Capital One 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Facility discussed above. The Company funds its foreign assets by directly or synthetically borrowing or

securitizing in the local currency to mitigate the financial statement effect of currency translations. All

borrowings under the Multicurrency Facility are based on varying terms of LIBOR.

In April 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in

certain auto loan assets (the “Collateralized Revolving Credit Facility”). As of December 31, 2003, the credit

facility had the capacity to issue up to $3.9 billion in secured notes. The Collateralized Revolving Credit Facility

has multiple participants each with a separate renewal date. The facility does not have a final maturity date.

Instead, each participant may elect to renew the commitment for another set period of time. Interest on the

facility is based on commercial paper rates.

As of December 31, 2003, the Corporation had one effective shelf registration statement under which the

Corporation from time to time may offer and sell senior or subordinated debt securities, preferred stock, common

stock, common equity units and stock purchase contracts. In November 2003, the Company issued

$300.0 million ten-year, 6.25% fixed rate senior notes through its shelf registration statement.

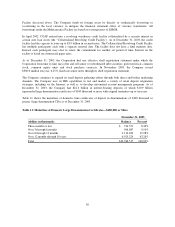

The Company continues to expand its retail deposit gathering efforts through both direct and broker marketing

channels. The Company uses its IBS capabilities to test and market a variety of retail deposit origination

strategies, including via the Internet, as well as, to develop customized account management programs. As of

December 31, 2003, the Company had $22.4 billion in interest-bearing deposits of which $10.9 billion

represented large denomination certificates of $100 thousand or more with original maturities up to ten years.

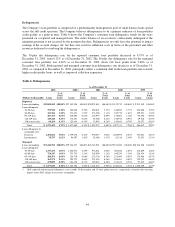

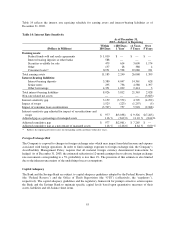

Table 11 shows the maturities of domestic time certificates of deposit in denominations of $100 thousand or

greater (large denomination CDs) as of December 31, 2003.

Table 11: Maturities of Domestic Large Denomination Certificates—$100,000 or More

December 31, 2003

(dollars in thousands) Balance Percent

Three months or less $ 914,551 8.36%

Over 3 through 6 months 996,087 9.10%

Over 6 through 12 months 2,110,650 19.28%

Over 12 months through 10 years 6,925,229 63.26%

Total $10,946,517 100.00%

50