PNC Bank 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

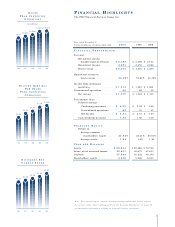

FI N A N C I A L HI G H L I G H T S

The PNC Financial Services Group, Inc.

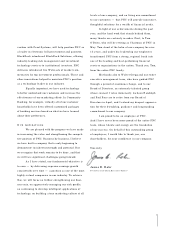

$991

IN C O M E

FR O M CO N T I N U I N G

OP E R AT I O N S

(in millions)

96 97 98 99 00

$1,038 $1,080

$1,202 $1,214

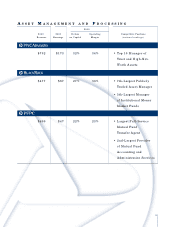

$1.42

DI V I D E N D S PE R

CO M M O N SH A R E

(in millions)

96 97 98 99 00

$1.50 $1.58 $1.68

$1.83

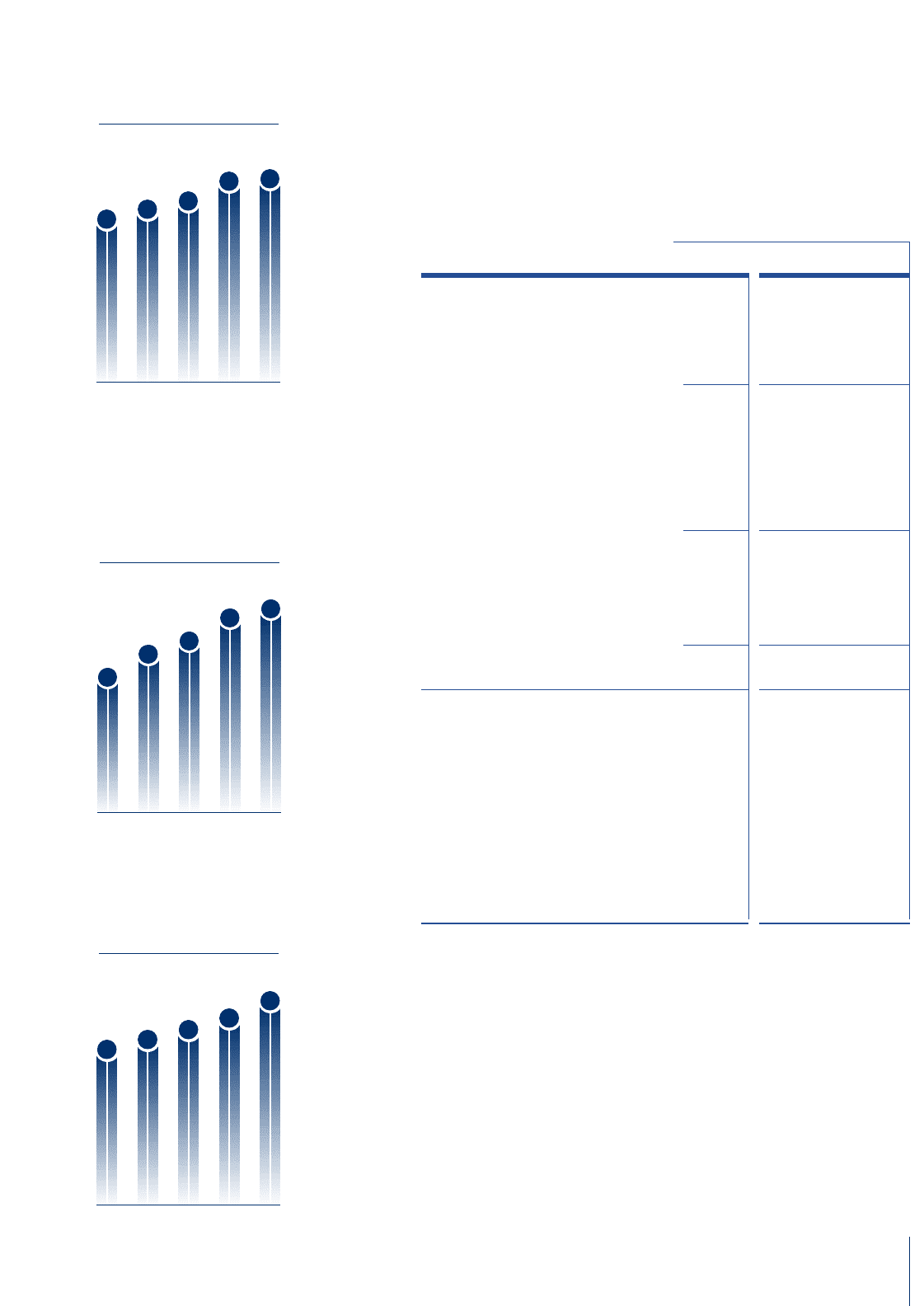

$2.88

DI L U T E D EA R N I N G S

PE R SH A R E

FR O M CO N T I N U I N G

OP E R AT I O N S

(in millions)

96 97 98 99 00

$3.24 $3.49

$3.94 $4.09

Year ended December 31

Dollars in millions, except per share data 2000 1999 1998

FI N A N C I A L PE R F O R M A N C E

Revenue

Net interest income

(taxable-equivalent basis) . . $ 2,182 $ 2,366 $ 2,514

Noninterest income . . . . . . . 2,891 2,450 2,086

Total revenue . . . . . . . . . . . . $ 5,073 $ 4,816 $ 4,600

Noninterest income to

total revenue . . . . . . . . . . . 56.99% 50.87% 45.35%

Income from continuing

operations . . . . . . . . . . . . . . . $ 1,214 $ 1,202 $ 1,080

Discontinued operations . . . . . . . 65 62 35

Net income . . . . . . . . . . . . . $ 1,279 $ 1,264 $ 1,115

Per common share

Diluted earnings

Continuing operations . . . . $ 4.09 $ 3.94 $ 3.49

Discontinued operations . . .22 .21 .11

Net Income . . . . . . . . . . . $ 4.31 $ 4.15 $ 3.60

Cash dividends declared . . . 1.83 1.68 1.58

SE L E C T E D RA T I O S

Return on

Average common

shareholders’ equity . . . . 21.63% 22.41% 20.81%

Average assets . . . . . . . . . . 1.68 1.69 1.49

YE A R -E N D BA L A NC E S

Assets . . . . . . . . . . . . . . . . . . . . $ 69,844 $ 69,286 $ 70,754

Loans, net of unearned income . . 50,601 49,673 57,633

Deposits . . . . . . . . . . . . . . . . . . 47,664 45,802 46,150

Shareholders’ equity . . . . . . . . . 6,656 5,946 6,043

1

Note: This annual report contains forward-looking statements. Please refer to

the section of this report captioned “ Forward-Looking Statements” on page 58

for important information relating to forward-looking statements.