PNC Bank 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

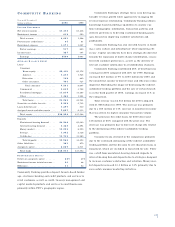

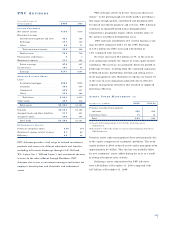

PNC B U S I N E S S CR E D I T

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Net interest income . . . . . . . . . . . . . . $99 $71

Noninterest income . . . . . . . . . . . . . . 20 11

Total revenue . . . . . . . . . . . . . . . . 119 82

Provision for credit losses . . . . . . . . . 12 11

Noninterest expense . . . . . . . . . . . . . 30 25

Pretax earnings . . . . . . . . . . . . . . . 77 46

Income taxes . . . . . . . . . . . . . . . . . . 28 17

Earnings . . . . . . . . . . . . . . . . . . . . $49 $29

AV E R A G E BA L A N C E SH E E T

Loans . . . . . . . . . . . . . . . . . . . . . . . $2,197 $1,726

Other assets . . . . . . . . . . . . . . . . . . . 74 33

Total assets . . . . . . . . . . . . . . . . . . $2,271 $1,759

Deposits . . . . . . . . . . . . . . . . . . . . . $66 $50

Assigned funds and other liabilities . . 2,053 1,591

Assigned capital . . . . . . . . . . . . . . . . 152 118

Total funds . . . . . . . . . . . . . . . . . . $2,271 $1,759

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . . 32% 25%

Efficiency . . . . . . . . . . . . . . . . . . . . . 24 28

PNC Business Credit provides asset-based lending, capital

markets and treasury management products and services to

middle market customers on a national basis. PNC Business

Credit’s lending services include loans secured by accounts

receivable, inventory, machinery and equipment, and other

collateral, and its customers include manufacturing, whole-

sale, distribution, retailing and service industry companies.

PNC Business Credit’s strategic focus is to build scale

through the disciplined expansion of existing offices as

well as the addition of new marketing locations. At

December 31, 2000, PNC Business Credit operated

15 offices in 13 states. PNC Business Credit continues to

emphasize risk management practices. In addition, a cen-

tralized back office is intended to provide consistency to the

control environment as well as cost efficiencies.

PNC Business Credit contributed 4% of total business

earnings for 2000 compared with 3% for 1999. Earnings

increased $20 million or 69% in the year-to-year compari-

son to $49 million for 2000.

Revenue was $119 million for 2000, a $37 million

or 45% increase compared with 1999 primarily due to the

impact of higher average loans associated with business

expansion.

Noninterest expense was $30 million and the efficiency

ratio improved to 24% for 2000 compared with $25 million

and 28%, respectively, in 1999. The efficiency ratio

improved in the comparison primarily due to economies of

scale. The return on assigned capital improved to 32% for

2000 due to strong revenue growth and improved efficiency.

Management expects the provision for credit losses to

increase in 2001 commensurate with a larger loan portfolio.

See Credit Risk in the Risk Management section of this

Financial Review for additional information regarding

credit risk.

40