PNC Bank 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

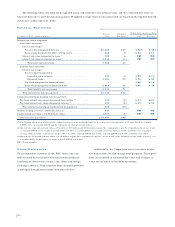

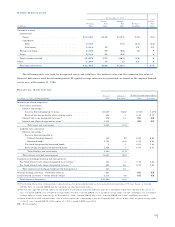

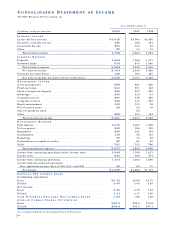

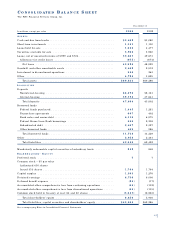

NO T E S T O CO N S O L I D AT E D FI N A N C I A L STA T E M E N T S

The PNC Financial Services Group, Inc.

BU S I N E S S

The PNC Financial Services Group, Inc. (“Corporation” or

“PNC”) is one of the largest diversified financial services

companies in the United States, operating community bank-

ing, corporate banking, real estate finance, asset-based

lending, wealth management, asset management and global

fund services businesses. The Corporation provides certain

p r oducts and services nationally and others in PNC’s primary

geographic markets in Pennsylvania, New Jersey, Delaware,

Ohio and Kentucky. The Corporation also provides certain

products and services internationally. PNC is subject to

intense competition from other financial services companies

and is subject to regulation by certain federal and state

agencies and undergoes periodic examinations by

those authorities.

NO T E 1 A C C O U N T I N G PO L I C I E S

BA S I S O F FI N A N C I A L ST A T E M E N T PR E S E N TA T I O N

The consolidated financial statements include the accounts

of PNC and its subsidiaries, most of which are wholly

owned. Such statements have been prepared in accordance

with accounting principles generally accepted in the United

States. All significant intercompany accounts and transac-

tions have been eliminated. Certain prior-period amounts

have been reclassified to conform with the current period

presentation. These classifications did not impact the

Corporation’s financial condition or results of operations.

In preparing the consolidated financial statements,

management is required to make estimates and assumptions

that affect the amounts reported. Actual results will differ

from such estimates and the differences may be material to

the consolidated financial statements.

The Consolidated Financial Statements and Notes to

Consolidated Financial Statements reflect the residential

mortgage banking business, which was sold on January 31,

2001, as discontinued operations, unless otherwise noted.

LO A N S HE L D FO R SA L E

Loans are designated as held for sale when the Corporation

has a positive intent to sell them. Loans are transferred at

the lower of cost or market to the loans held for sale catego-

ry. Upon the transfer, related write-downs on loans classified

as nonaccrual are charged against the allowance for credit

losses and for all other loans write-downs are charged to

noninterest income. Such loans are carried at the lower of

cost or aggregate market value and related valuation adjust-

ments subsequent to transfer are included in noninterest

income.

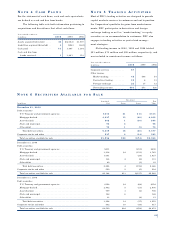

SE C U R I T I E S

Securities purchased with the intention of recognizing short-

term profits are placed in the trading account, carried at

market value and classified as short-term investments.

Gains and losses on trading securities are included in non-

interest income. Securities not classified as trading are des-

ignated as securities available for sale and carried at fair

value with unrealized gains and losses, net of income taxes,

reflected in accumulated other comprehensive income or

loss. Gains and losses realized on the sale of securities

available for sale are computed on a specific security basis

and included in noninterest income.

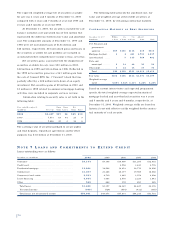

LO A N S

Loans are stated at the principal amounts outstanding, net

of unearned income. Interest income with respect to loans is

accrued on the principal amount outstanding, except for

lease financing income which is recognized over its respec-

tive terms using methods which approximate the level yield

method. Significant loan fees are deferred and accreted to

interest income over the respective lives of the loans.

LO A N SE C U R I T I Z AT I O N S A N D RE TA I N E D

IN T E R E S T S

The Corporation sells mortgage and other loans through sec-

ondary market securitizations. In certain cases, the

Corporation will retain interest-only strips, servicing rights

and cash reserve accounts, all of which are associated with

the securitized asset. Any gain or loss recognized on the

sale of the loans depends in part on the previous carrying

amount, allocated between the loans sold and the retained

interests, based on their relative fair market values at the

date of transfer. The Corporation generally estimates fair

value based on the present value of future expected cash

flows using assumptions as to discount rates, prepayment

speeds, credit losses and servicing costs, if applicable.

64