PNC Bank 2000 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

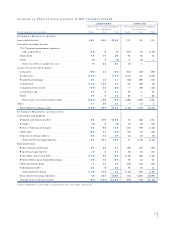

84

Real and personal property, lease financing, loan customer

relationships, deposit customer intangibles, retail branch

networks, fee-based businesses, such as asset management

and brokerage, trademarks and brand names are excluded

from the amounts set forth in the previous table.

Accordingly, the aggregate fair value amounts presented do

not represent the underlying value of the Corporation.

Fair value is defined as the estimated amount at which

a financial instrument could be exchanged in a current

transaction between willing parties, or other than in a forced

or liquidation sale. However, it is not management’s inten-

tion to immediately dispose of a significant portion of such

financial instruments, and unrealized gains or losses should

not be interpreted as a forecast of future earnings and cash

flows. The derived fair values are subjective in nature,

involve uncertainties and significant judgment and, there-

fore, cannot be determined with precision. Changes in

assumptions could significantly impact the derived fair

value estimates.

The following methods and assumptions were used in

estimating fair value amounts for financial instruments.

GE N E R A L

For short-term financial instruments realizable in three

months or less, the carrying amount reported in the consoli-

dated balance sheet approximates fair value. Unless other-

wise stated, the rates used in discounted cash flow analyses

are based on market yield curves.

CA S H A N D SH O R T - T E R M AS S E T S

The carrying amounts reported in the consolidated balance

sheet for cash and short-term investments approximate fair

values primarily due to their short-term nature. For purpos-

es of this disclosure only, short-term assets include due

from banks, interest-earning deposits with banks, federal

funds sold and resale agreements, trading securities, cus-

tomer’s acceptance liability and accrued interest receivable.

SE C U R I T I E S AV A I L A B L E F O R SA L E

The fair value of securities available for sale is based on

quoted market prices, where available. If quoted market

prices are not available, fair value is estimated using the

quoted market prices of comparable instruments.

NE T LO A N S A N D LO A N S HE L D F O R SA L E

Fair values are estimated based on the discounted value of

expected net cash flows incorporating assumptions about

prepayment rates, credit losses and servicing fees and costs.

For revolving home equity loans, this fair value does not

include any amount for new loans or the related fees that

will be generated from the existing customer relationships.

In the case of nonaccrual loans, scheduled cash flows

exclude interest payments. The carrying value of loans held

for sale approximates fair value.

CO M M E R C I A L MO R T G A G E SE RV I C I N G RI G H T S

The fair value of commercial mortgage servicing rights

is estimated based on the present value of future

cash flows.

DE P O S I T S

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits approx-

imate fair values. For time deposits, which include foreign

deposits, fair values are estimated based on the discounted

value of expected net cash flows taking into account current

interest rates.

BO R R O W E D FU N D S

The carrying amounts of federal funds purchased, commer-

cial paper, acceptances outstanding and accrued interest

payable are considered to be their fair value because of

their short-term nature. For all other borrowed funds, fair

values are estimated based on the discounted value of

expected net cash flows taking into account current interest

rates.

UN F U N D E D LO A N CO M M I T M E N T S A N D

LE T T E R S O F CR E D I T

Fair values for commitments to extend credit and letters of

credit are estimated based on the amount of deferred fees

and the creditworthiness of the counterparties.

FI N A N C I A L A N D OT H E R DE R I VA T I V E S

The fair value of derivatives is estimated based on the dis-

counted value of the expected net cash flows. These fair val-

ues represent the estimated amounts the Corporation would

receive or pay to terminate the contracts, taking into

account current interest rates.

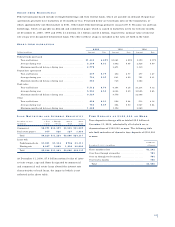

NO T E 2 7 UN U S E D LI N E O F CR E D I T

At December 31, 2000, the Corporation maintained a line of

credit in the amount of $500 million, none of which was

drawn. This line is available for general corporate purposes

and expires in 2003.