PNC Bank 2000 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

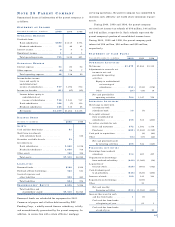

restrictive limitations. Such extensions of credit, with limit-

ed exceptions, must be fully collateralized. The maximum

amount available under statutory limitations for transfer

from subsidiary banks to the parent company in the form of

loans and dividends approximated 18% of consolidated net

assets at December 31, 2000.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal

Reserve Bank. During 2000, subsidiary banks maintained

reserves which averaged $113 million.

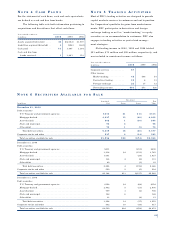

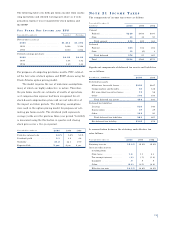

NO T E 1 8 FI N A N C I A L DE R I VAT I V E S

Positive Negative

Notional Fair Notional Fair

In millions Value Value Value Value

December 31, 2000

Interest rate

Swaps . . . . . . . . . . . . . . $5,173 $113 $1,814 $(12)

Caps . . . . . . . . . . . . . . . 308 4

Floors . . . . . . . . . . . . . . . 3,000 1 238 (2)

Total interest rate

risk management . . . . 8,481 118 2,052 (14)

Commercial mortgage

banking risk

management . . . . . . . . . . 121 4 265 (14)

Forward contracts . . . . . . . . 347

Credit default swaps . . . . . . 4,391 (2)

Total . . . . . . . . . . . . . . . $8,949 $122 $6,708 $(30)

December 31, 1999

Interest rate

Swaps . . . . . . . . . . . . . . . $3,666 $46 $5,402 $(108)

Caps . . . . . . . . . . . . . . . 474 12

Floors . . . . . . . . . . . . . . . 3,000 1 311 (1)

Total interest rate

risk management . . . . 7,140 59 5,713 (109)

Commercial mortgage

banking risk

management . . . . . . . . . . 643 51

Forward contracts . . . . . . . . 681

Credit default swaps . . . . . . 60 4,255 (4)

Total . . . . . . . . . . . . . . . $8,524 $110 $9,968 $(113)

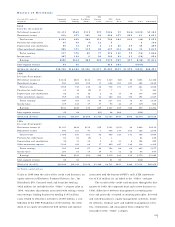

The Corporation uses a variety of off-balance-sheet financial

derivatives as part of the overall risk management process

and to manage interest rate, market and credit risk inherent

in the Corporation’s business activities. Financial deriva-

tives involve, to varying degrees, interest rate and credit

risk in excess of the amount recognized on the balance

sheet but less than the notional amount of the contract. For

interest rate swaps and purchased interest rate caps and

floors, only periodic cash payments and, with respect to

such caps and floors, premiums are exchanged. Therefore,

cash requirements and exposure to credit risk are signifi-

cantly less than the notional value. The Corporation man-

ages these risks as part of its asset and liability

management process and through credit policies and proce-

dures. The Corporation seeks to minimize the credit risk by

entering into transactions with only a select number of high-

quality institutions, establishing credit limits, requiring

bilateral-netting agreements, and, in certain instances, seg-

regated collateral.

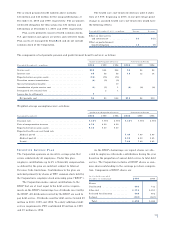

The Corporation uses interest rate swaps and pur-

chased caps and floors to modify the interest rate character-

istics of designated interest-bearing assets or liabilities from

fixed to variable, variable to fixed, or one variable index to

another. At December 31, 2000, $7.0 billion of interest rate

swaps, caps and floors were designated to loans. At

December 31, 2000, $135 million of financial derivatives

were designated to securities available for sale. During

2000, derivative contracts modified the average effective

yield on interest-earning assets from 7.93% to 7.85% . At

December 31, 2000, $3.5 billion of interest rate swaps were

designated to interest-bearing liabilities. During 2000,

derivative contracts had no impact on the average rate on

interest-bearing liabilities of 5.01% .

PNC also uses interest rate swaps to manage interest

rate risk associated with its commercial mortgage banking

activities.

Forward contracts are used to manage risk positions

associated with student lending activities. Substantially all

forward contracts mature within 90 days of origination.

Forward contracts are traded in over-the-counter markets

and do not have standardized terms. In the event the coun-

terparty is unable to meet its contractual obligations, the

Corporation may be exposed to selling or purchasing stu-

dent loans at prevailing market prices. Unrealized gains or

losses are considered in the lower of cost or market valua-

tion of loans held for sale.

Credit default swaps are used to mitigate credit risk

and lower the required regulatory capital associated with

commercial lending activities.

At December 31, 2000 and 1999, the Corporation’s

exposure to credit losses with respect to financial deriva-

tives was not material.