Capital One 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

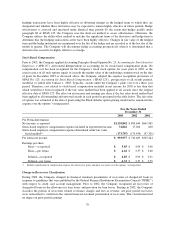

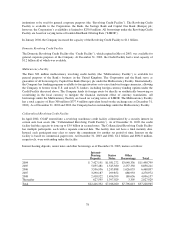

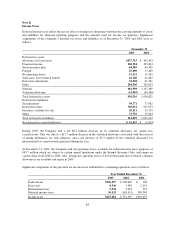

The fair value of the options granted during 2003, 2002 and 2001 was estimated at the date of grant using a

Black-Scholes option-pricing model with the weighted average assumptions described below:

For the Years Ended December 31

Assumptions 2003 2002 2001

Dividend yield .24% .25% .19%

Volatility factors of expected market price of stock 54% 55% 50%

Risk-free interest rate 3.25% 3.15% 4.15%

Expected option lives (in years) 5.0 5.0 8.5

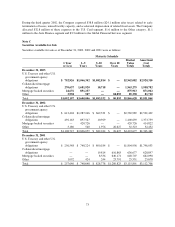

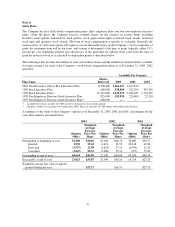

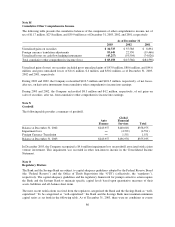

The following table summarizes information about options outstanding as of December 31, 2003:

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

Outstanding

(000s)

Weighted-Average

Remaining

Contractual Life

Weighted-Average

Exercise Price

Per Share

Number

Exercisable

(000s)

Weighted-Average

Exercise Price

Per Share

$4.31-$6.46 98 1.1 years $ 6.10 98 $ 6.10

$6.47-$9.70 211 1.9 7.99 211 7.99

$9.71-$14.56 4,954 1.8 9.95 4,954 9.95

$14.57-$21.85 1,319 4.0 16.13 1,319 16.13

$21.86-$32.79 842 6.2 31.65 639 31.61

$32.80-$49.20 27,587 7.6 44.32 14,156 43.62

$49.21-$73.82 9,636 6.7 57.37 2,539 57.88

$73.83-$76.37 7 5.7 76.37 7 76.37

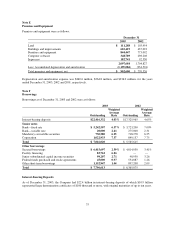

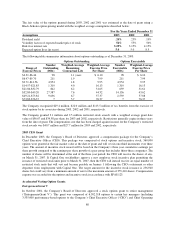

The Company recognized $29.4 million, $22.0 million and $113.5 million of tax benefits from the exercise of

stock options by its associates during 2003, 2002 and 2001, respectively.

The Company granted 3.1 million and 2.5 million restricted stock awards with a weighted average grant date

value of $56.07 and $34.58 per share for 2003 and 2002, respectively. Restrictions generally expire in three years

from the date of grant. The compensation cost that has been charged against income for the Company’s restricted

stock awards was $40.7 million and $27.7 million for 2003 and 2002, respectively.

2003 CEO Grant

In December 2003, the Company’s Board of Directors approved a compensation package for the Company’s

Chief Executive Officer (CEO). This package was comprised of stock options and incentive stock. 360,000

options were granted at the fair market value at the date of grant and will vest in one-third increments over three

years. The amount of incentive stock issued will be based on the Company’s three year cumulative earnings per

share growth compared to the earnings per share growth of a peer group that includes thirty-three companies. The

number of shares will be determined at the end of the three year period; the CEO will receive the shares, if any,

on March 31, 2007. If Capital One stockholders approve a new employee stock incentive plan permitting the

issuance of restricted stock units prior to March 31, 2007, then the CEO will instead receive an equal number of

restricted stock units that will vest and become payable on January 1 following the CEO’s retirement or other

departure from employment with Capital One. The target amount for the incentive stock issuance is 236,940

shares but could vary from a minimum amount of zero to the maximum amount of 355,410 shares. Compensation

expense was recorded for the options and incentive stock in accordance with SFAS 123.

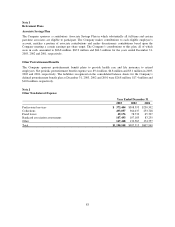

Accelerated Vesting Option Grants

EntrepreneurGrant V

In October 2001, the Company’s Board of Directors approved a stock options grant to senior management

(“EntrepreneurGrant V”). This grant was composed of 6,502,318 options to certain key managers (including

3,535,000 performance-based options to the Company’s Chief Executive Officer (“CEO”) and Chief Operating

80