Capital One 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

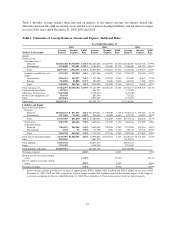

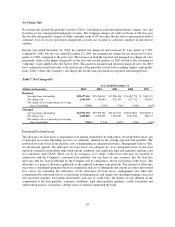

Net Charge-Offs

Net charge-offs include the principal amount of losses (excluding accrued and unpaid finance charges, fees and

fraud losses) less current period principal recoveries. The Company charges off credit card loans at 180 days past

the due date and generally charges off other consumer loans at 120 days past the due date or upon repossession of

collateral. Costs to recover previously charged-off accounts are recorded as collection expenses in non-interest

expense.

For the year ended December 31, 2003, the reported net charge-off rate increased 71 basis points to 5.74%

compared to 2002. For the year ended December 31, 2003, the managed net charge-off rate increased 62 basis

points to 5.86% compared to the prior year. The increase in both the reported and managed net charge-off rates

principally relate to the higher charge-offs in the first and second quarters of 2003 related to the seasoning of

“subprime” loans added in the first half of 2002. The quarterly managed and reported charge-off rates for 2003

have continued to trend lower due to the shift in mix of the portfolio towards lower yielding, higher credit quality

loans. Table 7 shows the Company’s net charge-offs for the years presented on a reported and managed basis.

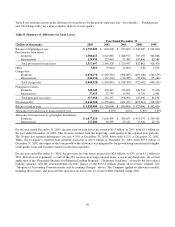

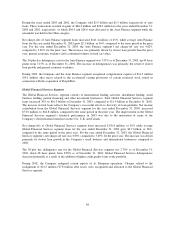

Table 7: Net Charge-offs

Year Ended December 31

(Dollars in thousands) 2003 2002 2001 2000 1999

Reported:

Average loans outstanding $28,677,616 $25,036,019 $17,284,306 $11,487,776 $ 7,667,355

Net charge-offs 1,646,360 1,259,684 822,257 627,312 318,992

Net charge-offs as a percentage of average

loans outstanding 5.74% 5.03% 4.76% 5.46% 4.16%

Managed:

Average loans outstanding $62,911,953 $52,799,566 $35,612,617 $22,634,862 $18,046,913

Net charge-offs 3,683,887 2,769,249 1,655,947 1,031,590 782,537

Net charge-offs as a percentage of average

loans outstanding 5.86% 5.24% 4.65% 4.56% 4.34%

Provision For Loan Losses

The allowance for loan losses is maintained at an amount estimated to be sufficient to absorb probable losses, net

of principal recoveries (including recovery of collateral), inherent in the existing reported loan portfolio. The

provision for loan losses is the periodic cost of maintaining an adequate allowance. Management believes that,

for all relevant periods, the allowance for loan losses was adequate to cover anticipated losses in the total

reported consumer loan portfolio under then current conditions, met applicable legal and regulatory guidance and

was consistent with GAAP. There can be no assurance as to future credit losses that may be incurred in

connection with the Company’s consumer loan portfolio, nor can there be any assurance that the loan loss

allowance that has been established by the Company will be sufficient to absorb such future credit losses. The

allowance is a general allowance applicable to the reported consumer loan portfolio. The amount of allowance

necessary is determined primarily based on a migration analysis of delinquent and current accounts and forward

loss curves. In evaluating the sufficiency of the allowance for loan losses, management also takes into

consideration the following factors: recent trends in delinquencies and charge-offs including bankrupt, deceased

and recovered amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in the

composition of the loan portfolio; economic conditions; legal and regulatory guidance; credit evaluations and

underwriting policies; seasonality; and the value of collateral supporting the loans.

45