s wide range of

financial services — such as treasury

management, capital markets and work-

place banking products.

As a result of these initiatives,

PNC Business Credit increased noninter-

est income 82% last year to $20 million.

With its strong marketing team and

emphasis on risk management practices,

PNC Business Credit is well positioned to

build on the success it has achieved.

COM-NET ERICSSON

The principals of The Anderson Group —

Bill Anderson, Steve Frobouck and Steve Savor —

have been banking and investing with The PNC

Financial Services Group for over 30 years. So

when their company, Com-Net Critical

Communications, sought financing to acquire the

mobile radio division of Ericsson, they selected

PNC Business Credit over a number of

asset-based lending groups to structure,

underwrite and syndicate the transaction.

PNC Business Credit worked closely with the

Com-Net team (Frobouck, the chairman,

is pictured here with PNC’s Greg Steve and Savor,

the CEO) in structuring the transaction so

that Com-Net had the liquidity to purchase

the division, with sufficient capital to grow and

meet its strategic objectives.

P N C BU S I N E S S CR E D I T

O

21

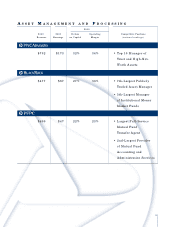

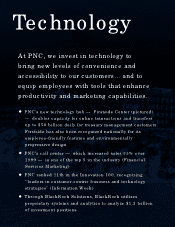

RE V E N U E

(in millions)

$62

98 99 00

$82

$119