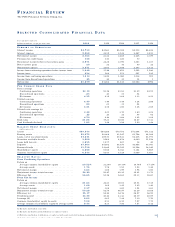

PNC Bank 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

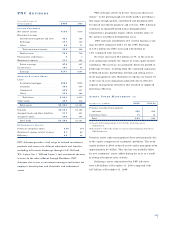

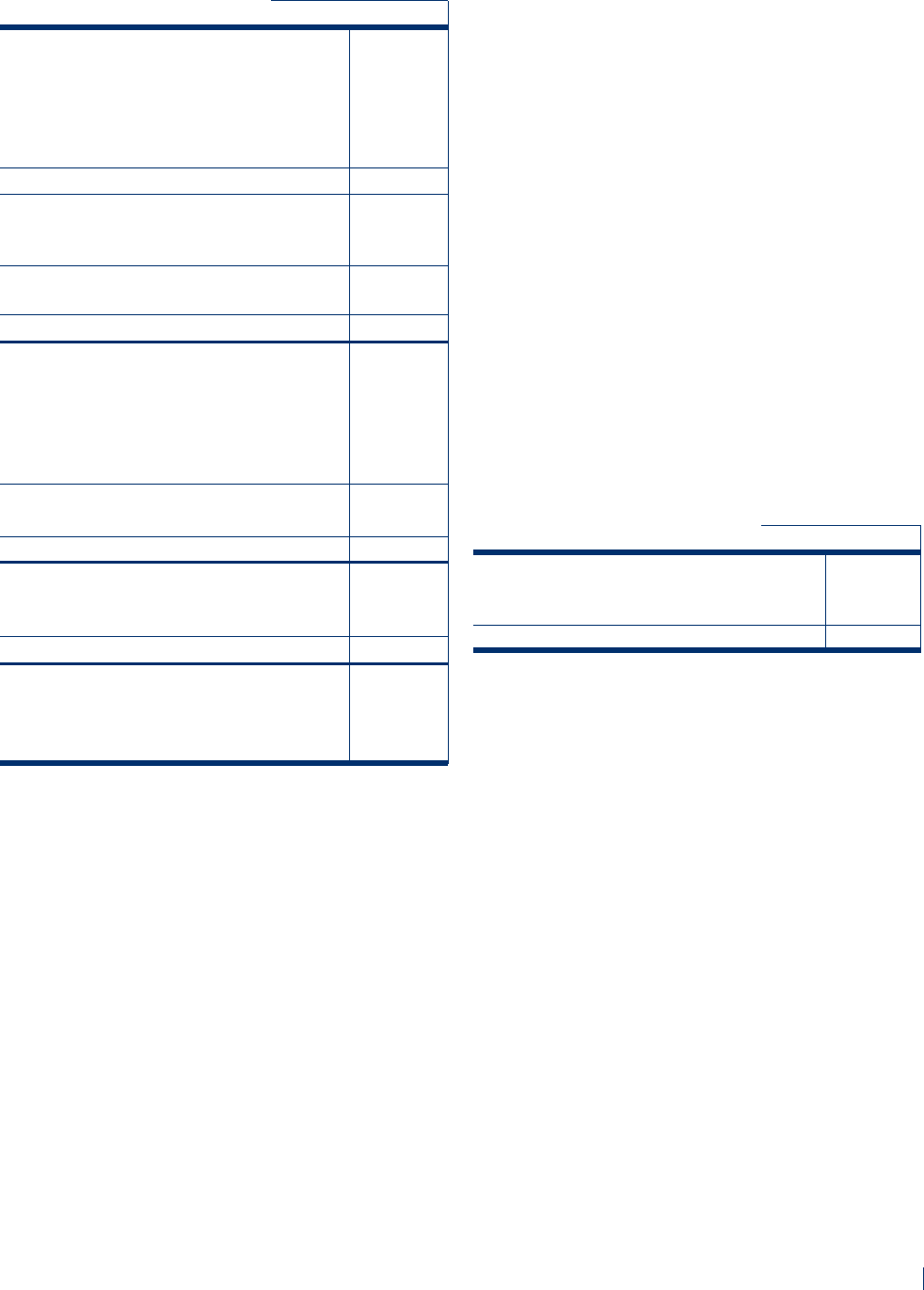

PN C A D V I S O R S

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Net interest income . . . . . . . . . . . . . $136 $130

Noninterest income

Investment management and tru s t . 421 388

Brokerage . . . . . . . . . . . . . . . . . . 171 149

Other . . . . . . . . . . . . . . . . . . . . . 64 71

Total noninterest income . . . . . 656 608

Total revenue . . . . . . . . . . . . . . . 792 738

Provision for credit losses . . . . . . . . 57

Noninterest expense . . . . . . . . . . . . 511 494

Pretax earnings . . . . . . . . . . . . . . 276 237

Income taxes . . . . . . . . . . . . . . . . . . 103 90

Earnings . . . . . . . . . . . . . . . . . . . $173 $147

AV E R A G E BA L A N C E SH E E T

Loans

Residential mortgage . . . . . . . . . . $962 $959

Consumer . . . . . . . . . . . . . . . . . . 965 940

Commercial . . . . . . . . . . . . . . . . . 602 631

Other . . . . . . . . . . . . . . . . . . . . . 532 389

Total loans . . . . . . . . . . . . . . . . 3,061 2,919

Other assets . . . . . . . . . . . . . . . . . . 439 434

Total assets . . . . . . . . . . . . . . . . . $3,500 $3,353

Deposits . . . . . . . . . . . . . . . . . . . . $2,034 $2,164

Assigned funds and other liabilities . 917 641

Assigned capital . . . . . . . . . . . . . . . 549 548

Total funds . . . . . . . . . . . . . . . . . $3,500 $3,353

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . 32% 27%

Noninterest income to total revenue . 83 82

Efficiency . . . . . . . . . . . . . . . . . . . . 64 66

PNC Advisors provides a full range of tailored investment

products and services to affluent individuals and families

including full-service brokerage through J.J.B. Hilliard,

W.L. Lyons, Inc. (“Hilliard Lyons”) and investment advisory

services to the ultra-affluent through Hawthorn. PNC

Advisors also serves as investment manager and trustee for

employee benefit plans and charitable and endowment

assets.

PNC Advisors strives to be the “financial advisor of

choice” in the growing high-net-worth market, providing a

full range of high-quality, customized and predominantly

fee-based investment products and services. PNC Advisors

continues to expand Hilliard Lyons throughout the

Corporation’s geographic region, which includes some of

the nation’s wealthiest metropolitan areas.

PNC Advisors contributed 14% of total business earn-

ings for 2000 compared with 13% for 1999. Earnings

of $173 million for 2000 increased $26 million or

18% compared with last year.

Revenue increased $54 million or 7% in the year-to-

year comparison despite the impact of weak equity market

conditions. The increase was primarily driven by growth in

brokerage revenue, resulting from the continued expansion

of Hilliard Lyons’ distribution network and strong invest-

ment management sales. Noninterest expense increased 3%

in the year-to-year comparison primarily due to effective

expense management initiatives that resulted in improved

operating efficiency.

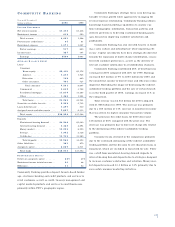

AS S E T S UN D E R MA N A G E M E N T (a)

Year ended December 31

December 31 – in billions 2000 1999 (b)

Personal investment management

and trust . . . . . . . . . . . . . . . . . . . $50 $52

Institutional tru s t . . . . . . . . . . . . . . . 15 14

Total . . . . . . . . . . . . . . . . . . . . . . $65 $66

(a) Assets under management do not include brokerage assets

administered.

(b) Restated to reflect the transfer of assets under management between

PNC businesses.

Personal assets under management decreased primarily due

to the equity component of customers’ portfolios. The weak

equity market in 2000 reduced assets under management by

approximately $3 billion. This decline was partially offset

by new customers’ assets added during the year as a result

of strong investment sales activity.

Brokerage assets administered by PNC Advisors

were $28 billion at December 31, 2000 compared with

$27 billion at December 31, 1999.

41