PNC Bank 2000 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

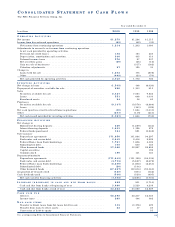

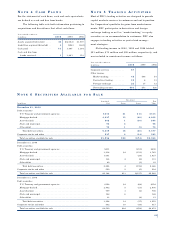

NO T E 4 CA S H FL O W S

For the statement of cash flows, cash and cash equivalents

are defined as cash and due from banks.

The following table sets forth information pertaining to

acquisitions and divestitures that affect cash flows:

Year ended December 31

In millions 2000 1999 1998

Assets acquired (divested) . . . . $4 $(2,062) $1,007

Liabilities acquired (divested) . . 4(208) (322)

Cash paid . . . . . . . . . . . . . . . . . 31 1,407 1,184

Cash and due from

banks received . . . . . . . . . . . 13,261 153

NO T E 5 T R A D I N G AC T I V I T I E S

Most of PNC’s trading activities are designed to provide

capital markets services to customers and not to position

the Corporation’s portfolio for gains from market move-

ments. PNC participates in derivatives and foreign

exchange trading as well as “market making” in equity

securities as an accommodation to customers. PNC also

engages in trading activities as part of risk manage-

ment strategies.

Net trading income in 2000, 1999 and 1998 totaled

$91 million, $73 million and $26 million, respectively, and

was included in noninterest income as follows:

Year ended December 31

In millions 2000 1999 1998

Corporate services . . . . . . . . . . $7

Other income

Market making . . . . . . . . . . . 42 $48 $3

Derivatives trading . . . . . . . . 20 8 11

Foreign exchange . . . . . . . . . 22 17 12

Net trading income . . . . . . . . $91 $73 $26

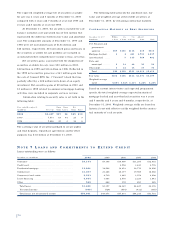

NO T E 6 SE C U R I T I E S AV A I L A B L E F O R SA L E

Amortized Unrealized Fair

In millions Cost Gains Losses Value

December 31, 2000

Debt securities

U.S. Treasury and government agencies . . . . . . . . . . . . . . . . . . . . . $313 $1 $(1) $313

Mortgage-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,037 13 (48) 4,002

Asset-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 902 1 (10) 893

State and municipal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94 2 96

Other debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73 1 (1) 73

Total debt securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,419 18 (60) 5,377

Corporate stocks and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 537 2 (14) 525

Total securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . $5,956 $20 $(74) $5,902

December 31, 1999

Debt securities

U.S. Treasury and government agencies . . . . . . . . . . . . . . . . . . . . . $411 $(11) $400

Mortgage-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,918 $2 (151) 3,769

Asset-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,051 (24) 1,027

State and municipal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134 2 (5) 131

Other debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 (1) 39

Total debt securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,554 4 (192) 5,366

Corporate stocks and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 590 9 (5) 594

Total securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . $6,144 $13 $(197) $5,960

December 31, 1998

Debt securities

U.S. Treasury and government agencies . . . . . . . . . . . . . . . . . . . . . $152 $2 $(2) $152

Mortgage-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,942 5 (11) 2,936

Asset-backed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 709 1 (2) 708

State and municipal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122 6 128

Other debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 (2) 31

Total debt securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,958 14 (17) 3,955

Corporate stocks and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 542 10 (35) 517

Total securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . $4,500 $24 $(52) $4,472