PNC Bank 2000 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Credit-related derivatives are entered into to mitigate

credit risk and lower the required regulatory capital associ-

ated with commercial lending activities. If the credit-related

derivative qualifies for hedge accounting treatment, the pre-

mium paid to enter the credit-related derivative is recorded

in other assets and is deferred and amortized to noninterest

expense over the life of the agreement. Changes in the fair

value of credit-related derivatives qualifying for hedge

accounting treatment are not reflected in the Corporation’s

financial position and have no impact on results of

operations.

If the credit-related derivative does not qualify for

hedge accounting treatment or if the Corporation is the

seller of credit protection, the credit-related derivative is

marked to market with gains or losses included in

noninterest income.

To accommodate customer needs, PNC also enters into

financial derivative transactions primarily consisting of

interest rate swaps, caps, floors and foreign exchange con-

tracts. Interest rate risk exposure from customer positions is

managed through transactions with other dealers. These

positions are recorded at estimated fair value and changes

in value are included in noninterest income.

Additionally, the Corporation enters into other deriva-

tive transactions for risk management purposes that do not

qualify for accrual accounting. These transactions are

recorded at estimated fair value and changes in value are

included in noninterest income.

IN C O M E TA X E S

Income taxes are accounted for under the liability method.

Deferred tax assets and liabilities are determined based on

differences between financial reporting and tax bases of

assets and liabilities and are measured using the enacted

tax rates and laws that will be in effect when the differences

are expected to reverse.

ST O C K OP T I O N S

For stock options granted at exercise prices not less than

the fair market value of common stock on the date of grant,

no compensation expense is recognized.

EA R N I N G S P E R CO M M O N SH A R E

Basic earnings per common share is calculated by dividing

net income adjusted for preferred stock dividends declared

by the weighted-average number of shares of common

stock outstanding.

Diluted earnings per common share is based on net

income adjusted for dividends declared on nonconvertible

preferred stock. The weighted-average number of shares of

common stock outstanding is increased by the assumed con-

version of outstanding convertible preferred stock and

debentures from the beginning of the year or date of

issuance, if later, and the number of shares of common

stock that would be issued assuming the exercise of stock

options and the issuance of incentive shares. Such adjust-

ments to net income and the weighted-average number of

shares of common stock outstanding are made only when

such adjustments are expected to dilute earnings per com-

mon share.

RE C E N T AC C O U N T I N G PR O N O U N C E M E N T S

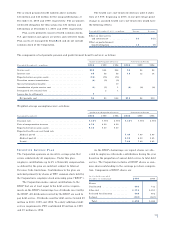

In June 1998, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standards

(“SFAS”) No. 133, “ Accounting for Derivative Instruments

and Hedging Activities,” as amended by SFAS No. 137 and

No. 138, which is required to be adopted effective

January 1, 2001. The statement will require the Corporation

to recognize all derivatives on the balance sheet at fair

value. Derivatives that are not designated as hedges must

be adjusted to their fair value through earnings. If the deriv-

ative is designated as a hedge, depending on the nature of

the hedge, changes in its fair value either will be offset

against the changes in fair value or expected future cash

flows of the hedged assets, liabilities or firm commitments

through earnings or recognized in accumulated other com-

prehensive income until the hedged items are recognized in

earnings. The ineffective portion of a derivative’s change in

fair value will be immediately recognized in earnings.

The Corporation adopted the new statement effective

January 1, 2001. As a result, the Corporation recognized an

after-tax loss from the cumulative effect of a change in

accounting principle of $5 million, to be reported in the

consolidated statement of income for the quarter ended

March 31, 2001, and an after-tax increase in accumulated

other comprehensive loss of $4 million. The impact of the

adoption of this standard related to the residential

mortgage banking business that was sold will be reflected

in the results of discontinued operations in the first quarter

of 2001.