PNC Bank 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

h r ough its Community Banking business,

PNC Bank offers deposit, brokerage, insur-

ance and credit products and services as well

as electronic banking. Its customer base

includes more than three million retail house-

holds and 180,000 small businesses, primari-

ly within PNC’s geographic re g i o n .

In 2000, Community Banking

continued its efforts to build a customer-

focused franchise. Initiatives to strengthen

its deposit franchise, increase revenues

contributed by fee-based sources, and

improve efficiency helped fuel 9% earnings

growth for the year.

Targeted sales and marketing

campaigns designed to attract new

business and retain and deepen existing

customer relationships led Community

Banking to increase average deposits to $36

billion — a 4% increase over 1999. These

e ff o rts also helped boost sales of fee-based

b r okerage, insurance and annuity pro d u c t s

— leading Community Banking to a 13%

i n c rease for the year in noninterest income.

Community Banking also continued

to leverage PNC’s leadership position in

technology to improve productivity and

streamline a variety of sales and service

processes. This ongoing focus, combined

with its commitment to managing costs,

has helped improve its efficiency ratio to

51% from 55% in 1998.

Moving into 2001, technology

will continue to play a key role in

Community Banking’s strategy to enhance

its diff e r entiated customer experience

and help drive revenue growth. By We b -

enabling all delivery channels — including

m o r e than 700 branches — and pro v i d i n g

its sales staff with information on customer

needs and insights from its industry - l e a d i n g

data mart, Community Banking will be

better positioned to increase sales and off e r

superior serv i c e .

Already one of the nation’s leading

small business lenders, Community

Banking is also intensifying its focus on

delivering a variety of non-traditional

services to this lucrative market. This

includes an arrangement for a prominent

insurance broker to offer insurance prod-

ucts to the businesses, offering wealth

management products to the owners, and

a package of financial products and serv-

ices called Workplace Banking to small

business employees. Community Banking

remains committed to the goal of creating

sustainable, long-term value for share-

holders, customers, employees and the

communities it serves.

ATYOUR SERVICE

To focus more time on keeping his multiple

Camp Hill, Pa.-area franchises operating as

efficiently as possible, Raghu Tadavarthy does

much of his personal and small business banking

t h r ough PNC’s 24 hours a day, seven days a week

National Financial Services Center (NFSC).

Ranked by Financial Services Marketing as one

of the top five call centers in the industry,

the NFSC has leveraged customer insight and

technology to streamline processes, enhance

services and increase sales — which jumped 55%

over 1999. These achievements have also

led to double-digit increases in both customer

and employee satisfaction.

T

PNC BA N K

—

CO M M U N I T Y BA N K I N G

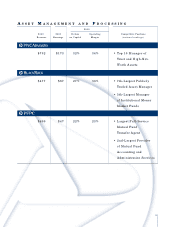

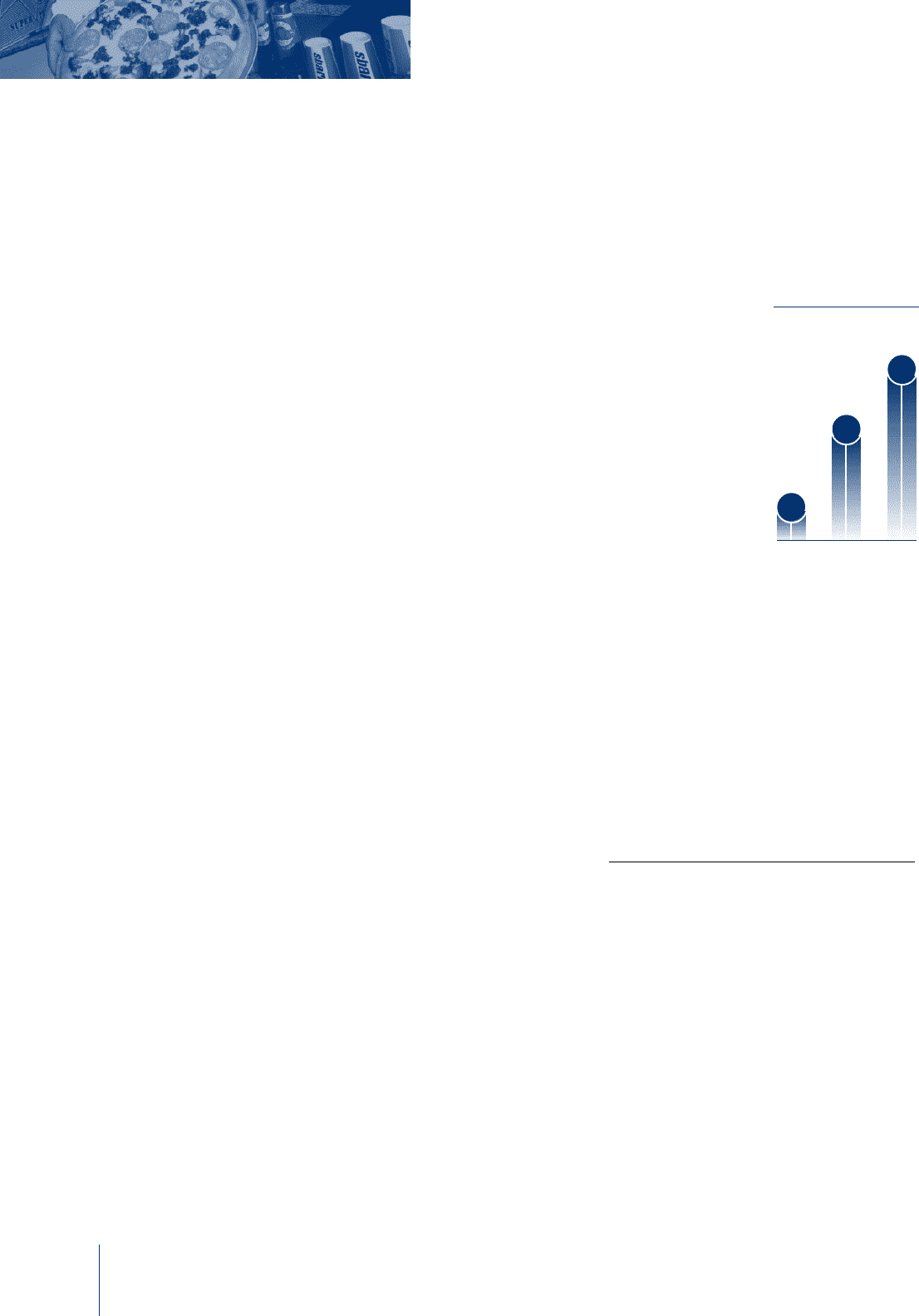

DE P O S I T

GR O W T H

( i n c r ease over previous year)

1%

98 99 00

2%

4%