Capital One 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

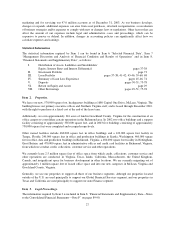

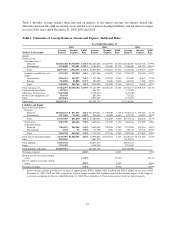

Item 6. Selected Financial Data

(Dollars in Thousands, Except Per Share Data) 2003(1) 2002(1) 2001 2000 1999

Five Year

Compound

Growth Rate

Income Statement Data:

Interest income $ 4,367,654 $ 4,180,766 $ 2,921,149 $ 2,453,899 $ 1,623,001 31.14%

Interest expense 1,582,565 1,461,654 1,171,007 801,017 540,882 30.12%

Net interest income 2,785,089 2,719,112 1,750,142 1,652,882 1,082,119 31.74%

Provision for loan losses 1,517,497 2,149,328 1,120,457 812,861 426,470 39.35%

Net interest income after provision for loan losses 1,267,592 569,784 629,685 840,021 655,649 25.13%

Non-interest income 5,415,924 5,466,836 4,463,762 3,065,110 2,386,364 29.36%

Non-interest expense 4,856,723 4,585,581 4,058,027 3,147,657 2,464,996 27.09%

Income before income taxes and cumulative effect of

accounting change 1,826,793 1,451,039 1,035,420 757,474 577,017 32.70%

Income taxes 675,914 551,395 393,455 287,840 213,926 32.00%

Income before cumulative effect of accounting change 1,150,879 899,644 641,965 469,634 363,091 33.13%

Cumulative effect of accounting change, net of taxes of $8,832 15,037 ————

Net income $ 1,135,842 $ 899,644 $ 641,965 $ 469,634 $ 363,091 32.78%

Dividend payout ratio 2.14% 2.61% 3.48% 4.43% 5.69%

Per Common Share:

Basic earnings per share $5.05$ 4.09 $ 3.06 $ 2.39 $ 1.84 29.25%

Diluted earnings per share 4.85 3.93 2.91 2.24 1.72 29.73%

Dividends 0.11 0.11 0.11 0.11 0.11

Book value as of year-end 25.75 20.44 15.33 9.94 7.69

Average common shares 224,832,203 219,983,691 209,866,782 196,477,624 197,593,371

Average common and common equivalent shares 234,103,197 228,743,610 220,576,093 209,448,697 210,682,740

Selected Average Balances:

Securities $ 5,335,492 $ 3,873,186 $ 3,038,360 $ 1,764,257 $ 2,027,051 23.23%

Allowance for loan losses (1,627,020) (1,178,243) (637,789) (402,208) (269,375) 49.99%

Total assets 41,195,413 34,201,724 23,346,309 15,209,585 11,085,013 37.67%

Interest-bearing deposits 19,767,963 15,606,942 10,373,511 5,339,474 2,760,536 69.09%

Borrowings 12,978,024 11,381,062 8,056,665 6,870,038 6,078,480 19.79%

Stockholders’ equity 5,323,470 4,148,150 2,781,182 1,700,973 1,407,899 37.38%

Selected Year-End Balances:

Securities $ 7,464,698 $ 5,064,946 $ 3,467,449 $ 1,859,029 $ 1,968,853

Consumer loans 32,850,269 27,343,930 20,921,014 15,112,712 9,913,549

Allowance for loan losses (1,595,000) (1,720,000) (840,000) (527,000) (342,000)

Total assets 46,283,706 37,382,380 28,184,047 18,889,341 13,336,443

Interest-bearing deposits 22,416,332 17,325,965 12,838,968 8,379,025 3,783,809

Borrowings 14,812,633 11,930,690 9,330,757 6,976,535 6,961,014

Stockholders’ equity 6,051,811 4,623,171 3,323,478 1,962,514 1,515,607

Consumer Loan Data:

Average reported loans $ 28,677,616 $ 25,036,019 $ 17,284,306 $ 11,487,776 $ 7,667,355 39.91%

Securitization adjustments 34,234,337 27,763,547 18,328,011 11,147,086 10,379,558 28.27%

Average total managed loans 62,911,953 52,799,566 35,612,317 22,634,862 18,046,913 32.84%

Year-End Reported Data

Reported consumer loan income $ 3,932,295 $ 3,792,461 $ 2,729,519 $ 2,350,771 $ 1,511,888 31.04%

Reported yield 13.71% 15.15% 15.79% 20.46% 19.72%

Reported revenue margin 21.95 26.28 30.01 35.60 35.78

Reported net interest margin 7.45 8.73 8.45 12.47 11.16

Reported delinquency rate 4.79 6.12 4.84 7.26 5.92

Reported net charge-off rate 5.74 5.03 4.76 5.46 4.16

Year-End Managed Data

Managed consumer loan income $ 8,735,189 $ 7,729,462 $ 5,654,363 $ 4,131,420 $ 3,231,979 27.28%

Managed yield 13.88% 14.64% 15.88% 18.25% 17.91%

Managed revenue margin 14.65 16.93 18.23 20.99 19.59

Managed net interest margin 8.64 9.23 9.40 11.11 11.12

Managed delinquency rate 4.46 5.60 4.95 5.23 5.23

Managed net charge-off rate 5.86 5.24 4.65 4.56 4.34

Year-end total managed loans 71,244,796 59,746,537 45,263,963 29,524,026 20,236,588 32.58%

Year-end total accounts (000s) 47,038 47,369 43,815 33,774 23,705 23.00%

Operating Ratios (Reported):

Return on average assets 2.76% 2.63% 2.75% 3.09% 3.28%

Return on average equity 21.34 21.69 23.08 27.61 25.79

Equity to assets (average) 12.92 12.13 11.91 11.18 12.70

Allowance for loan losses to reported loans as of year-end 4.86 6.29 4.02 3.49 3.45

(1) Certain prior period amounts have been reclassified to conform to the current period presentation for the Financial Accounting Standards

Board Staff Position, “Accounting for Accrued Interest Receivable Related to Securitized and Sold Receivables under FASB Statement

No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities”, (“FSP on AIR”) that was

issued April 2003. The Company reclassified $577.0 million and $509.7 million in subordinated finance charge and fee receivables on

the investors’ interest in securitized loans for December 2003 and 2002, respectively, from “Consumer loans” to “Accounts receivable

from securitizations” on the Consolidated Balance Sheet. The Company also reclassified $74.8 million and $76.2 million for the years

ended December 31, 2003 and 2002, respectively, in interest income derived from such balances from “Consumer loan interest income”

to “Other Interest Income” on the Consolidated Statements of Income. The reported delinquency rate would have been 5.13% and 6.51%

before the reclassification at December 31, 2003 and 2002, respectively. The reported net charge-off rate would have been 5.64% and

4.93% before the reclassification for the years ended December 31, 2003 and 2002.

29