PNC Bank 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

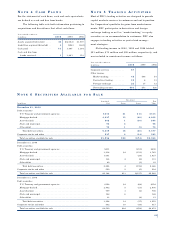

Loan outstandings and related unfunded commitments are

concentrated in PNC’s primary geographic markets. At

December 31, 2000, no specific industry concentration

exceeded 6.5% of total outstandings and unfunded commit-

ments.

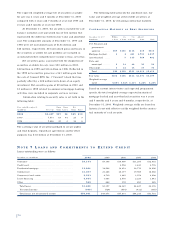

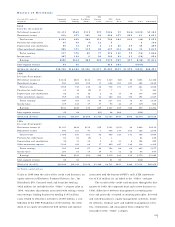

NE T UN F U N D E D CO M M I T M E N T S (a)

December 31 - in millions 2000 1999

Consumer . . . . . . . . . . . . . . . . . . . . . . . $4,414 $4,603

Commercial . . . . . . . . . . . . . . . . . . . . . 24,253 23,251

Commercial real estate . . . . . . . . . . . . . 1,039 740

Lease financing . . . . . . . . . . . . . . . . . . 123 136

Other . . . . . . . . . . . . . . . . . . . . . . . . . . 173 1,513

Total . . . . . . . . . . . . . . . . . . . . . . . . $30,002 $30,243

(a) Excludes unfunded commitments related to loans designated for exit.

Commitments to extend credit represent arrangements to

lend funds subject to specified contractual conditions.

Commercial commitments are reported net of participations,

assignments and syndications, primarily to financial institu-

tions, totaling $7.2 billion at December 31, 2000 and 1999.

Commitments generally have fixed expiration dates, may

require payment of a fee, and contain termination clauses in

the event the customer’s credit quality deteriorates. Based

on the Corporation’s historical experience, most commit-

ments expire unfunded, and therefore cash requirements are

substantially less than the total commitment.

Net outstanding letters of credit totaled $4.0 billion and

$4.6 billion at December 31, 2000 and 1999, respectively,

and consisted primarily of standby letters of credit that

commit the Corporation to make payments on behalf of cus-

tomers if certain specified future events occur. Such instru-

ments are typically issued to support industrial revenue

bonds, commercial paper, and bid-or-performance related

contracts. At year-end 2000, the largest industry concentra-

tion within standby letters of credit was for educational

services, which accounted for approximately 8% of the total.

Maturities for standby letters of credit ranged from 2001

to 2011.

Unfunded commitments and letters of credit related to

loans designated for exit in 1999 were $1.7 billion at

December 31, 2000 and $4.8 billion at December 31, 1999.

At December 31, 2000, $8.0 billion of loans were

pledged to secure borrowings and for other purposes.

Certain directors and executive officers of the

Corporation and its subsidiaries, as well as certain affiliated

companies of these directors and officers, were customers of

and had loans with subsidiary banks in the ordinary course

of business. All such loans were on substantially the same

terms, including interest rates and collateral, as those pre-

vailing at the time for comparable transactions with other

customers and did not involve more than a normal risk of

collectibility. The aggregate dollar amounts of these loans

were $29 million and $27 million at December 31, 2000

and 1999, respectively. During 2000, new loans of $16 mil-

lion were funded and repayments totaled $14 million.

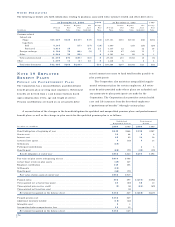

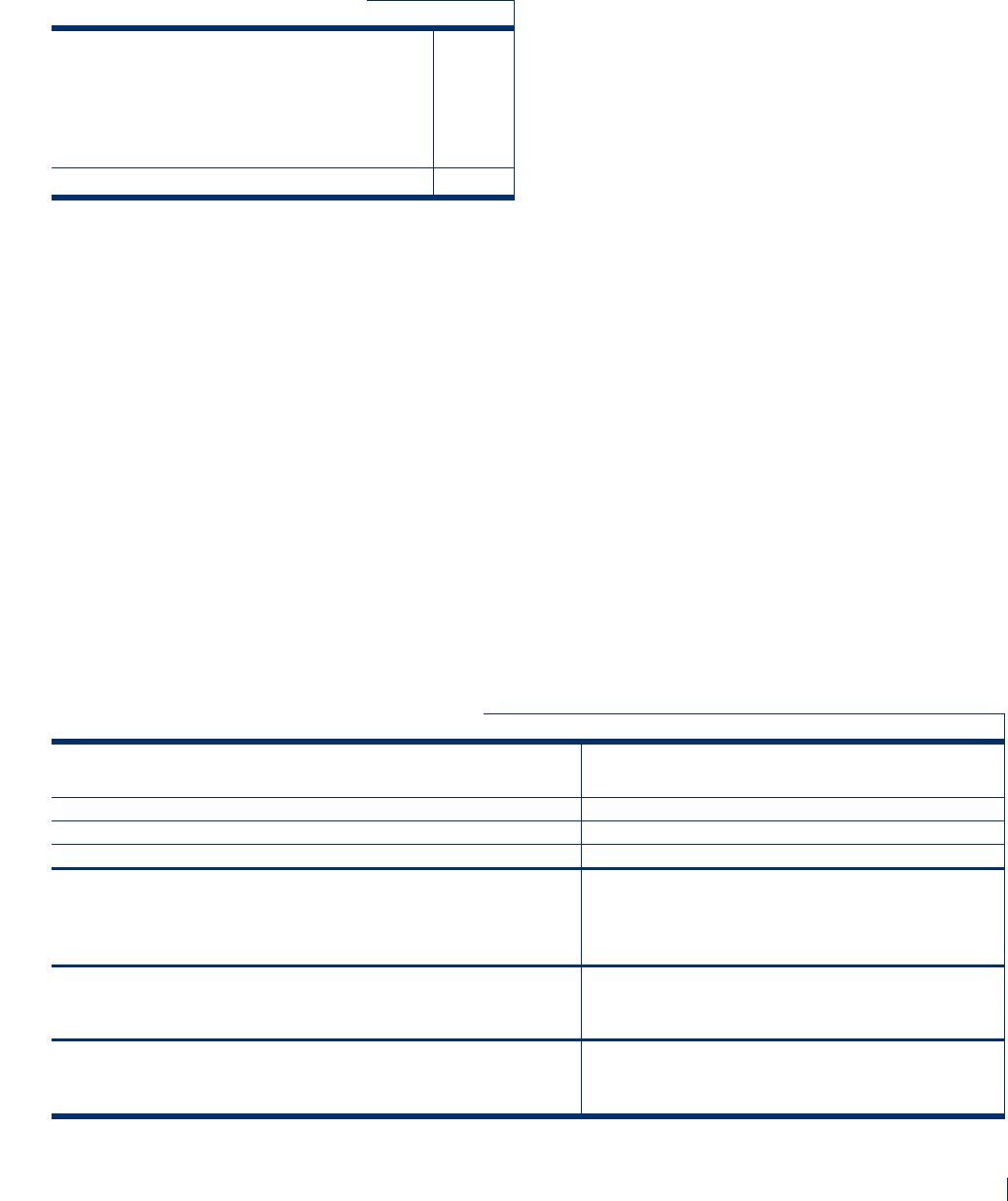

NO T E 8 NO N P E R F O R M I N G AS S E T S

The following table sets forth nonperforming assets and related information:

December 31 - dollars in millions 2000 1999 1998 1997 1996

Nonaccrual loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $323 $291 $286 $270 $343

Troubled debt restructured loans . . . . . . . . . . . . . . . . . . . 2

Total nonperforming loans . . . . . . . . . . . . . . . . . . . . . . . 323 291 286 270 345

Foreclosed and other assets . . . . . . . . . . . . . . . . . . . . . . . 49 34 33 52 106

Total nonperforming assets (a) . . . . . . . . . . . . . . . . . . . . $372 $325 $319 $322 $451

Nonperforming loans to total loans . . . . . . . . . . . . . . . . . . .64% .59% .50% .50% .67%

Nonperforming assets to total loans, loans held for sale

and foreclosed assets . . . . . . . . . . . . . . . . . . . . . . . . . . .71 .61 .55 .59 .87

Nonperforming assets to total assets . . . . . . . . . . . . . . . . . .53 .47 .45 .45 .63

Interest on nonperforming loans

Computed on original terms . . . . . . . . . . . . . . . . . . . . . $42 $28 $25 $31 $34

Recognized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 11 6 6 10

Past due loans

Accruing loans past due 90 days or more . . . . . . . . . . . $113 $86 $263 $287 $242

As a percentage of total loans . . . . . . . . . . . . . . . . . . . . .22% .17% .46% .53% .47%

(a) The above table excludes $18 million and $13 million of equity management assets at December 31, 2000 and 1999, respectively, that are carried at

estimated fair value.