PNC Bank 2000 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

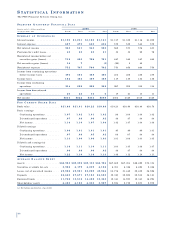

79

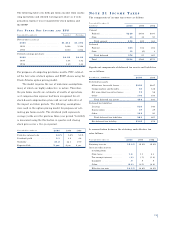

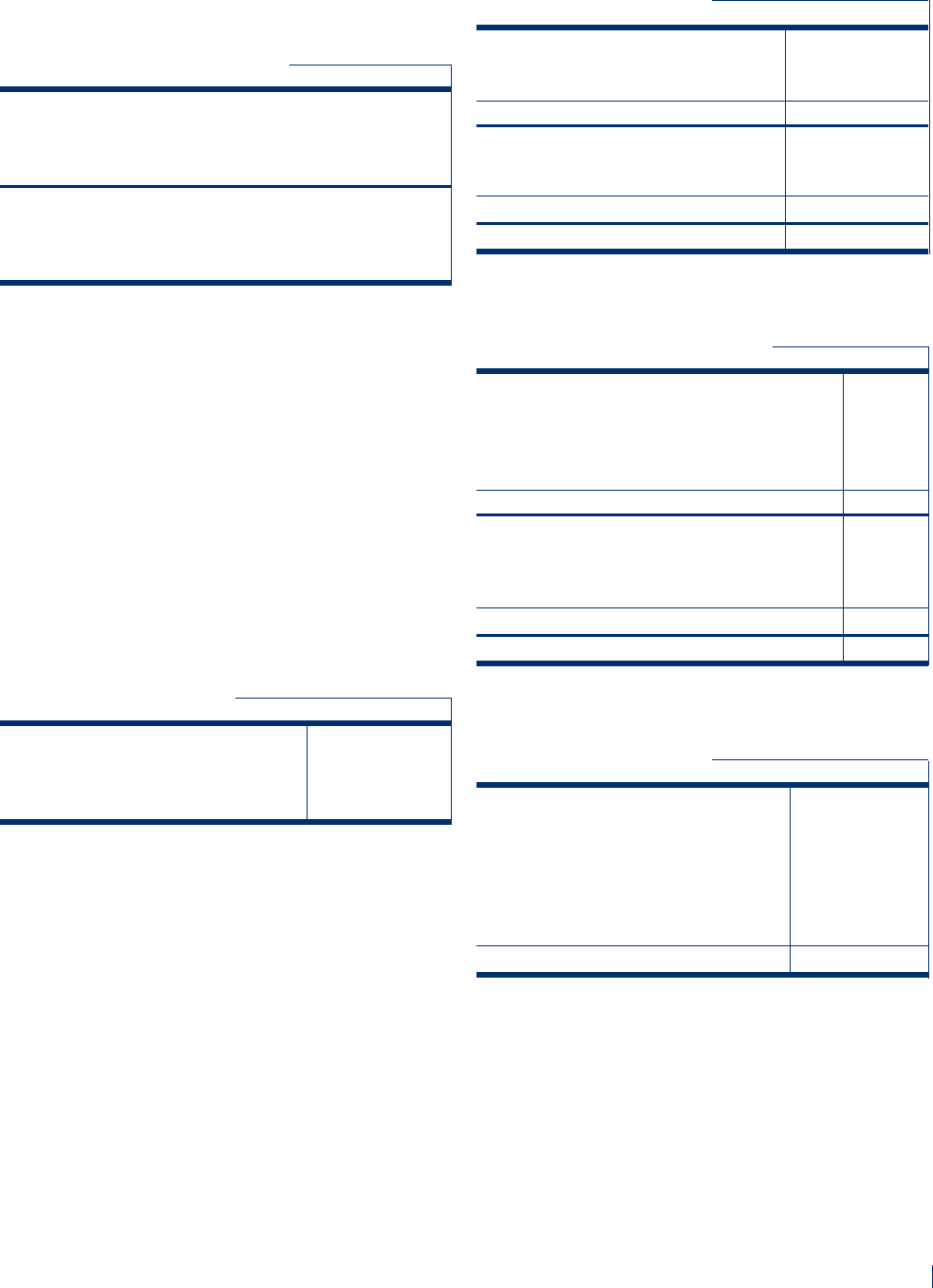

The following table sets forth pro forma income from contin-

uing operations and diluted earnings per share as if com-

pensation expense was recognized for stock options and

the ESPP.

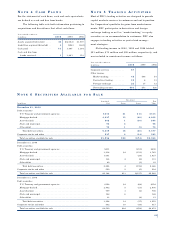

PR O FO R M A NE T IN C O M E A N D E P S

Year ended December 31 Reported Pro forma

Net income (in millions)

2000 . . . . . . . . . . . . . . . . . . . . . . . $1,214 $1,196

1999 . . . . . . . . . . . . . . . . . . . . . . . . 1,202 1,194

1998 . . . . . . . . . . . . . . . . . . . . . . . . 1,080 1,064

Diluted earnings per share . . . . . . . . . .

2000 . . . . . . . . . . . . . . . . . . . . . . . $4.09 $4.02

1999 . . . . . . . . . . . . . . . . . . . . . . . . 3.94 3.92

1998 . . . . . . . . . . . . . . . . . . . . . . . . 3.49 3.43

For purposes of computing pro forma results, PNC estimat-

ed the fair value of stock options and ESPP shares using the

Black-Scholes option pricing model.

The model requires the use of numerous assumptions,

many of which are highly subjective in nature. Therefore,

the pro forma results are estimates of results of operations

as if compensation expense had been recognized for all

stock-based compensation plans and are not indicative of

the impact on future periods. The following assumptions

were used in the option pricing model for purposes of esti-

mating pro forma results. The dividend yield represents

average yields over the previous three-year period. Volatility

is measured using the fluctuation in quarter-end closing

stock prices over a five-year period.

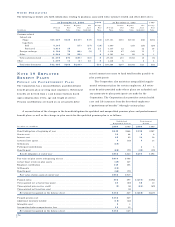

Year ended December 31 2000 1999 1998

Risk-free interest rate . . . . . . . 6.6% 5.2% 5.5%

Dividend yield . . . . . . . . . . . . . 3.1 3.6 4.4

Volatility . . . . . . . . . . . . . . . . . 21.8 22.1 19.9

Expected life . . . . . . . . . . . . . . 5 yrs. 6 yrs. 6 yrs.

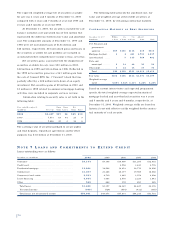

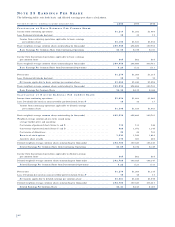

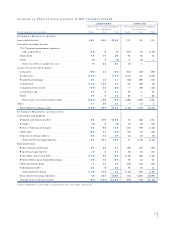

NO T E 2 1 IN C O M E TA X E S

The components of income taxes were as follows:

Year ended December 31

In millions 2 000 1999 1998

Current

Federal . . . . . . . . . . . . . . . . $226 $454 $307

State . . . . . . . . . . . . . . . . . . 32 35 57

Total current . . . . . . . . . . 258 489 364

Deferred

Federal . . . . . . . . . . . . . . . . 363 102 204

State . . . . . . . . . . . . . . . . . . 13 (5) 3

Total deferred . . . . . . . . . 376 97 207

Total . . . . . . . . . . . . . . . . . . $634 $586 $571

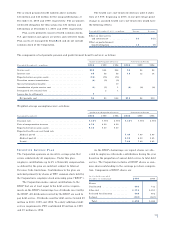

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2000 1999

Deferred tax assets

Allowance for credit losses . . . . . . . . $250 $247

Compensation and benefits . . . . . . . . 85 128

Net unrealized securities losses . . . . 19 58

Other . . . . . . . . . . . . . . . . . . . . . . . . 104 158

Total deferred tax assets . . . . . . . . 458 591

Deferred tax liabilities

Leasing . . . . . . . . . . . . . . . . . . . . . . 824 548

Depreciation . . . . . . . . . . . . . . . . . . 37 29

Other . . . . . . . . . . . . . . . . . . . . . . . . 102 90

Total deferred tax liabilities . . . . . 963 667

Net deferred tax liability . . . . . . . . . . $505 $76

A reconciliation between the statutory and effective tax

rates follows:

Year ended December 31 2000 1999 1998

Statutory tax rate . . . . . . . . . . . 35.0% 35.0% 35.0%

Increases (decreases)

resulting from

State taxes . . . . . . . . . . . . . . 1.6 1.1 2.3

Tax-exempt interest . . . . . . . (.6) (.7) (1.0)

Goodwill . . . . . . . . . . . . . . . .9 .9 .9

Other . . . . . . . . . . . . . . . . . (2.6) (3.5) (2.6)

Effective tax rate . . . . . . . . . 34.3% 32.8% 34.6%