Capital One 2003 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note G

Stock Plans

The Company has five stock-based compensation plans: three employee plans and two non-employee directors

plans. Under the plans, the Company reserves common shares for the issuance in various forms including

incentive stock options, nonstatutory stock options, stock appreciation rights, restricted stock awards, restricted

stock units and incentive stock awards. The form of stock compensation is specific to each plan. Generally the

exercise price of each stock option will equal or exceed the market price of the Company’s stock on the date of

grant, the maximum term will be ten years, and vesting is determined at the time of grant, typically either 33

1

⁄

3

percent per year beginning with the first anniversary of the grant date for options, three years from the time of

grant for restricted stock or accelerated vesting option grants as described below.

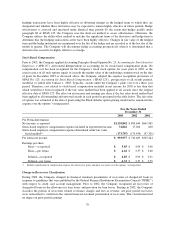

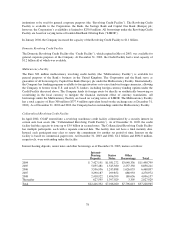

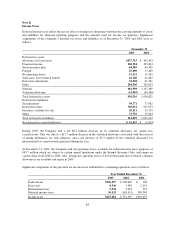

The following table provides the number of reserved common shares and the number of common shares available

for future issuance for each of the Company’s stock-based compensation plans as of December 31, 2003, 2002

and 2001:

Available For Issuance

Plan Name

Shares

Reserved 2003 2002 2001

2002 Non-Executive Officer Stock Incentive Plan 8,500,000 1,464,227 2,167,450 —

1999 Stock Incentive Plan 600,000 338,800 322,300 305,350

1994 Stock Incentive Plan(1) 67,112,640 1,423,352 2,186,615 2,770,459

1999 Non-Employee Directors Stock Incentive Plan 825,000 195,920 220,000 22,510

1995 Non-Employee Directors Stock Incentive Plan(2) 600,000 ———

(1) Available for issuance includes the CEO incentive stock grant at its maximum amount.

(2) The plan’s ability to issue grants was terminated in 1999. There are currently 457,500 options outstanding under the plan.

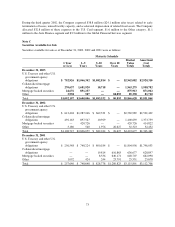

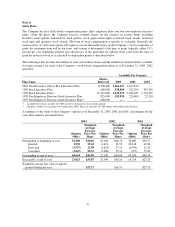

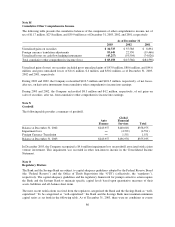

A summary of the status of the Company’s options as of December 31, 2003, 2002 and 2001, and changes for the

years then ended is presented below:

2003 2002 2001

Options

(000s)

Weighted-

Average

Exercise

Price Per

Share

Options

(000s)

Weighted-

Average

Exercise

Price Per

Share

Options

(000s)

Weighted-

Average

Exercise

Price Per

Share

Outstanding at beginning of year 52,108 $40.06 49,180 $40.74 36,689 $30.57

Granted 1,930 55.42 6,631 36.52 20,148 49.84

Exercised (5,737) 23.99 (1,623) 27.19 (6,950) 12.29

Cancelled (3,647) 50.76 (2,080) 53.31 (707) 55.89

Outstanding at end of year 44,654 $42.00 52,108 $40.06 49,180 $40.74

Exercisable at end of year 23,923 $35.87 23,340 $30.20 18,714 $23.25

Weighted-average fair value of options

granted during the year $27.27 $16.53 $29.73

79