PNC Bank 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Community Banking grew revenue by 3% for the

year but, driven by new applications of technology

to increase marketing efficiency, delivered earnings

growth of 9% .

A TE C H N O L O G Y LE A D E R

Part of our confidence in the future of this

company stems from our position of leadership in

technology, which has represented a significant com-

petitive advantage at PNC for many years. We have

focused on making disciplined and focused invest-

ments in technologies that have the potential to create

value for customers and shareholders alike.

And our efforts across a wide range of

businesses have received significant

recognition.

• In December, PNC was ranked

11th overall, and 2nd among

financial services organiza-

tions, in the “ Innovation

100” research study by

InformationWeek and Cap

Gemini Ernst & Young, which

evaluated companies based on

their success in using technol-

ogy to benefit customers.

•Our customer call center

was ranked 5th-best in

our industry by Financial

Services Marketing.

•Our data center — the heart of

our technology capabilities —

was ranked as the most effi-

cient in our peer group by the

GartnerGroup.

This recognition is only a

reflection of the value we contin-

ued to deliver to customers

through a number of significant

technology initiatives. Our

launch of BillingZone, a joint

deliver consistent earnings growth over time, up to

and including the sale or downsizing of additional

businesses that we do not believe are positioned to

help us achieve our performance objectives.

EN G I N E S F O R GR O W T H

Obviously, we have downsized

PNC’s balance sheet as a result of our

strategies to strengthen our busi-

ness mix. This has meant sacrific-

ing near-term net interest

income to drive what we believe

to be very positive changes in

the long-term earnings and

growth dynamics of our compa-

ny. But even as we have

removed substantial amounts of

lending-related

revenue, we have been able

to grow earnings per share at a

compound annual rate of 10%

over the past five years.

This performance during

a period of substantial transition

reflects the powerful growth

dynamics inherent in many

of our businesses. Our asset

management and processing

businesses — PNC Advisors,

BlackRock and PFPC — grew

revenue, collectively, by 22% in

2000. Among our banking business-

es, Treasury Management, Capital Markets and

Business Credit delivered revenue growth of

11% , 21% and 45%, respectively, in 2000.

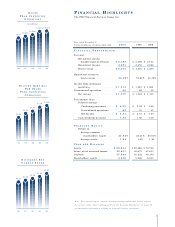

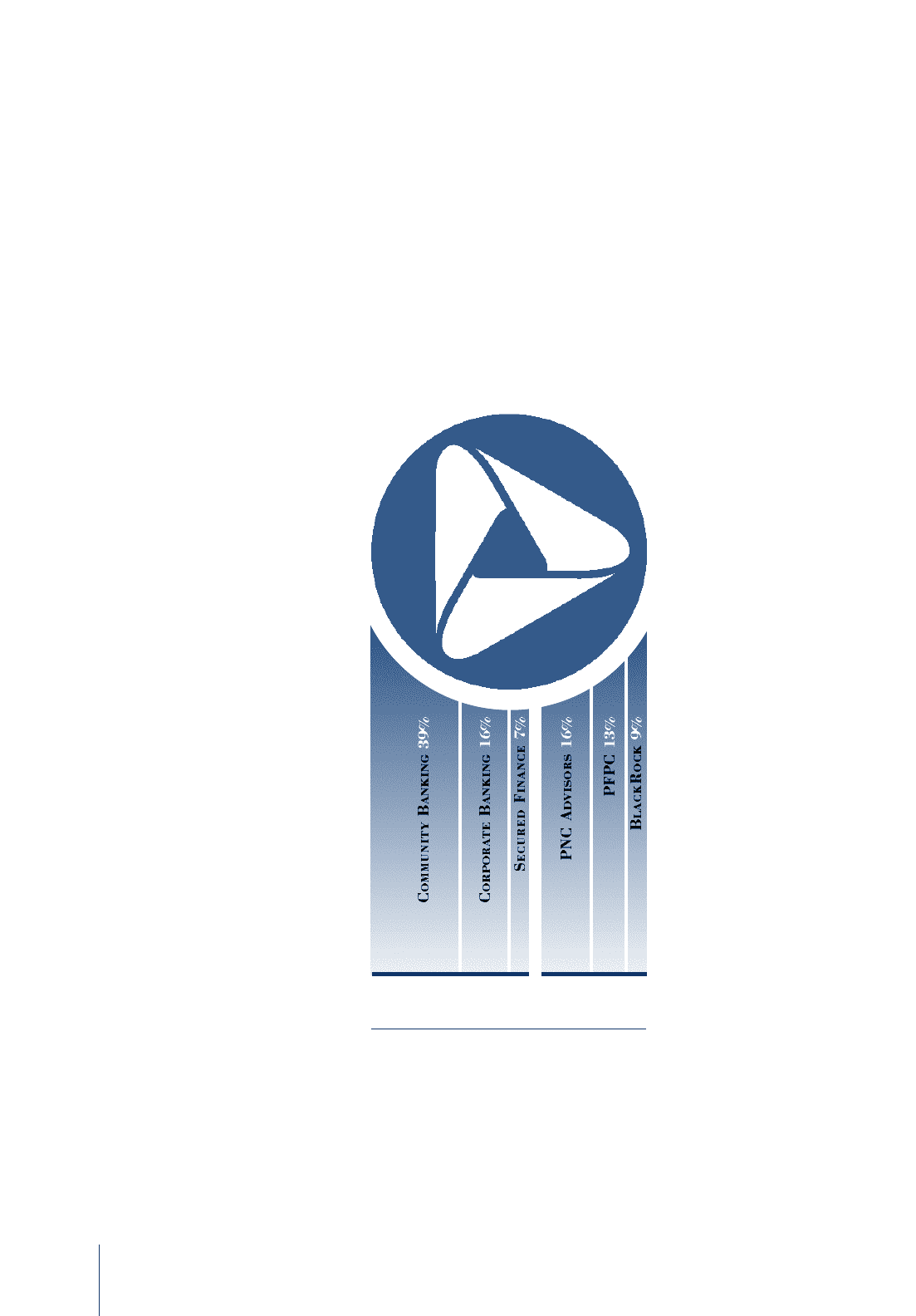

2 0 0 0 RE V E N U E CO N T R I B U T I O N

BYBU S I N E S S

Banking Asset

and Secured Finance Management

and Processing