Capital One 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

since the notifications discussed above that management believes would have changed either the Bank or the

Savings Bank’s capital category.

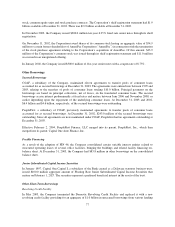

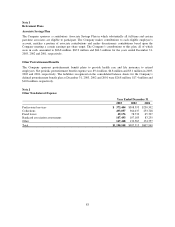

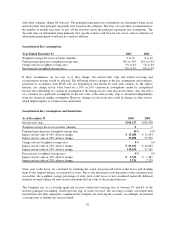

Regulatory

Filing

Basis

Ratios

Applying

Subprime

Guidance

Ratios

Minimum for Capital

Adequacy Purposes

To Be “Well-Capitalized”

Under

Prompt Corrective

Action Provisions

December 31, 2003

Capital One Bank

Tier 1 Capital 14.14% 11.54% 4.00% 6.00%

Total Capital 18.34 15.15 8.00 10.00

Tier 1 Leverage 13.17 13.17 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 14.79% 11.59% 4.00% 6.00%

Total Capital 16.10 12.88 8.00 10.00

Tier 1 Leverage 14.00 14.00 4.00 5.00

December 31, 2002

Capital One Bank

Tier 1 Capital 15.56% 11.50% 4.00% 6.00%

Total Capital 17.78 13.39 8.00 10.00

Tier 1 Leverage 13.79 13.79 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 15.10% 11.02% 4.00% 6.00%

Total Capital 16.80 12.59 8.00 10.00

Tier 1 Leverage 14.45 14.45 4.00 5.00

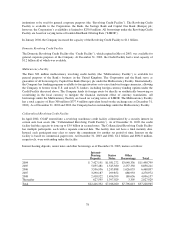

The Bank and Savings Bank treat a portion of their loans as “subprime” under the “Expanded Guidance for

Subprime Lending Programs” (the “Subprime Guidelines”) and have assessed their capital and allowance for

loan losses accordingly. Under the Subprime Guidelines, the Bank and the Savings Bank each exceed the

requirements for a “well-capitalized” institution as of December 31, 2003.

For purposes of the Subprime Guidelines, the Company has treated as “subprime” all loans in the Bank’s and

Savings Bank’s targeted “subprime” programs to customers either with a FICO score of 660 or below or with no

FICO score. The Bank and Savings Bank hold on average 200% of the total risk-based capital charge that would

otherwise apply to such assets. This results in higher levels of required regulatory capital at the Bank and the

Savings Bank. As of December 31, 2003, approximately $4.2 billion or 17% of the Bank’s, and $2.8 billion or

23% of the Savings Bank’s, on-balance sheet assets were treated as “subprime” for purposes of the Subprime

Guidelines.

On May 17, 2002, the regulators issued an advisory related to the application of the regulatory capital standards

to a residual interest commonly referred to as accrued interest receivable (“AIR Advisory”). The effect of this

AIR Advisory was to require all insured depository institutions, including the Bank and the Savings Bank, to

hold significantly higher levels of regulatory capital against accrued interest receivables beginning December 31,

2002. The Bank and the Savings Bank have met this capital requirement and remain “well-capitalized” after

applying the provisions of the AIR Advisory at December 31, 2002.

In August 2000, the Bank received regulatory approval and established a subsidiary bank in the United Kingdom.

In connection with the approval of its former branch office in the United Kingdom, the Company committed to

the Federal Reserve that, for so long as the Bank maintains a branch or subsidiary bank in the United Kingdom,

the Company will maintain a minimum Tier 1 Leverage ratio of 3.0%. As of December 31, 2003 and 2002, the

Company’s Tier 1 Leverage ratio was 13.01% and 11.95%, respectively.

87