Capital One 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

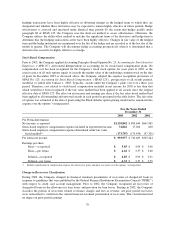

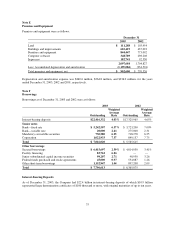

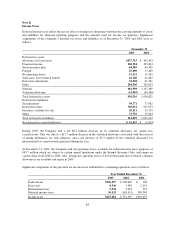

Note E

Premises and Equipment

Premises and equipment were as follows:

December 31

2003 2002

Land $ 111,288 $ 103,954

Buildings and improvements 610,419 437,023

Furniture and equipment 844,447 773,092

Computer software 348,789 298,208

In process 182,741 92,550

2,097,684 1,704,827

Less: Accumulated depreciation and amortization (1,195,084) (934,501)

Total premises and equipment, net $ 902,600 $ 770,326

Depreciation and amortization expense was $260.6 million, $264.8 million, and $236.0 million, for the years

ended December 31, 2003, 2002 and 2001, respectively.

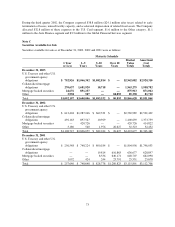

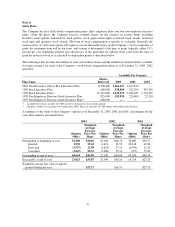

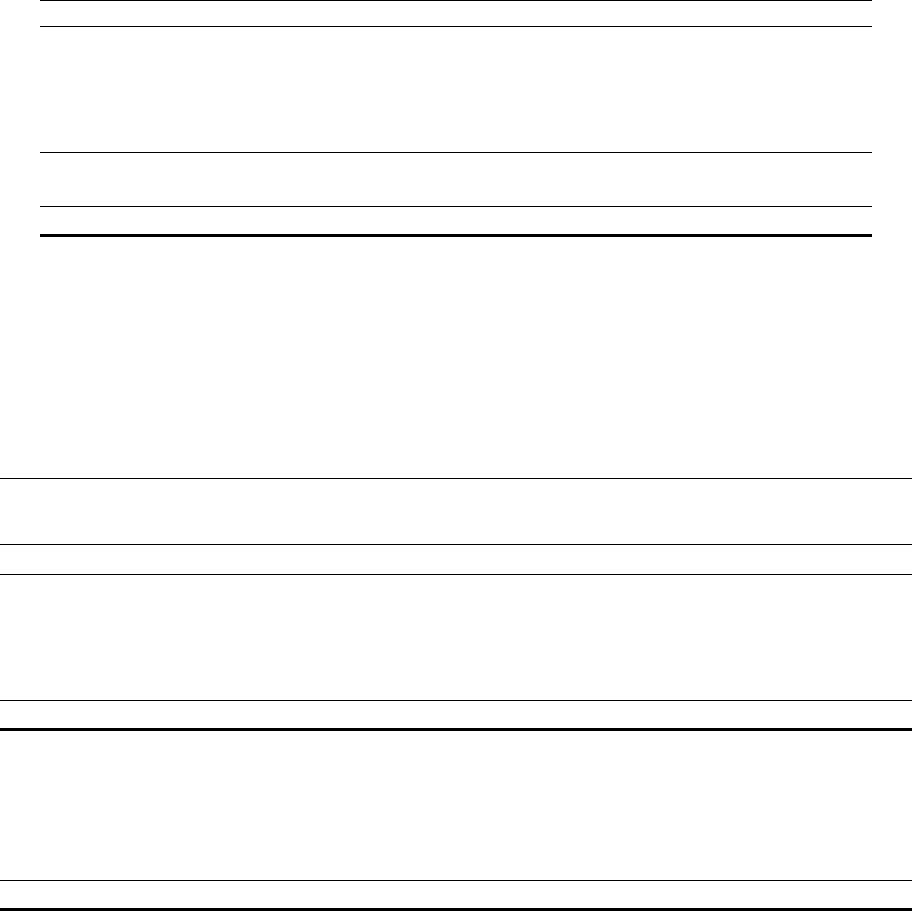

Note F

Borrowings

Borrowings as of December 31, 2003 and 2002 were as follows:

2003 2002

Outstanding

Weighted

Average

Rate Outstanding

Weighted

Average

Rate

Interest-bearing deposits $22,416,332 4.03% $17,325,965 4.65%

Senior notes

Bank—fixed rate $ 5,242,507 6.37% $ 3,723,200 7.00%

Bank—variable rate 20,000 2.41 275,000 2.31

Mandatory convertible securities 730,580 6.25 718,278 6.25

Corporation 1,022,933 7.37 849,137 7.75

Total $ 7,016,020 $ 5,565,615

Other borrowings

Secured borrowings $ 6,415,697 2.59% $ 4,814,030 3.41%

Facility financing 83,762 6.86 ——

Junior subordinated capital income securities 99,207 2.71 98,950 3.26

Federal funds purchased and resale agreements 45,000 0.97 554,887 1.26

Other short-term borrowings 1,152,947 1.44 897,208 2.09

Total $ 7,796,613 $ 6,365,075

Interest-Bearing Deposits

As of December 31, 2003, the Company had $22.4 billion in interest-bearing deposits of which $10.9 billion

represented large denomination certificates of $100 thousand or more, with original maturities of up to ten years.

75