Capital One 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The credit quality of the receivables is supported by credit enhancements, which may be in various forms

including interest-only strips, subordinated interests in the pool of receivables, cash collateral accounts, cash

reserve accounts and accrued interest and fees on the investor’s share of the pool of receivables. The Company’s

retained residual interests are generally restricted or subordinated to investors’ interests and their value is subject

to substantial credit, repayment and interest rate risks on transferred assets. The investors and the trusts have no

recourse to the Company’s assets, other than the retained residual interests, if the off-balance sheet loans are not

paid when due. See page 90 in Item 8 “Financial Statements and Supplementary Data—Notes to the

Consolidated Financial Statements—Note R” for quantitative information regarding retained interests.

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing

and other fees, and are available to absorb the investors’ share of credit losses. For revolving securitizations,

amounts collected in excess of that needed to pay the above amounts are remitted to the Company. For

amortizing securitizations, amounts in excess of the amount that is used to pay interest, fees and principal are

generally remitted to the Company, but may be paid to investors in further reduction of their outstanding

principal. See page 90 in Item 8 “Financial Statements and Supplementary Data—Notes to the Consolidated

Financial Statements—Note R” for quantitative information regarding revenues, expenses and cash flows that

arise from securitization transactions.

The securitization of consumer loans has been a significant source of liquidity for the Company. Maturity terms

of the existing securitizations vary from 2004 to 2013 and, for revolving securitizations, have accumulation

periods during which principal payments are aggregated to make payments to investors. As payments on the

loans are accumulated and are no longer reinvested in new loans, the Company’s funding requirements for such

new loans increase accordingly. Significant reduction or termination of the Company’s off-balance sheet

securitizations could require the Company to utilize secured borrowings or unsecured debt, increase its deposit

base or slow asset growth based on its strategy.

Securitization transactions may amortize earlier than scheduled due to certain early amortization triggers, which

would accelerate the need for funding. Additionally, early amortization would have a significant impact on the

ability of the Bank and Savings Bank to meet regulatory capital adequacy requirements as all off-balance sheet

loans experiencing such early amortization would be recorded on the balance sheet. At December 31, 2003, early

amortization of its off-balance sheet securitizations was not expected. The Company believes that it has the

ability to continue to utilize off-balance sheet securitization arrangements as a source of liquidity.

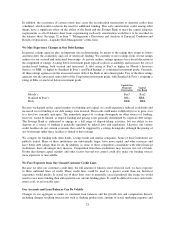

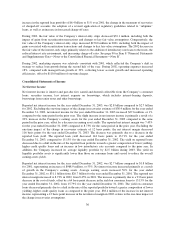

The amounts of investor principal from off-balance sheet consumer loans as of December 31, 2003 that are

expected to amortize into the Company’s consumer loans, or be otherwise paid over the periods indicated, are

summarized in Table 13. 53% of the Company’s total managed loans were included in off-balance sheet

securitizations for the years ended December 31, 2003 and 2002.

Guarantees

Residual Value Guarantees

In December 2000, the Company entered into a 10-year agreement for the lease of the headquarters building

being constructed in McLean, Virginia. The agreement called for monthly rent to commence upon completion,

which occurred in the first quarter of 2003, and is based on LIBOR rates applied to the cost of the building

funded. If, at the end of the lease term, the Company does not purchase the property, the Company guarantees a

maximum residual value of up to $114.8 million representing approximately 72% of the $159.5 million cost of

the building. This agreement, made with a multi-purpose entity that is a wholly-owned subsidiary of one of the

Company’s lenders, provides that in the event of a sale of the property, the Company’s obligation would be equal

to the sum of all amounts owed by the Company under a note issuance made in connection with the lease

inception. As of December 31, 2003, the value of the building was estimated to be above the maximum residual

value that the Company guarantees; thus, no deficiency existed and no liability was recorded relative to this

property.

32