PNC Bank 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FPC provides a wide range of global fund

services to the investment management

industry, including mutual funds, alterna-

tive investments and retirement plans.

This member of The PNC Financial

Services Group is the nation’s largest

full-service mutual fund transfer agent

and second largest provider of mutual

fund accounting and administration

services. PFPC now services $1.3 trillion

in total fund accounting and administra-

tion, transfer agency and custody assets

and is a leading provider of retirement,

custody, subaccounting and alternative

investment services.

By implementing a number of

initiatives to expand its reach and diversify

its revenue stream, PFPC has achieved

strong earnings growth and continues

to strengthen its leadership position in

servicing the funds marketplace.

The integration of Investor Serv i c e s

G r oup (ISG), which PFPC acquired in

December 1999, continued on schedule.

The addition of ISG greatly enhances

P F P C ’s transfer agency and re t i r e m e n t

s e r vices capabilities, and this acquisition

became accretive to PNC’s earnings in

the fourth quarter of 2000.

PFPC also continued its expansion

in the European market with the opening

of its Luxembourg office — and planning is

well underway to open a second office in

I reland in 2001. From its overseas s i t e s ,

PFPC provides accounting and administra-

tion for $9.4 billion in assets.

PFPC undertook other initiatives

to broaden its range of capabilities,

including acquiring Automated Business

Development Corp., a leading provider of

blue sky compliance services. PFPC also

leveraged its sophisticated technology

platform to enhance the innovative

solutions it offers clients.

In January 2001, PFPC signed a

nonbinding letter of intent with three

mutual fund providers, Fidelity Investments,

Franklin Templeton and Putnam Investments,

to create a multi-functional, Web-based

p o rtal for financial intermediaries. And

PFPC also introduced an electronic trade

i n t e r face system to help clients comply with

c o m p r essed settlement deadlines.

PFPC is well positioned to build

on the growth it has achieved. In 2001,

key areas of focus include enhancing

its Web-based products and services to

meet the needs of its growing client

base, furthering European expansion and

continuing the integration of ISG.

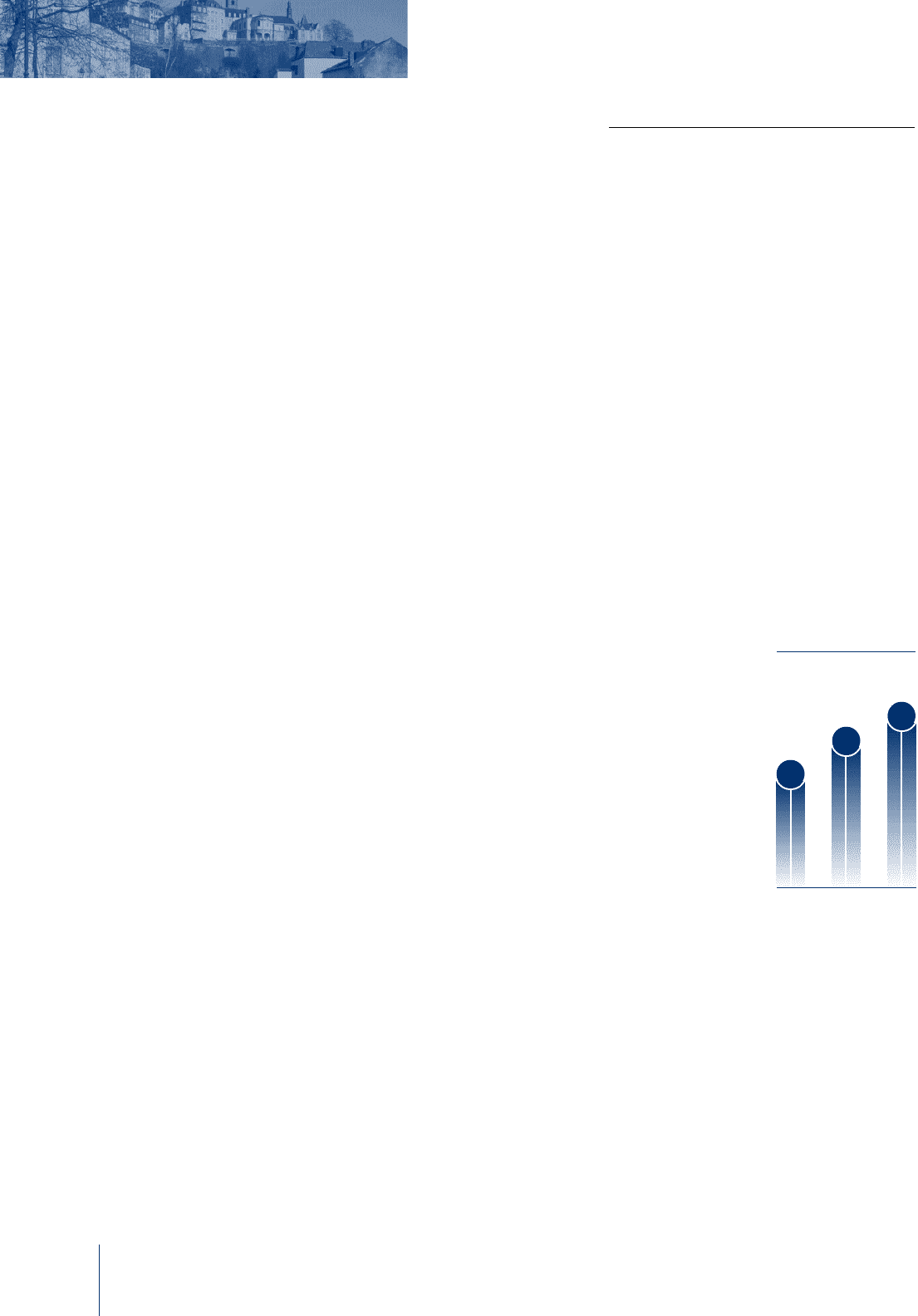

EUROPEAN EXPANSION

The opening of PFPC’s newest office — in

Luxembourg — is yet another step to strategically

position the business to capitalize on

the growth anticipated in Europe’s financial

services market. Luxembourg is a major

financial center catering to the offshore funds

marketplace. Luxembourg-based funds are

required to maintain their central administration

within the nation’s boundaries, a restriction that

offers growth opportunities for services firms with

local operations. The office complements

PFPC’s existing global fund servicing operations

in Dublin and Grand Cayman. Combined,

these operations provide accounting and adminis-

tration services for approximately

$9.4 billion in assets.

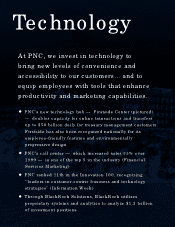

P

P F P C

28

SH A R E H O L D E R

AC C O U N T S

(in millions)

2.7

98 99 00

34.1*

42.5

*Increase reflects

ISG acquisition