PNC Bank 2000 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

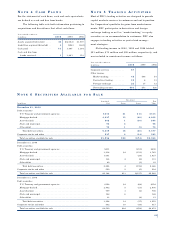

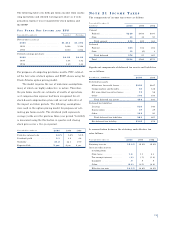

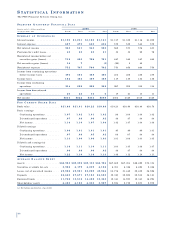

OT H E R DE R I V A T I V E S

The following schedule sets forth information relating to positions associated with customer-related and other derivatives:

At December 31, 2000 2000 At December 31, 1999 1999

Positive Negative Net Average Positive Negative Net Average

Notional Fair Fair Asset Fair Notional Fair Fair Asset Fair

In millions Value Value Value (Liability) Value Value Value Value (Liability) Value

Customer-related

Interest rate

Swaps . . . . . . . . . . . . . . . . $13,567 $120 $(127) $(7) $(1) $17,103 $110 $(116) $(6) $(13)

Caps/floors

Sold . . . . . . . . . . . . . . . . 5,145 (17) (17) (23) 3,440 (25) (25) (20)

Purchased . . . . . . . . . . . 3,914 15 15 21 3,337 22 22 18

Foreign exchange . . . . . . . . . . 6,108 79 (82) (3) 7 3,310 47 (36) 11 7

Other . . . . . . . . . . . . . . . . . . . 2,544 59 (59) 4 2,161 22 (9) 13 3

Total customer-related . . . . . . 31,278 273 (285) (12) 8 29,351 201 (186) 15 (5)

Other . . . . . . . . . . . . . . . . . . . 1,207 13 (1) 12 8 1,238 6 6 4

Total other derivatives . . . . . . $32,485 $286 $(286) $16 $30,589 $207 $(186) $21 $(1)

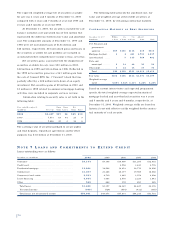

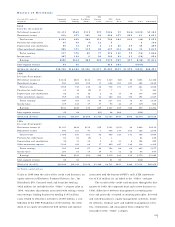

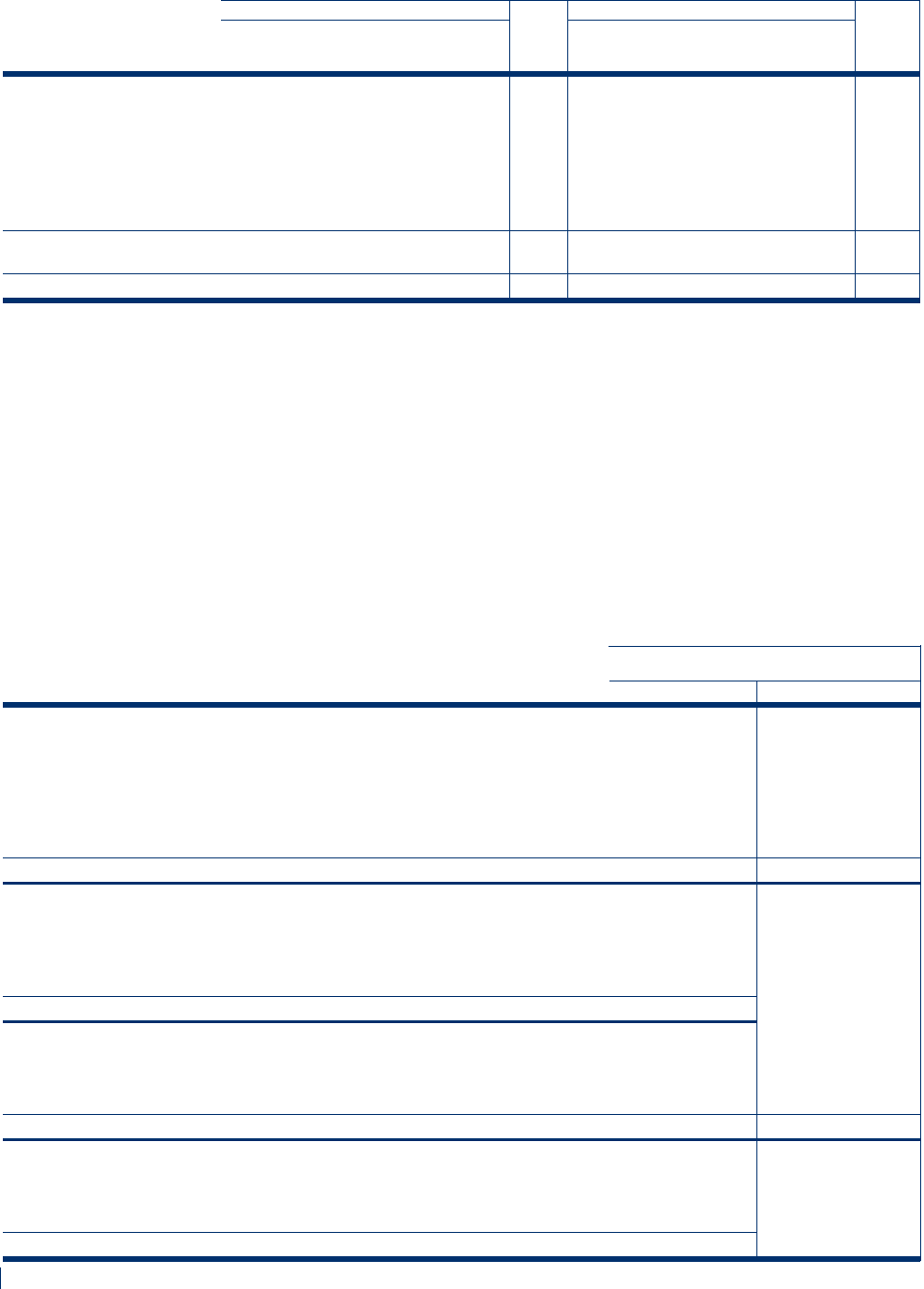

NO T E 1 9 EM P L O Y E E

BE N E F I T PL A N S

PE N S I O N A N D PO S T R E T I R E M E N T PL A N S

Qualified and Postretirement

Nonqualified Pensions Benefits

December 31 - in millions 2000 1999 2000 1999

Benefit obligation at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $840 $866 $198 $187

Service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 24 22

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 60 14 12

Actuarial loss (gain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7(39) 713

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20)

Participant contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (68) (71) (22) (19)

Benefit obligation at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $856 $840 $203 $198

Fair value of plan assets at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $939 $758

Actual (loss) return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29) 147

Employer contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 105

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20)

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (68) (71)

Fair value of plan assets at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $952 $939

Funded status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $96 $99 $(203) $(198)

Unrecognized net actuarial loss (gain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 (60) 38 30

Unrecognized prior service credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5) (6) (63) (69)

Unrecognized net transition asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4)

Net amount recognized on the balance sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . $156 $29 $(228) $(237)

Prepaid pension cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $156 $29

Additional minimum liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18) (22)

Intangible asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 19

Net amount recognized on the balance sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . $156 $29

The Corporation has a noncontributory, qualified defined

benefit pension plan covering most employees. Retirement

benefits are derived from a cash balance formula based

upon compensation levels, age and length of service.

Pension contributions are based on an actuarially deter-

mined amount necessary to fund total benefits payable to

plan participants.

The Corporation also maintains nonqualified supple-

mental retirement plans for certain employees. All retire-

ment benefits provided under these plans are unfunded and

any payments to plan participants are made by the

Corporation. The Corporation also provides certain health

care and life insurance benefits for retired employees

(“postretirement benefits”) through various plans.

A reconciliation of the changes in the benefit obligation for qualified and nonqualified pension plans and postre t i r e m e n t

benefit plans as well as the change in plan assets for the qualified pension plan is as follows: