PNC Bank 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

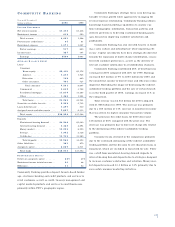

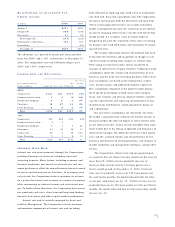

DE TA I L S O F SE C U R I T I E S AV A I L A B L E FO R SA L E

Year ended December 31

In millions Amortized Cost Fair Value

December 31, 2000

Debt securities

U.S. Treasury and government

agencies . . . . . . . . . . . . . . . . . $313 $313

Mortgage-backed . . . . . . . . . . . . . 4,037 4,002

Asset-backed . . . . . . . . . . . . . . . 902 893

State and municipal . . . . . . . . . . . 94 96

Other debt . . . . . . . . . . . . . . . . . 73 73

Corporate stocks and other . . . . . . . 537 525

Total securities available for sale . . $5,956 $5,902

December 31, 1999

Debt securities

U.S. Treasury and government

agencies . . . . . . . . . . . . . . . . . $411 $400

Mortgage-backed . . . . . . . . . . . . . 3,918 3,769

Asset-backed . . . . . . . . . . . . . . . 1,051 1,027

State and municipal . . . . . . . . . . . 134 131

Other debt . . . . . . . . . . . . . . . . . 40 39

Corporate stocks and other . . . . . . . 590 594

Total securities available for sale . . $6,144 $5,960

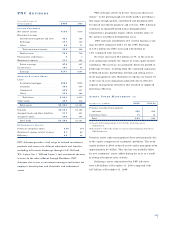

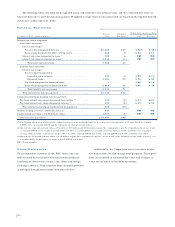

FU N D I N G SO U R C E S

Total funding sources were $59.4 billion at December 31,

2000 and $60.0 billion at December 31, 1999. Increases in

demand and money market deposits allowed PNC to reduce

higher-cost funding sources including deposits in foreign

offices, Federal Home Loan Bank borrowings and bank

notes and senior debt.

DE TA I L S O F FU N D I N G SO U R C E S

Year ended December 31

December 31 – in millions 2000 1999

Deposits

Demand, savings and

money market . . . . . . . . . . . . . $30,686 $27,823

Retail certificates of deposit . . . . . 14,175 14,153

Other time . . . . . . . . . . . . . . . . . 567 633

Deposits in foreign offices . . . . . . 2,236 3,193

Total deposits . . . . . . . . . . . . . 47,664 45,802

Borrowed funds

Federal funds purchased . . . . . . . 1,445 1,281

Repurchase agreements . . . . . . . . 607 402

Bank notes and senior debt . . . . . 6,110 6,975

Federal Home Loan Bank

borrowings . . . . . . . . . . . . . . . 500 2,258

Subordinated debt . . . . . . . . . . . . 2,407 2,327

Other borrowed funds . . . . . . . . . 649 986

Total borrowed funds . . . . . . . . 11,718 14,229

Total . . . . . . . . . . . . . . . . . . . . . . $59,382 $60,031

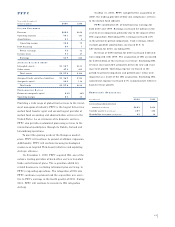

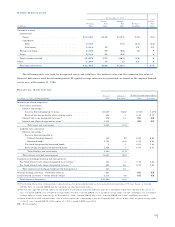

CA P I TA L

The access to and cost of funding new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, deposit

insurance costs, and the level and nature of regulatory over-

sight depend, in large part, on a financial institution’s capi-

tal strength. At December 31, 2000, the Corporation and

each bank subsidiary were considered well capitalized

based on regulatory capital ratio requirements.

RI S K - B A S E D CA P I TA L

Year ended December 31

December 31 – dollars in millions 2000 1999 (a)

Capital components

Shareholders’ equity

Common . . . . . . . . . . . . . . . . . $6,344 $5,633

Preferred . . . . . . . . . . . . . . . . . 312 313

Trust preferred capital securities . 848 848

Goodwill and other . . . . . . . . . . . (2,214) (2,318)

Net unrealized securities losses . . 77 255

Tier I risk-based capital . . . . . . 5,367 4,731

Subordinated debt . . . . . . . . . . . . 1,824 2,040

Eligible allowance for credit losses 667 667

Investment in unconsolidated

finance subsidiary . . . . . . . . . . (13)

Total risk-based capital . . . . . . . . $7,845 $7,438

Assets

Risk-weighted assets and

off-balance-sheet instruments . $62,430 $67,118

Average tangible assets . . . . . . . . 66,809 71,617

Capital ratios

Tier I risk-based . . . . . . . . . . . . . 8.60% 7.05%

Total risk-based . . . . . . . . . . . . . . 12.57 11.08

Leverage . . . . . . . . . . . . . . . . . . . 8.03 6.61

(a) Includes discontinued operations.

The capital position is managed through balance sheet size

and composition, issuance of debt and equity instruments,

treasury stock activities, dividend policies and retention of

earnings.

During 2000, PNC repurchased 6.7 million shares of

common stock. On February 15, 2001, the Board of

Directors authorized the Corporation to purchase up to

15 million shares of common stock through February 28,

2002. This new program replaces the prior program that was

rescinded.

47