PNC Bank 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

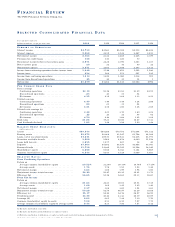

43

P F P C

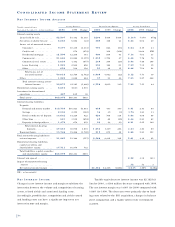

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Revenue . . . . . . . . . . . . . . . . . . . . . $690 $264

Operating expense . . . . . . . . . . . . . 501 181

Amortization . . . . . . . . . . . . . . . . . . 31 4

Operating income . . . . . . . . . . . . 158 79

Debt financing . . . . . . . . . . . . . . . . 80 7

Pretax earnings . . . . . . . . . . . . . . 78 72

Income taxes . . . . . . . . . . . . . . . . . . 31 27

Earnings . . . . . . . . . . . . . . . . . . . $47 $45

AV E R A G E BA L A N C E SH E E T

Intangible assets . . . . . . . . . . . . . . . $1,107 $103

Other assets . . . . . . . . . . . . . . . . . . 471 205

Total assets . . . . . . . . . . . . . . . . . $1,578 $308

Assigned funds and other liabilities . $1,369 $196

Assigned capital . . . . . . . . . . . . . . . 209 112

Total funds . . . . . . . . . . . . . . . . . $1,578 $308

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . 22% 40%

Operating margin . . . . . . . . . . . . . . 23 30

Providing a wide range of global fund services to the invest-

ment management industry, PFPC is the largest full-service

mutual fund transfer agent and second largest provider of

mutual fund accounting and administration services in the

United States. As an extension of its domestic services,

PFPC also provides customized processing services to the

international marketplace through its Dublin, Ireland and

Luxembourg operations.

To meet the growing needs of the European market-

place, PFPC will continue its pursuit of offshore expansion.

Additionally, PFPC will continue focusing technological

resources on targeted Web-based initiatives and exploring

strategic alliances.

On December 1, 1999, PFPC acquired ISG, one of the

nation’s leading providers of back-office services to mutual

funds and retirement plans. The acquisition added key

related businesses, including retirement plan servicing, to

PFPC’s expanding operations. The integration of ISG into

PFPC continues as planned and the acquisition was accre-

tive to PNC’s earnings in the fourth quarter of 2000. During

2001, PFPC will continue to execute its ISG integration

strategy.

On May 31, 2000, PFPC completed the acquisition of

ABD, the leading provider of blue sky compliance services

to the mutual fund industry.

PFPC contributed 4% of total business earnings for

both 2000 and 1999. Earnings increased $2 million in the

year-to-year comparison primarily due to the impact of the

ISG acquisition. Excluding ISG, earnings increased 21%

in the period-to-period comparison. Cash earnings, which

exclude goodwill amortization, increased 81% to

$87 million for 2000, including ISG.

Revenue of $690 million for 2000 increased $426 mil-

lion compared with 1999. The acquisition of ISG accounted

for $406 million of the increase in revenue. Excluding ISG,

revenue increased 22% primarily driven by new and exist-

ing client growth. Operating expense increased in the

period-to-period comparison and performance ratios were

impacted as a result of the ISG acquisition. Excluding ISG,

noninterest expense increased 21% commensurate with fee-

based revenue growth.

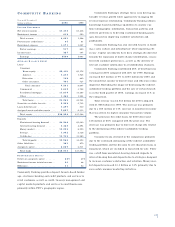

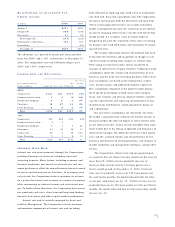

SE RV I C I N G ST AT I S T I C S

Year ended December 31

December 31 2000 1999

Accounting/administration

assets ($ in billions) . . . . . . . . . . . . . $463 $412

Custody assets ($ in billions) . . . . . . . . 437 388

Shareholder accounts (in millions) . . . . 43 34