Capital One 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

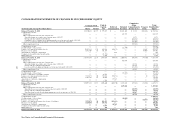

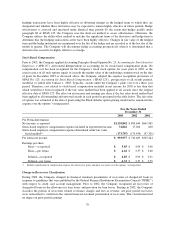

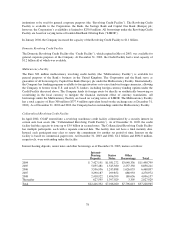

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in

conformity with GAAP. The following tables present information prepared from the Company’s internal

management information system, which is maintained on a line of business level through allocations from legal

entities.

For the Year Ended December 31, 2003

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 4,287,814 $ 727,987 $ 1,072,098 $ (49,985) $ 6,037,914 $ (3,252,825)$ 2,785,089

Non-interest income 3,583,357 101,984 605,821 (90,536) 4,200,626 1,215,298 5,415,924

Provision for loan losses 2,647,406 382,952 595,543 (70,877) 3,555,024 (2,037,527) 1,517,497

Non-interest expenses 3,348,894 289,414 988,321 253,963 4,880,592 — 4,880,592

Income tax provision (benefit) 693,702 58,314 29,216 (114,150) 667,082 — 667,082

Net income (loss) $ 1,181,169 $ 99,291 $ 64,839 $(209,457)$ 1,135,842 $ — $ 1,135,842

Loans receivable $46,278,750 $8,466,873 $16,507,937 $ (8,764)$71,244,796 $(38,394,527)$32,850,269

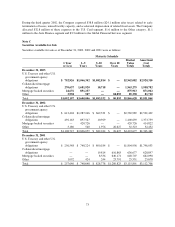

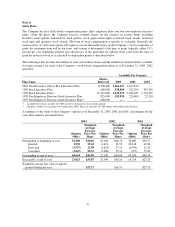

For the Year Ended December 31, 2002

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 3,931,880 $ 544,501 $ 750,540 $ 57,417 $ 5,284,338 $ (2,565,226) $ 2,719,112

Non-interest income 3,874,987 65,509 504,438 (33,760) 4,411,174 1,055,662 5,466,836

Provision for loan losses 2,801,423 361,717 440,616 55,136 3,658,892 (1,509,564) 2,149,328

Non-interest expenses 3,391,283 231,741 827,376 135,181 4,585,581 — 4,585,581

Income tax provision (benefit) 613,381 6,290 (4,883) (63,393) 551,395 — 551,395

Net income (loss) $ 1,000,780 $ 10,262 $ (8,131) $(103,267)$ 899,644 $ — $ 899,644

Loans receivable $40,862,142 $6,992,541 $11,868,006 $ 23,848 $59,746,537 $(32,402,607) $27,343,930

For the Year Ended December 31, 2001

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 2,988,939 $ 215,838 $ 484,183 $ (55,143)$ 3,633,817 $ (1,883,675)$ 1,750,142

Non-interest income 3,008,536 19,879 324,396 60,966 3,413,777 1,049,985 4,463,762

Provision for loan losses 1,589,242 174,897 251,862 (61,854) 1,954,147 (833,690) 1,120,457

Non-interest expenses 3,159,370 117,853 632,980 147,824 4,058,027 — 4,058,027

Income tax provision (benefit) 474,568 (21,672) (31,618) (27,823) 393,455 — 393,455

Net income (loss) $ 774,295 $ (35,361)$ (44,645)$ (52,324) $ 641,965 $ — $ 641,965

Loans receivable $33,037,910 $3,957,729 $8,318,395 $ (50,071) $45,263,963 $(24,342,949)$20,921,014

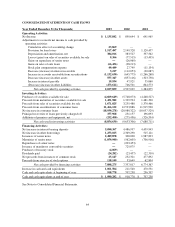

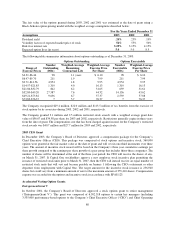

The $15.0 million ($23.9 million pre-tax) charge for the cumulative effect of a change in accounting principle

related to the adoption of FIN 46 was included in non-interest expense and reported in the Other category for

segment reporting for the year ended December 31, 2003.

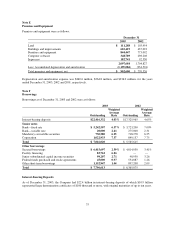

During the years ended December 31, 2003 and 2002, the Company sold $1.9 billion and $1.5 billion,

respectively, of auto loans. These transactions resulted in gains of $66.4 million and $28.2 million for the years

ended December 31, 2003 and 2002, respectively, of which $56.9 million and $24.6 million was allocated to the

Auto Finance segment while the remainder was held in the Other category.

During 2002, the Company realigned certain aspects of its European operations. Charges related to the

realignment of $12.5 million ($7.8 million after taxes) were recognized and allocated to the Global Financial

Services segment.

72