PNC Bank 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hrough PNC Real Estate Finance,

commercial real estate developers, owners

and investors are provided credit, capital

markets, tre a s u r y management, and other

p r oducts and services. The PNC Real

Estate Finance platform includes Midland

Loan Services, which provides serv i c i n g

for commercial mortgage loans, and

Columbia Housing, a national syndicator

of aff o r dable housing equity.

PNC Real Estate Finance contin-

ued to reposition itself in 2000, taking

additional steps to enhance its strong

technology and processing platform and

to increase the relative contribution of

fee-generating, non-lending activities.

To enhance its national leadership

position in commercial mortgage serv i c i n g ,

Midland Loan Services merged with

Univest Financial Group, a privately held

p rovider of technology and data manage-

ment services to the commercial real estate

finance industry. The combined operation

is a leading provider of Web-based loan

s e rvicing and asset administration solutions

for the commercial real estate industry.

The contributions of Midland and

Columbia Housing, another primarily

fee-based business, helped to further

diversify the earnings composition of PNC

Real Estate Finance and create a more

valuable enterprise. In 2000, noninterest

income grew to 48% of total revenue,

compared with 29% in 1998.

Efforts to drive higher-quality

earnings were also helped by measures

PNC Real Estate Finance took to reduce

its reliance on more volatile and cyclical

credit-related revenues. It continued

throughout the year to move away from

credit-only relationships by emphasizing

its fully-integrated package of commercial

real estate financial products and services.

In addition, this business will focus

on growing higher- q u a l i t y revenues by

expanding third - p a rty processing services to

other commercial real estate lenders.

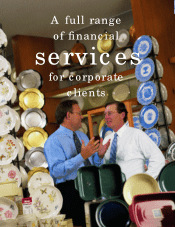

THE CHARLES E. SMITH REALTY

COMPANIES

By leveraging the quality and breadth of a broad

range of financial services, a relationship

that began with a construction loan in the 1980s

now encompasses several PNC businesses. Denny

Minami, COO/CFO of Charles E. Smith

Residential Realty L.P., and Paul Larner, CFO of

Charles E. Smith Commercial Realty L.P.

(pictured with PNC’s Bill Lynch and Connie

Bond Stuart), rely on PNC for a wide

range of financial services. In addition to the

lines of credit, construction loans and

capital markets products provided by PNC Real

Estate Finance, the Smith Companies utilize the

services of PNC Advisors, Hawthorn and PNC

Bank’s treasury management group.

T

PNC RE A L ES TAT E FI N A N C E

18

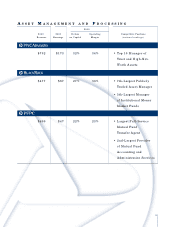

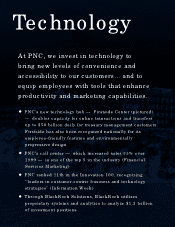

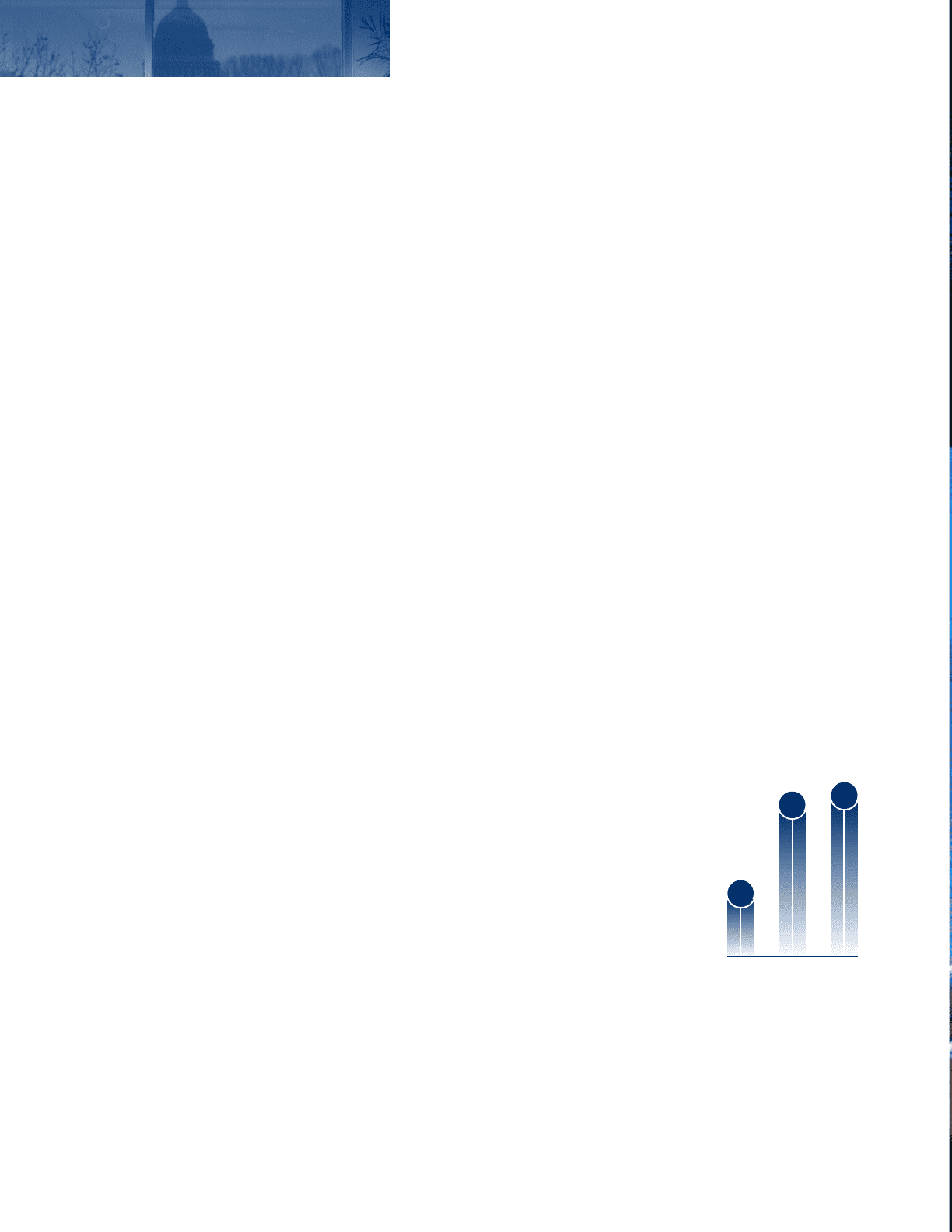

NO N I N T E R E S T

IN C O M E

(in millions)

$47

98 99 00

$100 $105