PNC Bank 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

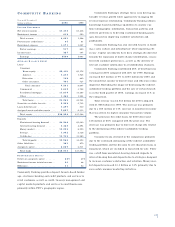

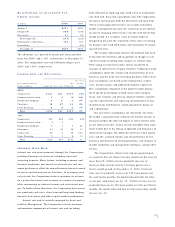

As a result of the sale of the credit card business and

exiting or downsizing certain non-strategic lending busi-

nesses, average loans decreased $2.8 billion and represent-

ed 84% of average earning assets for 2000 compared with

86% for the prior year. Average loans held for sale

increased $1.1 billion in the year-to-year comparison,

reflecting the decisions to exit certain non-strategic lending

businesses and to sell student loans in repayment.

Funding cost is affected by the volume and composi-

tion of funding sources as well as related rates paid thereon.

Average deposits comprised 66% and 65% of total sources

of funds for 2000 and 1999, respectively, with the remain-

der primarily comprised of wholesale funding obtained at

prevailing market rates.

Average demand and money market deposits increased

$1.8 billion or 11% to $18.7 billion for 2000, primarily

reflecting the impact of strategic marketing initiatives to

grow more valuable transaction accounts, while other time

deposits decreased in the period-to-period comparison.

Average borrowed funds for 2000 decreased $1.7 billion

compared with 1999 as lower bank notes and Federal Home

Loan Bank borrowings more than offset increases in federal

funds purchased, subordinated debt and other borrowed

funds. The overall decrease in average borrowed funds was

primarily due to the combined impact of deposit growth and

a stable level of total assets.

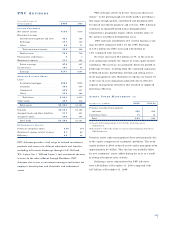

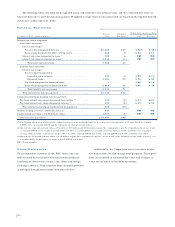

PR O V I S I O N FO R CR E D I T LO S S E S

The provision for credit losses was $136 million for 2000

compared with $163 million for 1999. Net charge-offs were

$135 million or .27% of average loans for 2000 compared

with $161 million or .31% , respectively, for 1999. The

decreases were primarily due to the sale of the credit card

business in the first quarter of 1999, partially offset by

higher commercial net charge-offs in 2000. PNC’s provision

for credit losses fully covered net charge-offs in both years.

See Credit Risk in the Risk Management section of this

Financial Review for additional information regarding

credit risk.

NO N I N T E R E S T IN C O M E

Noninterest income was $2.891 billion for 2000 and repre-

sented 57% of total revenue. On a comparable basis, nonin-

terest income increased $640 million or 28% compared

with full year 1999, excluding the non-core items that are

detailed in the 1999 Versus 1998 section of this Financial

Review. The increase was primarily driven by growth in cer-

tain fee-based businesses, the benefit of the ISG acquisition

and higher equity management income. Excluding ISG,

noninterest income increased 13% compared with the

prior year.

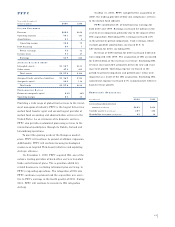

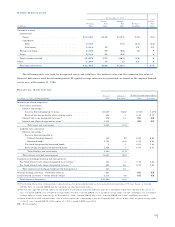

Asset management fees of $809 million for 2000

increased $128 million or 19% primarily driven by new

business. Assets under management were $253 billion at

December 31, 2000, a 19% increase compared with

December 31, 1999. Fund servicing fees were $654 million

for 2000, a $403 million increase compared with the prior

year primarily driven by the ISG acquisition. Excluding

ISG, fund servicing fees increased 22% mainly due to

existing and new client growth.

Brokerage fees of $249 million for 2000 increased

$30 million or 14% reflecting the continued expansion of

Hilliard Lyons’ distribution network. Consumer services

revenue of $209 million for 2000 increased 7% compared

with the prior year, excluding credit card fees. The increase

was primarily due to higher consumer transaction volume.

Corporate services revenue of $342 million for 2000

increased 7% compared with the prior year, excluding the

impact of valuation adjustments in 1999. The increase was

primarily driven by higher treasury management and

commercial mortgage servicing fees that were partially

offset by a lower level of commercial mortgage-backed

securitization gains.

Equity management income was $133 million for

2000 compared with $100 million in the prior year.

Equity investments are carried at estimated fair value and,

accordingly, revenue related to these investments may be

affected by market volatility. While equity management

income was strong in the first half of 2000, weak capital

markets caused the second half to be near break even.

Net securities gains were $20 million for 2000 com-

pared with $22 million for 1999. The net securities gains in

1999 included a $41 million gain from the sale of Concord

EFS, Inc. (“Concord”) stock that was partially offset by a

$28 million write-down of an equity investment.

Sale of subsidiary stock of $64 million in 1999 reflect-

ed the gain from the BlackRock IPO.

Other noninterest income of $269 million for 2000

increased $24 million or 10% compared with the prior year

excluding non-core items, primarily due to growth in cus-

tomer derivative and foreign exchange activity.