Capital One 2003 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

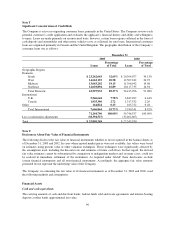

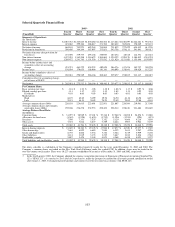

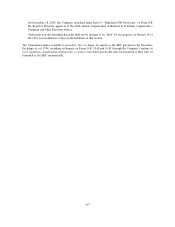

Selected Quarterly Financial Data

2003(1) 2002

(Unaudited)

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Summary of Operations:

(In Thousands)

Interest income $1,087,783 $1,103,025 $1,070,280 $1,106,566 $1,113,664 $1,108,079 $1,024,661 $ 934,361

Interest expense 423,682 399,104 388,017 371,762 382,632 385,650 370,249 323,123

Net interest income 664,101 703,921 682,263 734,804 731,032 722,429 654,412 611,238

Provision for loan losses 390,405 364,144 387,097 375,851 543,758 674,111 541,841 389,617

Net interest income after provision for

loan losses 273,696 339,777 295,166 358,953 187,274 48,318 112,571 221,621

Non-interest income 1,437,491 1,363,208 1,310,622 1,304,603 1,320,322 1,520,178 1,384,812 1,241,524

Non-interest expense 1,289,472 1,241,763 1,151,556 1,173,932 1,121,020 1,151,020 1,153,646 1,159,895

Income before income taxes and

cumulative effect of accounting

change 421,715 461,222 454,232 489,624 386,576 417,476 343,737 303,250

Income taxes 156,034 170,653 168,066 181,161 146,899 158,641 130,620 115,235

Income before cumulative effect of

accounting change 265,681 290,569 286,166 308,463 239,677 258,835 213,117 188,015

Cumulative effect of accounting change,

netoftaxesof$8,832 —15,037——————

Net income $ 265,681 $ 275,532 $ 286,166 $ 308,463 $ 239,677 $ 258,835 $ 213,117 $ 188,015

Per Common Share:

Basic earnings per share $ 1.16 $ 1.23 $ 1.28 1.38 $ 1.08 $ 1.17 $ 0.97 $ 0.86

Diluted earnings per share 1.11 1.17 1.23 1.35 1.05 1.13 0.92 0.83

Dividends 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Market prices

High 64.25 62.02 54.99 39.70 36.50 61.10 66.50 64.91

Low 55.15 44.51 30.05 24.91 25.49 24.05 52.00 43.01

Average common shares (000s) 228,110 224,615 223,691 222,951 221,807 220,564 219,961 217,548

Average common shares and common

equivalent shares (000s) 239,206 236,270 232,553 228,422 228,214 228,418 231,684 226,605

Average Balance Sheet Data:

(In Millions)

Consumer loans $ 31,297 $ 28,949 $ 27,101 $ 27,316 $ 27,260 $ 26,058 $ 24,876 $ 21,880

Allowance for loan losses (1,567) (1,590) (1,635) (1,719) (1,596) (1,241) (994) (873)

Securities 7,598 7,331 7,535 5,352 5,120 4,666 4,216 3,850

Other assets 7,674 7,014 6,677 7,369 6,424 5,987 5,942 5,139

Total assets $ 45,002 $ 41,704 $ 39,678 $ 38,318 $ 37,208 $ 35,470 $ 34,040 $ 29,996

Interest-bearing deposits $ 21,605 $ 20,303 $ 19,178 $ 17,940 $ 17,077 $ 16,520 $ 15,277 $ 13,505

Other borrowings 7,661 6,892 6,683 7,010 6,332 5,631 5,947 4,926

Senior and deposit notes 6,735 6,066 5,534 5,310 5,564 5,719 5,959 5,430

Other liabilities 3,114 3,019 3,135 3,235 3,667 3,182 2,836 2,563

Stockholder’s equity 5,887 5,424 5,148 4,823 4,568 4,418 4,021 3,572

Total liabilities and stockholders’ equity $ 45,002 $ 41,704 $ 39,678 $ 38,318 $ 37,208 $ 35,470 $ 34,040 $ 29,996

The above schedule is a tabulation of the Company’s unaudited quarterly results for the years ended December 31, 2003 and 2002. The

Company’s common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the

over-the-counter stock market. There were 10,227 common stockholders of record as of December 31, 2003 and 2002, respectively.

(1) In the fourth quarter 2003, the Company adopted the expense recognition provisions of Statement of Financial Accounting Standard No.

123, (“SFAS 123”) Accounting for Stock Based Compensation, under the prospective method for all awards granted, modified or settled

after January 1, 2003. Certain prior period amounts and statistics have been restated in accordance with SFAS 123.

103