Capital One 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Funding

Funding Availability

The Company has established access to a variety of funding alternatives in addition to securitization of its consumer

loans. Table 10 illustrates the Company’s unsecured funding sources.

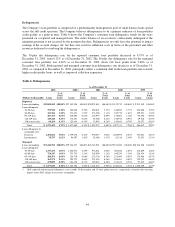

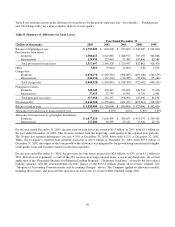

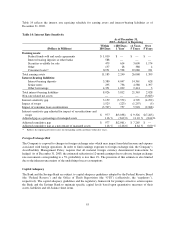

Table 10: Funding Availability

(Dollars or dollar equivalents in millions)

Effective/

Issue Date Availability(1)(6) Outstanding

Final

Maturity(5)

Senior and Subordinated Global Bank Note Program(2) 1/03 $2,800 $4,736 —

Senior Domestic Bank Note Program(3) 4/97 — $ 527 —

Revolving Credit Facility 5/03 $1,000 — 5/05

Multicurrency Facility(4) 8/00 $ 377 — 8/04

Collateralized Revolving Credit Facility — $2,697 $1,153 —

Corporation shelf registration 3/02 $1,948 N/A —

(1) All funding sources are non-revolving except for the Multicurrency Credit Facility, the Revolving Credit Facility and the Collateralized

Revolving Credit Facility. Funding availability under the credit facilities is subject to compliance with certain representations, warranties and

covenants. Funding availability under all other sources is subject to market conditions.

(2) The notes issued under the Global Senior and Subordinated Bank Note Program may have original terms of thirty days to thirty years from their

date of issuance. This program was updated in May 2003.

(3) The notes issued under the Senior Domestic Bank Note Program have original terms of one to ten years. The Senior Domestic Bank Note

Program is no longer available for issuances.

(4) US dollar equivalent based on the USD/Euro exchange rate as of December 31, 2003.

(5) Maturity date refers to the date the facility terminates, where applicable.

(6) Availability does not include unused conduit capacity related to securitization structures of $6.8 billion at December 31, 2003.

The Senior and Subordinated Global Bank Note Program gives the Bank the ability to issue securities to both U.S. and

non-U.S. lenders and to raise funds in U.S. and foreign currencies. The Senior and Subordinated Global Bank Note

Program had $4.7 billion outstanding at December 31, 2003. In January 2003, the Bank increased its capacity under the

Senior and Subordinated Global Bank Note Program to $8.0 billion and in May 2003 updated this Program. During

2003, under the Senior and Subordinated Global Bank Note Program, the Bank issued $500.0 million of five-year,

4.25% fixed rate bank notes in November, $600.0 million of seven-year, 5.75% fixed rate bank notes in September,

$500.0 million of ten-year, 6.5% fixed rate subordinated bank notes in June, and $600.0 million of five-year, 4.875%

fixed rate bank notes in May. Prior to the establishment of the Senior and Subordinated Global Bank Note Program, the

Bank issued senior unsecured debt through its $8.0 billion Senior Domestic Bank Note Program, of which

$526.5 million was outstanding at December 31, 2003. The Bank did not renew the Senior Domestic Bank Note

Program for future issuances following the establishment of the Senior and Subordinated Global Bank Note Program.

In May 2003, the Company terminated the Domestic Revolving Credit Facility and replaced it with a new revolving

credit facility providing for an aggregate of $1.0 billion in unsecured borrowings from various lending institutions to be

used for general corporate purposes (the “Revolving Credit Facility”). The Revolving Credit Facility is available to the

Corporation, the Bank, the Savings Bank and Capital One Bank (Europe) plc; however, the Corporation’s availability

is limited to $250.0 million. All borrowings under the Revolving Credit Facility are based on varying terms of London

InterBank Offering Rate (“LIBOR”). In January 2004, the Company increased the capacity of the Revolving Credit

Facility to $1.1 billion.

The Euro 300 million multicurrency revolving credit facility (the “Multicurrency Facility”) is available for general

purposes of the Bank’s business in the United Kingdom. The Corporation and the Bank serve as guarantors of all

borrowings by Capital One Bank (Europe), plc under the Multicurrency Facility. Internationally, the Company has

funding programs available to foreign investors or to raise funds in foreign currencies, allowing the Company to

borrow from U.S. and non-U.S. lenders, including foreign currency funding options under the Revolving Credit

49