Capital One 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

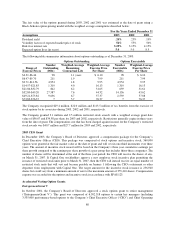

During the third quarter 2002, the Company expensed $38.8 million ($24.1 million after taxes) related to early

termination of leases, unused facility capacity, and accelerated depreciation of related fixed assets. The Company

allocated $32.8 million of these expenses to the U.S. Card segment, $1.6 million to the Other category, $1.1

million to the Auto Finance segment and $3.3 million to the Global Financial Services segment.

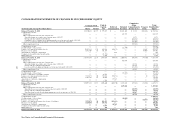

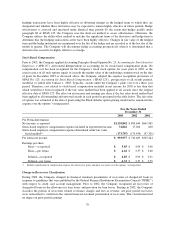

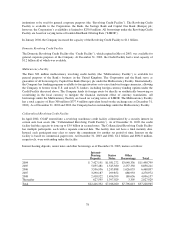

Note C

Securities Available for Sale

Securities available for sale as of December 31, 2003, 2002 and 2001 were as follows:

Maturity Schedule

1Year

or Less

1–5

Years

5–10

Years

Over 10

Years

Market

Value

Totals

Amortized

Cost

Totals

December 31, 2003

U.S. Treasury and other U.S.

government agency

obligations $ 792,926 $1,066,342 $1,082,814 $ — $2,942,082 $2,920,310

Collateralized mortgage

obligations 270,637 1,681,920 10,718 — 1,963,275 1,958,782

Mortgage backed securities 24,676 851,237 — — 875,913 871,062

Other 3,958 507 — 80,893 85,358 81,710

Total $1,092,197 $3,600,006 $1,093,532 $ 80,893 $5,866,628 $5,831,864

December 31, 2002

U.S. Treasury and other U.S.

government agency

obligations $ 613,404 $1,287,246 $ 669,339 $ — $2,569,989 $2,522,429

Collateralized mortgage

obligations 492,163 897,547 10,929 — 1,400,639 1,373,759

Mortgage backed securities — 420,726 — — 420,726 414,822

Other 3,180 540 1,976 26,627 32,323 32,452

Total $1,108,747 $2,606,059 $ 682,244 $ 26,627 $4,423,677 $4,343,462

December 31, 2001

U.S. Treasury and other U.S.

government agency

obligations $ 256,548 $ 748,224 $ 800,184 $ — $1,804,956 $1,796,033

Collateralized mortgage

obligations — — 19,814 616,863 636,677 628,897

Mortgage backed securities — — 8,536 640,171 648,707 662,098

Other 1,092 424 244 23,791 25,551 25,678

Total $ 257,640 $ 748,648 $ 828,778 $1,280,825 $3,115,891 $3,112,706

73