PNC Bank 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AS S E T MA N A G E M E N T PE R F O R M A N C E

Asset management revenue is primarily based on a percent-

age of the value of assets under management and perform-

ance fees expressed as a percentage of the returns realized

on assets under management. A decline in the prices of

debt and equity instruments, among other things, could

cause asset management revenue to decline.

Investment performance is an important factor for the

level of assets under management. Poor investment perform-

ance could impair revenue and growth as existing clients

might withdraw funds in favor of better performing products.

Also, performance fees could be lower or nonexistent.

Additionally, the ability to attract funds from existing and

new clients might diminish.

FU N D SE RV I C I N G

Fund servicing fees are primarily based on the market value

of the assets and the number of shareholder accounts

administered by the Corporation for its clients. A rise in

interest rates or a decline in the debt and equity markets

could influence an investor

’

s decision whether to invest or

maintain an investment in a mutual fund. As a result, fluc-

tuations may occur in assets that the Corporation has under

administration. A significant investor migration from mutual

fund investments could have a negative impact on the

Corporation’s revenues by reducing the assets and the num-

ber of shareholder accounts it administers. There has been

and continues to be merger, acquisition and consolidation

activity in the financial services industry. Mergers or cons o l-

idations of financial institutions in the future could re d u c e

the number of existing or potential fund servicing clients.

AC Q U I S I T I O N S

The Corporation expands its business from time to time by

acquiring other financial services companies. Factors per-

taining to acquisitions that could adversely affect the

Corporation’s business and earnings include, among others:

•anticipated cost savings or potential revenue enhance-

ments that may not be fully realized or realized within the

expected time frame;

•customer loss or revenue loss following an acquisition that

may be greater than expected; and

• costs or difficulties related to the integration of businesses

that may be greater than expected.

RI S K MA N A G E M E N T

In the normal course of business, the Corporation assumes

various types of risk, which include, among others, credit

risk, interest rate risk, liquidity risk, and risk associated

with trading activities and financial derivatives. PNC has

risk management processes designed to provide for risk

i d e n t i fication, measurement and monitoring.

CR E D I T RI S K

Credit risk represents the possibility that a borrower or

counterparty may not perform in accordance with contrac-

tual terms. Credit risk is inherent in the financial services

business and results from extending credit to customers,

purchasing securities and entering into off-balance-sheet

financial derivative transactions. The Corporation seeks to

manage credit risk through, among other things, diversifica-

tion, limiting exposure to any single industry or customer,

requiring collateral, selling participations to third parties,

and purchasing credit-related derivatives.

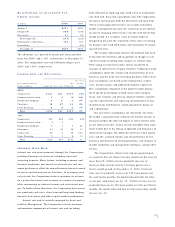

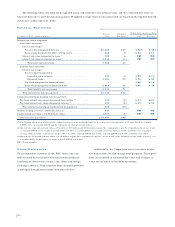

NO N P E R F O R M I N G AS S E T S

Year ended December 31

December 31 – dollars in millions 2 000 1999

Nonaccrual loans

Commercial . . . . . . . . . . . . . . . . . $312 $219

Commercial real estate . . . . . . . . 321

Residential mortgage . . . . . . . . . . 448

Consumer . . . . . . . . . . . . . . . . . . 22

Lease financing . . . . . . . . . . . . . . 21

Total nonaccrual loans . . . . . . . 323 291

Foreclosed and other assets

Commercial real estate . . . . . . . . 35

Residential mortgage . . . . . . . . . . 87

Other . . . . . . . . . . . . . . . . . . . . . 38 22

Total foreclosed and other assets 49 34

Total nonperforming assets . . . . . $372 $325

Nonaccrual loans to total loans . . . . .64% .59%

Nonperforming assets to total loans,

loans held for sale and

foreclosed assets . . . . . . . . . . . . . .71 .61

N o n p e r f o rming assets to total assets . . .53 .47

The above table excludes $18 million and $13 million of

equity management assets at December 31, 2000 and 1999,

respectively, that are carried at estimated fair value.

49