PNC Bank 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 0 0 0 A N N U A L RE P O R T

Table of contents

-

Page 1

2 0 0 0 ANNUAL REPO RT -

Page 2

... Financial Highlights ... 1 3 8 Letter To Our Shareholders Q&A ... Business Overview ...10 Customer Insight ...12 PNC Bank - Community Banking ...14 PNC Bank - Corporate Banking ...16 PNC Real Estate Finance ...18 PNC Business Credit ...20 Superior Technology ...22 PNC Advisors ...24 BlackRock... -

Page 3

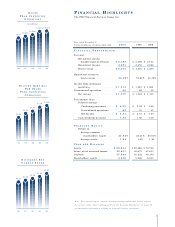

...) $1,202 $1,214 $991 $1,038 $1,080 FI NA NCI A L H I GH L I GH T S The PNC Financial Services Group, Inc. Year ended December 31 Dollars in millions, except per share data 2000 1999 1998 FINANCIAL PERFO RMANCE Revenue Net interest income (taxable-equivalent basis) . . Noninterest income... -

Page 4

The Thinking Behind The Money -

Page 5

... PNC Financial Services Group delivered record performance in 2000 Powerful, Diversiï¬ed Businesses Superior Technology Positioned for Growth in the face of extremely challenging market dynamics and competition. Our fundamental objectives for the year were to deliver strong near-term ï¬nancial... -

Page 6

... earnings consistently over time. Accordingly, we have focused our strategies on creating a business mix with the following characteristics: • Greater diversity of earnings, with increased contributions from our more highly-valued businesses, including asset management and processing. • Greater... -

Page 7

... the revenue generated by lending activities within our banking businesses. And again, this increased diversity was due in large part to the growth of more highly-valued activities, including treasury management, deposit gathering and brokerage. and signiï¬cant portions of our national real estate... -

Page 8

... inherent in many of our businesses. Our asset management and processing businesses - PNC Advisors, BlackRock and PFPC - grew revenue, collectively, by 22% in 2000. Among our banking businesses, Treasury Management, Capital Markets and Business Credit delivered revenue growth of 11% , 21% and... -

Page 9

..., will help position PNC as a leader in electronic bill presentment and payment. BlackRock introduced BlackRock Solutions, offering industry-leading risk management and investment technology services to institutional investors. PNC Advisors introduced live Webcasts of market commentaries by top... -

Page 10

... very signiï¬cant progress in strengthening the business mix of this organization. We continued to invest in, and grow, highly-valued businesses like PFPC, BlackRock and Treasury Management. We continued to reshape our traditional banking businesses in an effort to decrease volatility and risk and... -

Page 11

...have been driven business by business...We've had tremendous success with acquisitions like BlackRock, Midland, ISG and Hilliard Lyons...And we've developed a real talent for integrating a diverse range of organizations quickly and efï¬ciently. - Rohr Jim Rohr President and Chief Executive Ofï¬cer... -

Page 12

... Cards Corporate Banking $839 $244 20% 33% • 9th-Largest Treasury Management Business • 13th-Largest Bank Leasing Company Real Estate Finance $220 $82 21% 48% • 2nd-Largest Servicer of Commercial MortgageBacked Securities • 2nd-Largest Servicer of Commercial Mortgage Loans Business Credit... -

Page 13

... 10 Manager of Trust and High-NetWorth Assets $477 $87 27% 36% • 7th-Largest Publicly Traded Asset Manager • 5th-Largest Manager of Institutional Money Market Funds $690 $47 22% 23% • Largest Full-Service Mutual Fund Transfer Agent • 2nd-Largest Provider of Mutual Fund Accounting... -

Page 14

Customer -

Page 15

... access to customer information and histories for more than 5 million accounts • PNC Advisors professionals have wireless online access to market data and customer information • Treasury management offers customized electronic bill presentment programs to meet speciï¬c cash management... -

Page 16

... its Community Banking business, PNC Bank offers deposit, brokerage, insur- D EPO SIT GROWTH (inc rease over previous year) 4% ance and credit products and services as well as electronic banking. Its customer base includes more than three million retail households and 180,000 small businesses... -

Page 17

An insightful provider to small businesses and consumers -

Page 18

services for corporate clients A full range of ï¬nancial -

Page 19

... and government agencies - which included developing a stronger focus on more highly-valued earnings. Central to this transition are Corporate Banking's specialized credit, capital markets, treasury management and leasing services. At the same time, Corporate Banking has focused on decreasing its... -

Page 20

...PNC Advisors, Hawthorn and PNC Bank's treasury management group. hrough PNC Real Estate Finance, commercial real estate developers, owners and investors are provided credit, capital markets, treasury management, and other products and services. The PNC Real Estate Finance platform includes Midland... -

Page 21

Innovative solutions for the commercial real estate market -

Page 22

A national in asset-based lending leader -

Page 23

... REVENUE (in millions) $119 asset-based lenders, PNC Business products and services to middle market customers on a national basis. PNC Business Credit enables clients to leverage the value of their assets and cash ï¬,ow to achieve both short- and long-term goals. Led by a seasoned management team... -

Page 24

Superior -

Page 25

...and accessibility to our customers...and to equip employees with tools that enhance productivity and marketing capabilities. • PNC's new technology hub - Firstside Center (pictured) - doubles capacity for online transactions and transfers up to $50 billion daily for treasury management customers... -

Page 26

...managers in the nation, PNC Advisors provides clients with tailored investment and traditional banking solutions. It includes Hilliard Lyons, a full-service brokerage, and Hawthorn, an investment consulting The Unlocking Paper Wealth area on the home page allows visitors, such as Marconi executive... -

Page 27

expertise- when and where you need it Investment -

Page 28

World class solutions for institutional investors -

Page 29

... and systems. In August 2000, BlackRock announced that these services would be offered to a broader universe of institutional investors under the name BlackRock Solutions, building in 2001 on a year-end base of over $1.37 trillion in " assets under risk management." and diluted earnings per... -

Page 30

... global fund industry, including mutual funds, alterna- services to the investment management tive investments and retirement plans. This member of The PNC Financial Services Group is the nation's largest full-service mutual fund transfer agent and second largest provider of mutual fund accounting... -

Page 31

A premier provider of fund services worldwide -

Page 32

... Banking D O NNA L. H AMMEL Technology & Processing Services K A R E N S. M O R G A N Community Banking D E N N I S K . H AYA S H I Community Banking Corporate Banking A LV E N A H E R A L D ARLENE M. O HLER Corporate Banking Corporate Banking JO S E P H W . " C H I P " S E I D L E PNC Advisors... -

Page 33

... 1983 LO R E N E K . ST E F F E S 3 Finance 4 Corporate Governance 5 Personnel and Compensation 6 Credit Vice President Software Services and Software Group Pittsburgh Site Executive IBM Corporation (consulting, education and training software services) Director since 2000 *Retiring as of April... -

Page 34

The PNC Financial Services Group, Inc. One PNC Plaza 249 Fifth Avenue Pittsburgh, PA 15222-2707 -

Page 35

... 56 58 Selected Consolidated Financial Data Overview Review of Businesses Community Banking Corporate Banking PNC Real Estate Finance PNC Business C redit PNC Advisors BlackRock PFPC Consolidated Income Statement Review Consolidated Balance Sheet Review Risk Factors Risk Management 1999 Versus 1998... -

Page 36

... ...Discontinued operations ...Net income ...Book value ...Cash dividends declared ...B ALANCE SHEET HIGHLIGHT S (at December 31) ...Assets ...Earning assets ...Loans, net of unearned income ...Securities available for sale ...Loans held for sale ...Deposits ...Borrowed funds ...Shareholders' equity... -

Page 37

... banking, corporate banking, real estate ï¬nance, assetbased lending, wealth management, asset management and global fund services businesses. The Corporation provides certain products and services nationally and others in PNC's primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio... -

Page 38

... banking, real estate ï¬nance, assetbased lending, wealth management, asset management and global fund services: Community Banking, Corporate Banking, PNC Real Estate Finance, PNC Business Credit, PNC Advisors, BlackRock and PFPC. Business results are presented based on PNC's management accounting... -

Page 39

... ended December 31 - dollars in millions 2000 1999 2000 1999 2000 1999 2000 1999 PNC Bank Community Banking ...Corporate Banking ...Total PNC Bank ...PNC Secured Finance PNC Real Estate Finance ...PNC Business Credit ...Total PNC Secured Finance ...Asset Management PNC Advisors ...BlackRock... -

Page 40

...22% 30 51 21% 28 52 Community Banking provides deposit, branch-based brokerage, electronic banking and credit products and services to retail customers as well as credit, treasury management and capital markets products and services to small businesses primarily within PNC's geographic region. 37 -

Page 41

... and services. Treasury management and capital markets products offered through Corporate Banking are sold by several businesses across the Corporation and related proï¬tability is included in the results of those businesses. Consolidated revenue from treasury management was $341 million for 2000... -

Page 42

... PNC Real Estate Finance provides credit, capital markets, treasury management, commercial mortgage loan servicing and other products and services to developers, owners and investors in commercial real estate. PNC's commercial real estate ï¬nancial services platform includes Midland Loan Services... -

Page 43

... ... 32% 24 25% 28 PNC Business Credit provides asset-based lending, capital markets and treasury management products and services to middle market customers on a national basis. PNC Business Credit's lending services include loans secured by accounts receivable, inventory, machinery and equipment... -

Page 44

...in millions PNC Advisors strives to be the " ï¬nancial advisor of choice" in the growing high-net-worth market, providing a full range of high-quality, customized and predominantly 2000 1999 fee-based investment products and services. PNC Advisors continues to expand Hilliard Lyons throughout the... -

Page 45

...investment separate accounts and mutual funds, including its ï¬,agship fund families, BlackRock Funds and BlackRock Provident Institutional Funds. In addition, BlackRock provides risk management and technology services to a growing number of institutional investors under the BlackRock Solutions name... -

Page 46

...technological resources on targeted Web-based initiatives and exploring strategic alliances. On December 1, 1999, PFPC acquired ISG, one of the nation's leading providers of back-ofï¬ce services to mutual funds and retirement plans. The acquisition added key related businesses, including retirement... -

Page 47

... 7.93 1999 Change Interest-earning assets Loans held for sale...Securities available for sale ...Loans, net of unearned income Consumer ...Credit card...Residential mortgage ...Commercial ...Commercial real estate...Lease ï¬nancing ...Other...Total loans, net of unearned income ...Other ...Total... -

Page 48

...ecting the impact of strategic marketing initiatives to grow more valuable transaction accounts, while other time deposits decreased in the period-to-period comparison. Average borrowed funds for 2000 decreased $1.7 billion compared with 1999 as lower bank notes and Federal Home Loan Bank borrowings... -

Page 49

...Retail/wholesale ...Service providers ...Real estate related ...Communications ...Health care ...Financial services ...Other ...Total commercial ...Commercial real estate Mortgage ...Real estate project ...Total commercial real estate ...Lease ï¬nancing ...Other ...Unearned income ...Total, net of... -

Page 50

... F O R S A L E Amortized Cost Fair Value C A P I TA L Year ended December 31 The access to and cost of funding new business initiatives including acquisitions, the ability to engage in expanded business activities, the ability to pay dividends, deposit insurance costs, and the level and nature of... -

Page 51

... could impact the Corporation's business, ï¬nancial condition and results of operations. money and credit in the United States. The Federal Reserve Board's policies inï¬,uence the rates of interest that PNC charges on loans and pays on interest-bearing deposits and can also affect the value of... -

Page 52

... credit-related derivatives. NO NPERFO RMING ASSET S Year ended December 31 December 31 - dollars in millions Fund servicing fees are primarily based on the market value of the assets and the number of shareholder accounts administered by the Corporation for its clients. A rise in interest rates... -

Page 53

... real estate ...Residential mortgage ...Consumer ...Lease ï¬nancing ... Total ...$ 1 1 3 Loans not included in nonaccrual or past due categories, but where information about possible credit problems causes management to be uncertain about the borrower's ability to comply with existing repayment... -

Page 54

... net interest margin. To further these objectives, the Corporation uses securities purchases and sales, short-term and long-term funding, ï¬nancial derivatives and other capital markets instruments. Interest rate risk is centrally managed by Asset and Liability Management. The Corporation actively... -

Page 55

... forms of borrowing, including federal funds purchased, repurchase agreements and shortterm and long-term debt issuances. Liquidity for the parent company and subsidiaries is also generated through the issuance of securities in public or private markets and lines of credit. At December 31, 2000... -

Page 56

... prior year. Most of PNC's trading activities are designed to provide capital markets services to customers and not to position the Corporation's portfolio for gains from market movements. PNC participates in derivatives and foreign exchange trading as well as " market making" in equity securities... -

Page 57

...-bearing deposits ...Borrowed funds ...Pay ï¬xed designated to borrowed funds ...Basis swaps designated to borrowed funds ...Total liability rate conversion ...Total interest rate risk management ...Commercial mortgage banking risk management Pay ï¬xed interest rate swaps designated to securities... -

Page 58

... rate risk management ...Commercial mortgage banking risk management Pay ï¬xed interest rate swaps designated to securities (1) ...Pay ï¬xed interest rate swaps designated to loans (1) ...Total commercial mortgage banking risk management...Student lending activities - Forward contracts ...Credit... -

Page 59

... of credit card business Gain on sale of equity interest in EPS BlackRock IPO gain ...Branch gains ...Gain on sale of Concord stock, net of PNC Foundation contribution ...Wholesale lending repositioning ...Costs related to efï¬ciency initiatives Write-down of an equity investment Mall ATM buyout... -

Page 60

... funding related to the credit card business that was sold in the ï¬rst quarter of 1999. Total demand, savings and money market deposits decreased approximately $190 million in the year-to-year comparison as increases in money market deposits were more than offset by decreases in time deposits... -

Page 61

...of PNC products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; valuation of debt and equity investments; the inability to successfully manage risks inherent in the Corporation's business; the introduction, withdrawal, success and timing of... -

Page 62

... and 1999, and the related consolidated statements of income, shareholders' equity, and cash ï¬,ows for each of the three years in the period ended December 31, 2000. These ï¬nancial statements are the responsibility of The PNC Financial Services Group, Inc.'s management. Our responsibility is to... -

Page 63

......Provision for credit losses ...Net interest income less provision for credit losses ...NO NINT EREST INCO ME Asset management ...Fund servicing ...Service charges on deposits ...Brokerage ...Consumer sevices ...Corporate services ...Equity management ...Net securities gains ...Sale of subsidiary... -

Page 64

... T The PNC Financial Services Group, Inc. December 31 In millions, except par value 2000 ... 1999 $3,080 1,100 3,477 5,960 49,673 (674) 48,999 2,512 263 3,895 $69,286 ASSET S Cash and due from banks ...Short-term investments ...Loans held for sale ...Securities available for sale ...Loans, net of... -

Page 65

... PNC Financial Services Group, Inc. OF Accumulated Other Comprehensive Loss from Deferred In millions Preferred Stock Common Stock Capital Surplus Retained Earnings Beneï¬t Expense Continuing Disc ontinued Operations Operations Treasury Stock Total Balance at January 1, 1998 ...Net income ...Net... -

Page 66

...Subordinated debt ...Other borrowed funds ...Capital securities ...Common stock ...Repayment/maturity Repurchase agreements ...Bank notes and senior debt ...Federal Home Loan Bank borrowings ...Subordinated debt ...Other borrowed funds ...Acquisition of treasury stock ...Cash dividends paid ...Net... -

Page 67

..., corporate banking, real estate ï¬nance, asset-based lending, wealth management, asset management and global fund services businesses. The Corporation provides certain produc ts and services nationally and others in PNC's primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio and... -

Page 68

... the lower of carrying value or fair market value and are amortized in proportion to estimated net servicing income. Retained interests in loan securitizations are carried at fair market value and, if included in securities available for sale, adjusted to fair market value through accumulated other... -

Page 69

... rate swaps are agreements with a counterparty to exchange periodic interest payments calculated on a notional principal amount. Purchased interest rate caps and ï¬,oors are agreements where, for a fee, the counterparty agrees to pay the Corporation the amount, if any, by which a speciï¬ed market... -

Page 70

... swaps, caps, ï¬,oors and foreign exchange contracts. Interest rate risk exposure from customer positions is managed through transactions with other dealers. These positions are recorded at estimated fair value and changes in value are included in noninterest income. Additionally, the Corporation... -

Page 71

...and the income statement impact of the sale will depend on fair market values and other factors, and will not be determined until ï¬nal settlement. The transaction closed on January 31, 2001. Earnings for the residential mortgage banking business for the years ended December 31, 2000, 1999 and 1998... -

Page 72

...Cash paid ...Cash and due from banks received ... 2000 $7 42 20 22 $91 1999 1998 Corporate services ...Other income Market making ...Derivatives trading ...Foreign exchange ...Net trading income ... $48 8 17 $73 $3 11 12 $26 N O T E 6 S E C U R I T I E S AV A I L A B L E In millions FO R SALE... -

Page 73

...million write-down of an equity investment. Net securities gains of $9 million in 2000 and $3 million in 1999 related to commercial mortgage banking activities were included in corporate services revenue. Information relating to security sales is set forth in the following table: Year ended December... -

Page 74

... ...Commercial real estate ...Lease ï¬nancing ...Other ...Total ... (a) Excludes unfunded commitments related to loans designated for exit. Commitments to extend credit represent arrangements to lend funds subject to speciï¬ed contractual conditions. Commercial commitments are reported net of... -

Page 75

...) $902 Year ended December 31 - in millions Land ... 2000 $116 1999 $80 6 1998 $67 36 12 7 $122 Buildings ...Equipment ...Leasehold improvements ...Total ...Accumulated depreciation and amortization ...Net book value ... Goodwill ...Purchased credit cards ...Commercial mortgage servicing rights... -

Page 76

... and student loans totaling $16 million and $46 million, respectively, at December 31, 2000. The loans associated with these retained interests were sold and removed from the Corporation's balance sheet at securitization. Trust B, formed in May 1997, holds $300 million of 8.315% junior subordinated... -

Page 77

...03 8.20 7.05% 7.69 11.08 11.04 6.61 7.13 PNC Bank, N.A. PNC Bank, N.A. (a) Includes discontinued operations The access to and cost of funding new business initiatives including acquisitions, the ability to pay dividends, deposit insurance costs, and the level and nature of regulatory oversight... -

Page 78

... of credit, with limited exceptions, must be fully collateralized. The maximum amount available under statutory limitations for transfer from subsidiary banks to the parent company in the form of loans and dividends approximated 18% of consolidated net assets at December 31, 2000. Federal Reserve... -

Page 79

...assets ...Employer contribution ...Settlements ...Beneï¬ts paid ... Fair value of plan assets at end of year ...Funded status ...Unrecognized net actuarial loss (gain) ...Unrecognized prior service credit ...Unrecognized net transition asset ... $ (2 0 3 ) 38 (6 3 ) $ (2 2 8 ) $(198) 30 (69) $(237... -

Page 80

... to Internal Revenue Code limitations. Contributions to the plan are matched primarily by shares of PNC common stock held by the Corporation's employee stock ownership plan (" ESOP" ). The Corporation makes annual contributions to the ESOP that are at least equal to the debt service requirements on... -

Page 81

...of market value in 2000. Shares of common stock available for the granting of options under the Incentive Plan and the predecessor plans were 10,584,683 at December 31, 2000, 1999 and 1998. NO T E 2 0 ST O CK - B ASED C O M P E N S AT I O N P L A N S The Corporation has a senior executive long-term... -

Page 82

... in quarter-end closing stock prices over a ï¬ve-year period. Year ended December 31 are as follows: December 31 - in millions 2000 $250 85 19 104 458 824 37 102 963 $505 1999 Deferred tax assets Allowance for credit losses ...Compensation and beneï¬ts ...Net unrealized securities losses... -

Page 83

... to developers, owners and investors in commercial real estate. PNC Business Credit provides asset-based lending, capital markets and treasury management products and services to middle market customers on a national basis. PNC Business Credit's lending services include loans secured by accounts... -

Page 84

...B USINESSES Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors BlackRock Year ended December 31 In millions PFPC Other Consolidated 2000 IN CO ME STAT E ME N T Net interest income (a) ...Noninterest income ...Total revenue ...Provision for credit losses... -

Page 85

.... Year ended December 31 - in millions, except share and per share data 2000 $1,214 19 $1,195 289,958 $4.12 1999 1998 C A L C U L AT I O N OF B A SI C E A R N I N G S P E R C O MMO N SH A R E $1,202 19 $1,183 296,886 $3.98 $1,080 19 $1,061 300,761 $3.53 Income from continuing operations... -

Page 86

...655 5,902 1,655 Net loans (excludes leases) ...4 6 , 0 6 6 4 6 , 8 7 2 Commercial mortgage servicing rights ... 156 267 LIAB ILIT IES Demand, savings and money market deposits ...3 0 , 6 8 6 3 0 , 6 8 6 Time deposits ...1 6 , 9 7 8 1 7 , 1 0 1 Borrowed funds ...1 1 , 8 2 2 1 2 , 0 4 3 (15) 3 (11... -

Page 87

..., short-term assets include due from banks, interest-earning deposits with banks, federal funds sold and resale agreements, trading securities, customer's acceptance liability and accrued interest receivable. CRED IT Fair values for commitments to extend credit and letters of credit are estimated... -

Page 88

...from banks ...Short-term investments with subsidiary bank ...Securities available for sale ...Investments in: Bank subsidiaries ...Nonbank subsidiaries ...Other assets ...Total assets ... Purchases ...Cash paid in acquisitions ...$16 Other ... 53 5,640 1,656 160 $7,510 6,016 734 154 $6,920 Net cash... -

Page 89

...PNC Financial Services Group, Inc. S E L E C T E D Q U A R T E R LY F I N A N C I A L D A T A Quarter ended - dollars in millions, except per share data 2000... 7 5 6 Securities available for sale ...Loans, net of unearned income ...Deposits ...Borrowed funds ...Shareholders' equity ...(a) Excluding ... -

Page 90

...T S Loans held for sale ...Securities available for sale U.S. Treasury, government agencies and corporations ...Other debt ...Other ...Total securities available for sale ...Loans, net of unearned income Consumer ...Credit card ...Residential mortgage ...Commercial ...Commercial real estate ...Lease... -

Page 91

... Loans held for sale ...Securities available for sale U.S. Treasury and government agencies and corporations ...Other debt ...Other ...Total securities available for sale ...Loans, net of unearned income Consumer ...Credit card ...Residential mortgage ...Commercial ...Commercial real estate ...Lease... -

Page 92

1999 Average Balances Interest Average Yields/Rates Average Balances 1998 Interest Average Yields/Rates Average Balances 1997 Interest Average Yields/Rates Average Balances 1996 Interest Average Yields/Rates $1,392 1,970 3,441 673 6,084 10,310 672 12,258 23,082 3,362 2,564 532 52,780 1,045 61,... -

Page 93

... ...Credit card ...Residential mortgage ...Commercial ...Commercial real estate Commercial mortgage ...Real estate project ...Lease ï¬nancing ...Other ...Total recoveries ...Net charge-offs ...Provision for credit losses ...(Divestitures)/acquisitions ...Allowance at end of year ...Allowance... -

Page 94

..., notional value of interest rate swaps were designated to borrowed funds. The effect of these swaps is included in the rates set forth in the table. SH O R T- T E R M Dollars in millions BO RRO W INGS 2000 Amount Rate 1999 Amount Rate 1998 Amount Rate Federal funds purchased Year-end balance... -

Page 95

... Ohio/N. Kentucky Region PNC Bank, N.A. 15 years of service Chief Executive Ofï¬cer PNC Real Estate Finance 18 years of service W ILLIAM A. K O SIS Chief Human Resources Ofï¬cer 6 years of service 1 Executive Ofï¬cer Chief Executive Ofï¬cer PNC Business Credit and Middle Market Banking... -

Page 96

... and without paying brokerage commissions or service charges. A prospectus and enrollment card may be obtained by writing to Shareholder Relations at corporate headquarters. T RUST PRO X Y VO T ING Reports of 2000 nonroutine proxy voting by the trust divisions of The PNC Financial Services Group...