PNC Bank 2000 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

SFAS No. 140, “Accounting for Transfers and Servicing

of Financial Assets and Extinguishments of Liabilities” (a

replacement of SFAS No. 125) was issued in September

2000 and replaces SFAS No. 125. Although SFAS No. 140

has changed many of the rules regarding securitizations, it

continues to require an entity to recognize the financial and

servicing assets it controls and the liabilities it has incurred

and to derecognize financial assets when control has been

surrendered in accordance with the criteria provided in the

standard. As required, the Corporation will apply the new

rules prospectively to transactions beginning in the second

quarter of 2001. Based on current circumstances, manage-

ment believes that the application of the new rules will not

have a material impact on the Corporation’s financial posi-

tion or results of operations. SFAS No. 140 requires certain

disclosures pertaining to securitization transactions effec-

tive for fiscal years ending after December 15, 2000. These

disclosures are included in Note 12.

NO T E 2 DI S C O N T I N U E D OP E R AT I O N S

On October 2, 2000, PNC announced that it reached a

definitive agreement to sell its residential mortgage banking

business. The capital made available by the sale will be

redeployed in a number of ways, which may include repur-

chasing common stock, continuing to reduce balance sheet

leverage, reducing debt and making targeted investments in

higher-growth businesses. The amount of capital available

for redeployment and the income statement impact of the

sale will depend on fair market values and other factors,

and will not be determined until final settlement. The

transaction closed on January 31, 2001.

Earnings for the residential mortgage banking business

for the years ended December 31, 2000, 1999 and 1998

were $65 million, $62 million and $35 million, respectively,

and are reflected in discontinued operations throughout the

Corporation’s financial statements. Earnings and net assets

of the residential mortgage banking business are shown sep-

arately on one line in the income statement and balance

sheet, respectively, for all periods presented.

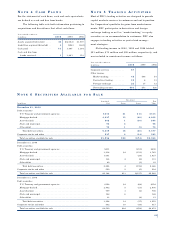

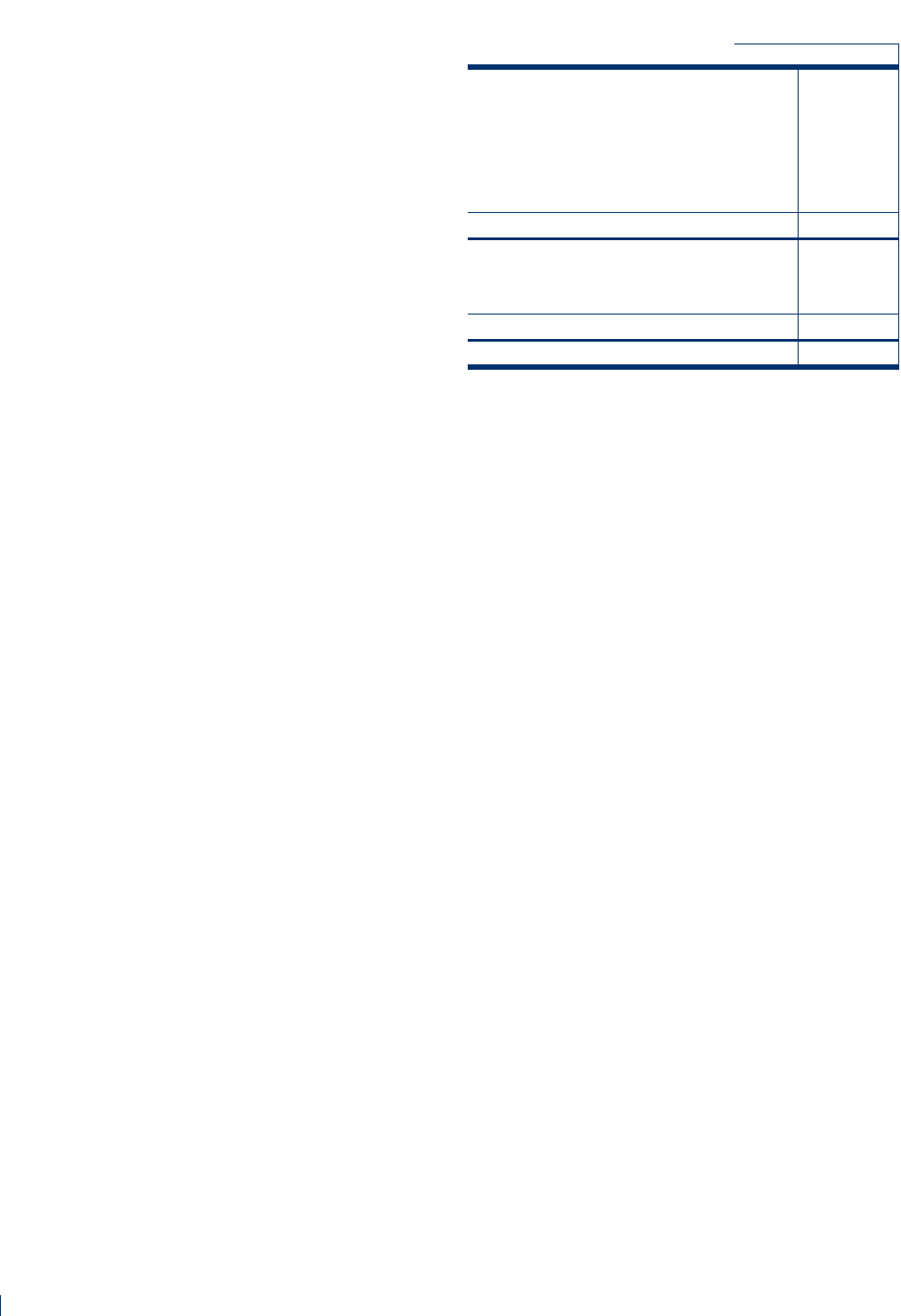

IN V E S T M E N T I N DI S C O N T I N U E D OP E R AT I O N S

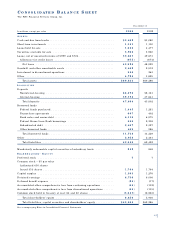

December 31 - in millions 2000 1999

Loans held for sale . . . . . . . . . . . . . $3,003 $2,321

Securities available for sale . . . . . . . 3,016 1,651

Loans, net of unrealized income . . . . 739 373

Goodwill and other

amortizable assets . . . . . . . . . . . . 1,925 1,611

All other assets . . . . . . . . . . . . . . . . 1,168 434

Total assets . . . . . . . . . . . . . . . . . 9,851 6,390

Deposits . . . . . . . . . . . . . . . . . . . . . 1,150 866

Borrowed funds . . . . . . . . . . . . . . . . 7,601 5,118

Other liabilities . . . . . . . . . . . . . . . . 744 143

Total liabilities . . . . . . . . . . . . . . 9,495 6,127

Net assets . . . . . . . . . . . . . . . . . . $356 $263

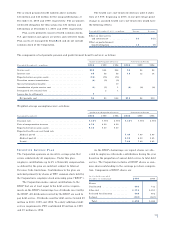

The notional and fair value of financial derivatives used for

residential mortgage banking risk management were

$15.2 billion and $124 million, respectively, at

December 31, 2000. The comparable amounts at

December 31, 1999 were $9.3 billion and $28 million,

respectively. The weighted-average maturity of financial

derivatives used for residential mortgage banking risk m a n -

agement was 2 years and 2 months at December 31, 2000.

NO T E 3 SA L E O F SU B S I D I A RY ST O C K

PNC recognizes as income the gain from the sale of stock by

its subsidiaries. The gain is the difference between PNC’s

basis in the stock and the proceeds per share received. PNC

provides applicable taxes on the gain.

In October 1999, BlackRock, Inc. (“BlackRock”), a

majority-owned investment management subsidiary of the

Corporation, issued nine million shares of class A common

stock at $14.00 per share in an initial public offering

(“IPO”). Prior to the IPO, PNC and BlackRock’s manage-

ment owned approximately 82% and 18% , respectively, of

BlackRock’s outstanding common stock. Proceeds from the

sale were approximately $115 million and resulted in PNC

recording a pretax gain in the amount of $64 million or $59

million after tax. As of December 31, 2000, PNC owned

approximately 70% of BlackRock.