Capital One 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s Core Strategy: IBS

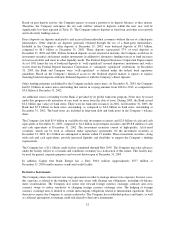

The Company’s core strategy has been, and is expected to continue to be, to apply its proprietary IBS to its

consumer lending business and other financial products. The Company continues to seek to identify new product

and new market opportunities, and to make investment decisions that are informed by the Company’s intensive

testing and analysis. The Company’s objective is to become a diversified consumer financial institution, which

may include expansion into additional geographic markets, other consumer loan products, and/or the retail

branch banking business.

The Company’s lending products and other products are subject to intense competitive pressures that

management anticipates will continue to increase as the lending markets mature, and that could affect the

economics of decisions that the Company has made or will make in the future in ways that it did not anticipate,

test or analyze.

U.S. Card Segment

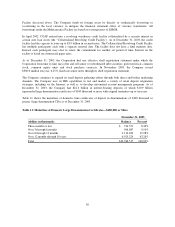

The Company’s U.S. Card segment consisted of $46.3 billion of U.S. consumer credit card receivables as of

December 31, 2003, marketed to consumers across the full credit spectrum. The Company’s strategy for its U.S.

Card business is to gradually increase the proportion of higher credit quality loans in its portfolio and to offer

compelling, value-added products to its customers, such as Lifestyles and Rewards credit cards.

The competitive environment is currently intense for credit card products. Industry mail volume has increased

substantially in recent years, resulting in declines in response rates to the Company’s new customer solicitations.

Additionally, competition has increased the attrition levels in the Company’s existing portfolio. Despite this

intense competition, the Company continues to believe that its IBS approach will enable it to originate new credit

card accounts that exceed the Company’s return on investment requirements.

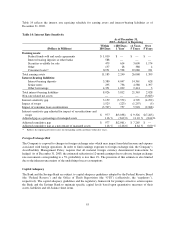

The Company continues to use its IBS to test new credit card products. In 2003, the Company increased

marketing of its balance building, low-fixed rate and MilesOne Rewards cards, which are each targeted at

consumers with strong credit histories. These products, together with other high credit quality consumer card

products, tend to be more expensive for the Company to originate, and produce revenues and balances more

slowly than credit card products marketed to customers with weaker credit histories.

The Company’s credit card products marketed to consumers with less established or higher risk credit profiles

continue to experience steady mail volume and increased pricing competition. These products generally feature

higher annual percentage rates, lower credit lines, and annual membership fees. They are less expensive to

originate and produce revenues more quickly than higher credit quality loans.

Additionally, since these borrowers are generally viewed as higher risk, they tend to be more likely to pay late or

exceed their credit limit, which results in additional fees assessed to their accounts. The Company’s strategy has

been, and is expected to continue to be, to offer competitive annual percentage rates and annual membership, late

and overlimit fees on these accounts. This portion of the Company’s U.S. consumer credit card business

experienced little to no growth in 2003, but is expected to resume a moderate growth rate in 2004.

Auto Finance Segment

This segment consisted of $8.5 billion of U.S. auto receivables as of December 31, 2003, marketed across the

credit spectrum, via direct and indirect marketing channels. The Company expects to increase its auto loan

portfolio more quickly in prime and direct marketed products than through other products or channels in 2004.

The Company continues to believe that full credit spectrum financing provides competitive advantage and scale

benefits to the auto business but expects its auto loan portfolio will continue to shift to higher credit quality

loans in 2004.

59