Capital One 2003 Annual Report Download - page 54

Download and view the complete annual report

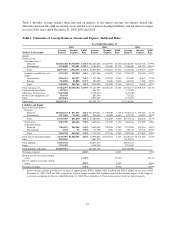

Please find page 54 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increase in the reported loan portfolio of $6.4 billion or 31% over 2001, the change in the treatment of recoveries

of charged-off accounts, the adoption of a revised application of regulatory guidelines related to “subprime”

loans, as well as an increase in forecasted charge-off rates.

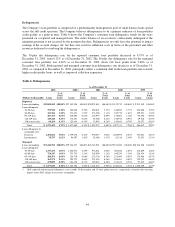

During 2002, the fair value of the Company’s interest-only strips decreased $33.1 million, including both the

impact of gains from securitization transactions and changes to key fair value assumptions. Comparatively, the

fair value of the Company’s interest-only strips increased $150.0 million in 2001, including both the impact of

gains associated with securitization transactions and changes to key fair value assumptions. The 2002 decrease in

the fair value of the interest-only strips primarily relates to the addition of introductory rate loans to the trusts, the

reduced interest rate environment, and increasing charge-off rates. See page 90 in Item 8 “Financial Statements

and Supplementary Data—Notes to the Consolidated Financial Statements—Note R”.

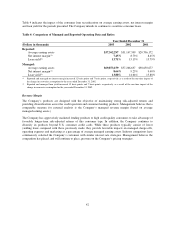

During 2002, marketing expense was relatively consistent with 2001, which reflected the Company’s shift in

strategy to reduce loan growth during the second half of the year. During 2002, operating expenses increased

18%, compared with managed loan growth of 32%, reflecting lower account growth and increased operating

efficiencies, offset by $110.0 million of one-time charges.

Consolidated Statements of Income

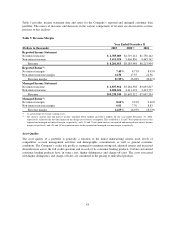

Net Interest Income

Net interest income is interest and past-due fees earned and deemed collectible from the Company’s consumer

loans, securities income, less interest expense on borrowings, which includes interest-bearing deposits,

borrowings from senior notes and other borrowings.

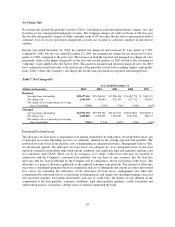

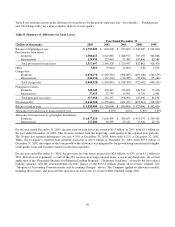

Reported net interest income for the year ended December 31, 2003, was $2.8 billion compared to $2.7 billion

for 2002. Excluding the one-time impact of the change in recoveries estimate of $38.4 million for the year ended

December 31, 2002, net interest income for the year ended December 31, 2003 increased $27.6 million, or 1%

compared to the same period in the prior year. The slight increase in net interest income is primarily a result of a

20% increase in the Company’s earning assets for the year ended December 31, 2003 compared to the same

period in the prior year, offset by a decrease in earning asset yields. The reported net interest margin was 7.45%

for the year ended December 31, 2003 compared to 8.73% for the same period in the prior year. Excluding the

one-time impact of the change in recoveries estimate of 12 basis points, the net interest margin decreased

116 basis points for the year ended December 31, 2003. The decrease was primarily due to a decrease in the

reported loan yield. The reported loan yield decreased 144 basis points to 13.71% for the year ended

December 31, 2003, compared to 15.15% for the year ended December 31, 2002. The yield on reported loans

decreased due to a shift in the mix of the reported loan portfolio towards a greater composition of lower yielding,

higher credit quality loans and an increase in low introductory rate accounts compared to the prior year. In

addition, the Company increased its average liquidity portfolio by $2.5 billion during 2003. The yield on

liquidity portfolio assets is significantly lower than those on consumer loans and served to reduce the overall

earning assets yields.

Reported net interest income for the year ended December 31, 2002, was $2.7 billion compared to $1.8 billion

for 2001, representing an increase of $968.9 million, or 55%. Net interest income increased primarily as a result

of growth in the Company’s earning assets. Average earning assets increased 50% for the year ended

December 31, 2002, to $31.1 billion from $20.7 billion for the year ended December 31, 2001. The reported net

interest margin increased to 8.73% in 2002, from 8.45% in 2001. The increase is primarily due to a 93 basis point

decrease in the cost of funds, offset by a 64 basis point decrease in the yield on consumer loans to 15.15% for the

year ended December 31, 2002, from 15.79% for the year ended December 31, 2001. The yield on consumer

loans decreased primarily due to a shift in the mix of the reported portfolio toward a greater composition of lower

yielding, higher credit quality loans as compared to the prior year. $38.4 million of the increase in net interest

income, representing a 12 basis point increase in the net interest margin in 2002, relates to the one-time impact of

the change in recoveries assumptions.

36