PNC Bank 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CO N S I S T E N C Y A N D GR O W T H: OU R TA R G E T E D

OU T C O M E S

Our overriding objective is to achieve a

premium valuation relative to our peers, and we

recognize that achieving this objective will require

the demonstrated ability to deliver strong growth

in earnings consistently over time. Accordingly,

we have focused our strategies on creating a business

mix with the following characteristics:

•G r eater diversity of earnings, with increased contri-

butions from our more highly-valued businesses,

including asset management and processing.

•Greater consistency of earnings, an objective that

will demand decreased reliance on historically

volatile lending activities and increased contribu-

tions from fee-based activities.

•Strong growth dynamics, which

will require continued investments in

our higher-growth businesses and

increased relative contributions from

higher-growth activities within our

banking businesses.

BU I L D I N G A MO R E VA L U A B L E

BU S I N E S S MI X

In 2000, we invested over

$1 billion in our businesses, including

our acquisition of Automated Business

Development, Corp., which will be inte-

g rated into PFPC, and BillingZone, our

joint venture with Perot Systems. Our

investments have focused on expanding

the scope and scale of our more highly-

valued businesses, building the PNC

brand, attracting and retaining talented

professionals, and developing and

Positive change defined our company in

2000, and our ability to embrace change during the

year without compromising near-term performance is

a testament to the will and resolve of our employees.

In this, my first letter to shareholders, I want to thank

all of my colleagues at PNC. Their efforts paved the

way for a strong 2000 and drove our progress in

creating a more valuable company.

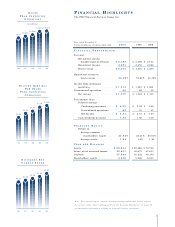

ST R O N G FI N A N C I A L PE R F O R M A N C E

On an absolute basis and relative

to our industry peers, the financial

performance of our continuing operations

was strong in 2000:

•Earnings per share rose to $4.09,

a 10% increase over core earnings

per share in 1999.

•Noninterest income accounted

for 57% of total revenue.

• Asset quality remained relatively

stable, with net charge-offs to average

loans of .27% and nonperforming

loans to total loans of .64% .

• Returns on equity and assets were

21% and 1.8% , respectively.

We are pleased with our financial

results in 2000, and are gratified that

investors have recognized the strength

and consistency of our performance. In

2000, PNC’s stock price increased by over

60% , more than four times the increase

for the S&P Major Regional Banks Index.

4

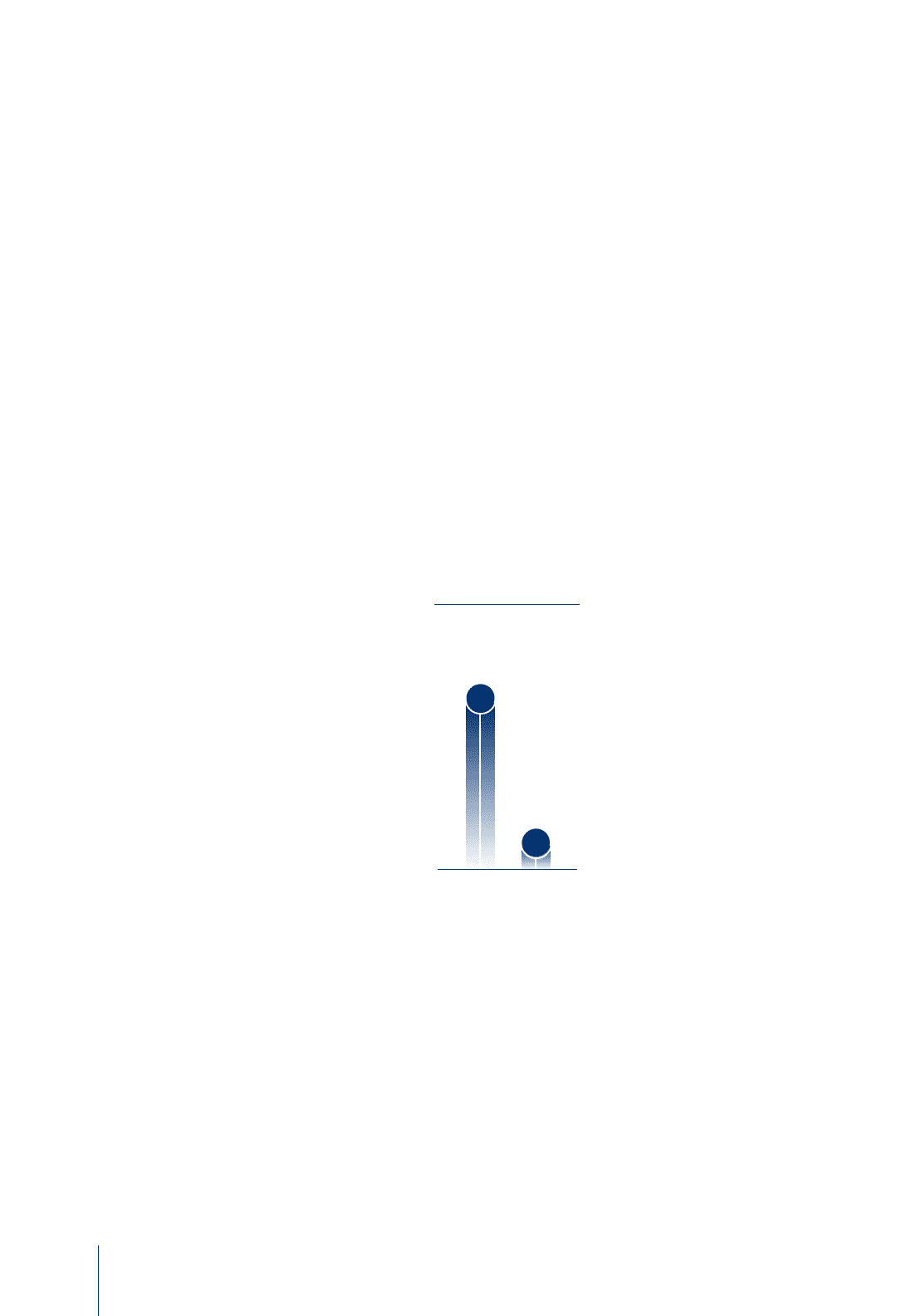

P N C C O M M O N

ST O C K V S . S & P

MA J O R RE G I O N A L

BA N K S IN D E X

(per share price increase —

Dec. 31, 2000 vs.

Dec. 31, 1999)

PNC S&P

MRBI

64%

14%