PNC Bank 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

implementing leading technologies to drive both rev-

enue and efficiency. Very importantly, our investments

have resulted in greater business diversity, which we

believe will help to mitigate the impact of cycles that

individual businesses will inevitably face.

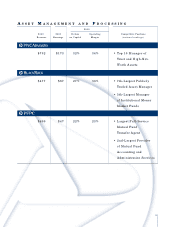

The diversity of our franchise has been impro v e d

by the exceptional growth of our asset management

and processing businesses — PNC Advisors,

BlackRock and PFPC. These businesses contributed

nearly 25% of earnings in 2000, up from approxi-

mately 15% in 1996. Because of the strong growth

dynamics of these businesses, we believe that their

relative contributions to total earnings will continue

to move higher. And because these businesses

compete in some of the most highly-valued sectors

in financial services, we believe their increased

contributions will further improve the valuation

dynamics of our company.

Equally important, we have increased revenue

and earnings diversity within our banking businesses.

In 2000, non-lending revenue accounted for more

than twice the revenue generated by lending activities

within our banking businesses. And again, this

increased diversity was due in large part to the growth

of more highly-valued activities, including treasury

management, deposit gathering and brokerage.

A FO C U S O N CO N S I S T E N C Y A N D VA L U E

We recognize that no company operating in the

financial markets is immune to risk. But we believe

that our strategic actions in recent years have signifi-

cantly improved our potential to generate consistent

earnings growth over time.

We have lowered our reliance on traditional

lending activities, which are historically more volatile

than fee-driven businesses because of their inherent

vulnerability to credit risk and economic cycles. We

have exited the credit card business, warehouse lending

and significant portions of our national real estate

and corporate lending businesses. In the first quarter

of 2001, we sold our residential mortgage banking

business, which competes in an industry historically

vulnerable to significant levels of volatility.

In the past two years alone, our loan commit-

ments have decreased by nearly $30 billion. But

there is still work to be done, particularly in light of

an uncertain economic future. We will not hesitate to

take further strategic actions to improve our ability to

James E. Rohr, President and Chief Executive Officer