PNC Bank 2000 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

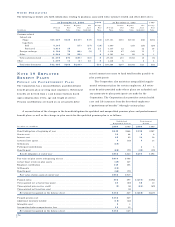

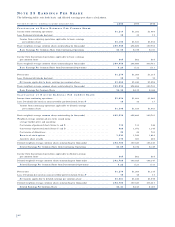

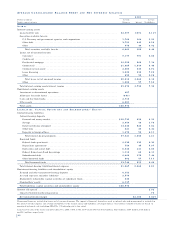

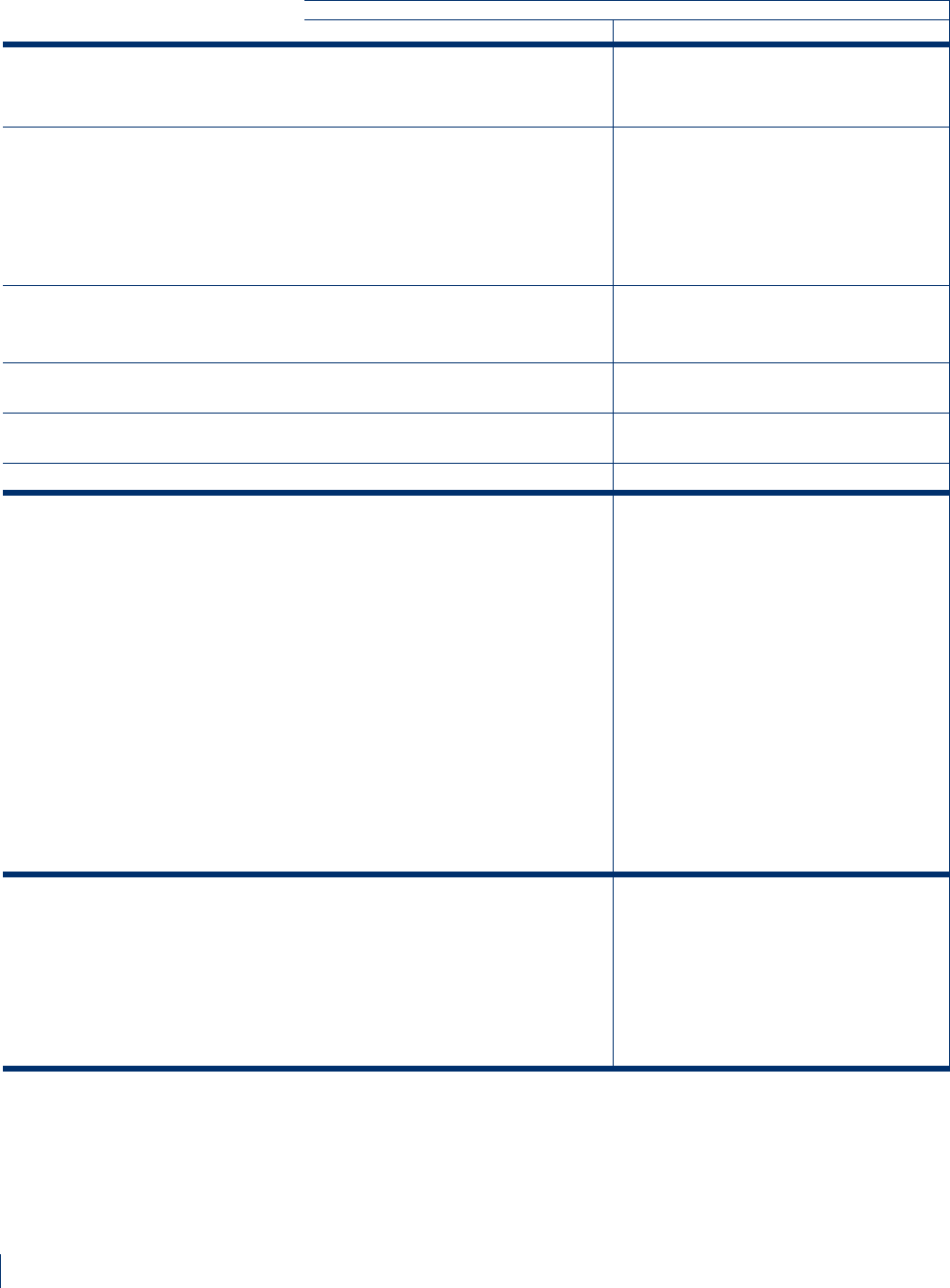

SE L E C T E D QU A R T E R L Y FI N A N C I A L DA TA

Quarter ended – dollars in millions, 2000 1999

except per share data Fourth Third Second First Fourth Third Second First

SU M M A R Y O F OP E R AT I O N S

Interest income . . . . . . . . . . . . . . . $ 1 , 1 9 0 $ 1 , 2 0 1 $ 1 , 1 8 0 $ 1 , 1 6 1 $1,137 $1,125 $1,116 $1,205

Interest expense . . . . . . . . . . . . . . . 6 5 7 6 7 0 6 3 5 6 0 6 575 552 540 572

Net interest income . . . . . . . . . . . . 5 3 3 5 3 1 5 4 5 5 5 5 562 573 576 633

Provision for credit losses . . . . . . . . 4 0 3 0 3 5 3 1 30 30 25 78

Noninterest income before net

securities gains (losses) . . . . . . . . 7 1 9 6 9 3 7 2 8 7 3 1 647 569 547 665

Net securities gains (losses) . . . . . . 1 6 7 ( 3 ) (22) 2 42

Noninterest expense . . . . . . . . . . . . 7 5 2 7 4 7 7 8 0 7 9 2 753 656 684 750

Income from continuing operations

before income taxes . . . . . . . . . . 4 7 6 4 5 4 4 5 8 4 6 0 404 458 456 470

Income taxes . . . . . . . . . . . . . . . . . 1 6 2 1 5 5 1 5 9 1 5 8 117 159 154 156

Income from continuing

operations . . . . . . . . . . . . . . . . . 3 1 4 2 9 9 2 9 9 3 0 2 287 299 302 314

Income from discontinued

operations . . . . . . . . . . . . . . . . . 2 0 2 3 1 6 6 17 21 13 11

Net income . . . . . . . . . . . . . . . . . . $ 3 3 4 $ 3 2 2 $ 3 1 5 $ 3 0 8 $304 $320 $315 $325

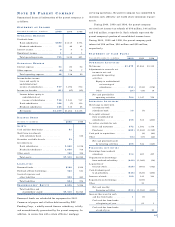

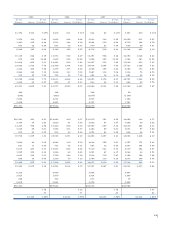

PE R CO M M O N SH A R E DA TA

Book value . . . . . . . . . . . . . . . . . . . $ 2 1 . 8 8 $ 2 1 . 0 1 $ 2 0 . 2 2 $ 1 9 . 6 8 $19.23 $18.90 $18.40 $18.78

Basic earnings

Continuing operations . . . . . . . . . 1 . 0 7 1 . 0 2 1 . 0 1 1 . 0 2 .96 1.00 1.00 1.02

Discontinued operations . . . . . . . . 0 7 . 0 8 . 0 6 . 0 2 .06 .07 .04 .04

Net income . . . . . . . . . . . . . . . . . 1 . 1 4 1 . 1 0 1 . 0 7 1 . 0 4 1.02 1.07 1.04 1.06

Diluted earnings

Continuing operations . . . . . . . . . 1 . 0 6 1 . 0 1 1 . 0 1 1 . 0 1 .95 .99 .99 1.01

Discontinued operations . . . . . . . . 0 7 . 0 8 . 0 5 . 0 2 .06 .07 .04 .04

Net income . . . . . . . . . . . . . . . . . 1 . 1 3 1 . 0 9 1 . 0 6 1 . 0 3 1.01 1.06 1.03 1.05

Diluted cash earnings (a)

Continuing operations . . . . . . . . . 1 . 1 6 1 . 1 1 1 . 1 0 1 . 1 1 1.03 1.05 1.06 1.07

Discontinued operations . . . . . . . . 0 6 . 0 8 . 0 6 . 0 2 .06 .07 .04 .04

Net income . . . . . . . . . . . . . . . . . 1 . 2 2 1 . 1 9 1 . 1 6 1 . 1 3 1.09 1.12 1.10 1.11

AV E R A G E BA L A N C E SH E E T

Assets . . . . . . . . . . . . . . . . . . . . . . $ 6 8 , 9 5 3 $ 6 9 , 0 9 8 $ 6 9 , 1 0 5 $ 6 8 , 7 5 6 $67,609 $67,054 $68,499 $70,334

Securities available for sale . . . . . . 5 , 9 2 8 6 , 1 7 9 6 , 0 0 9 6 , 1 2 8 6,351 6,386 6,495 5,086

Loans, net of unearned income . . . . 4 9 , 9 2 8 4 9 , 9 5 1 5 0 , 2 2 9 4 9 , 9 6 6 50,716 51,445 52,439 56,596

Deposits . . . . . . . . . . . . . . . . . . . . 3 8 , 6 6 0 3 7 , 6 7 1 3 7 , 1 8 3 3 6 , 5 5 5 35,363 35,820 35,530 36,161

Borrowed funds . . . . . . . . . . . . . . . 1 1 , 7 3 8 1 3 , 5 1 8 1 4 , 4 2 2 1 5 , 3 3 3 15,341 14,903 15,343 16,294

Shareholders' equity . . . . . . . . . . . . 6 , 4 2 5 6 , 1 8 5 6 , 0 0 5 5 , 9 2 7 5,904 5,732 5,873 5,975

(a) Excluding amortization of goodwill

86

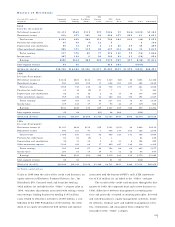

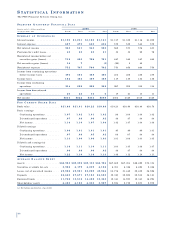

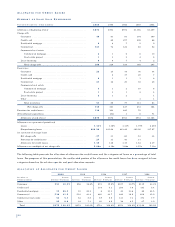

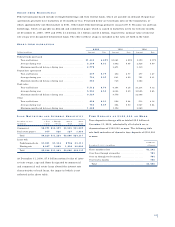

STAT I S T I C A L IN F O R M AT I O N

The PNC Financial Services Group, Inc.