Capital One 2003 Annual Report Download - page 71

Download and view the complete annual report

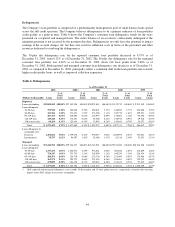

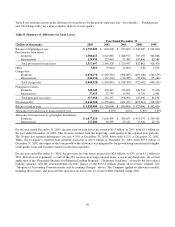

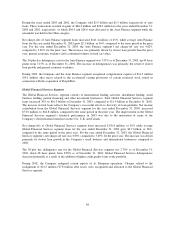

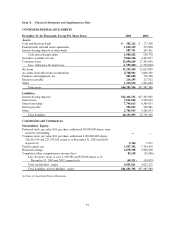

Please find page 71 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based on past deposit activity, the Company expects to retain a portion of its deposit balances as they mature.

Therefore, the Company anticipates the net cash outflow related to deposits within the next year will be

significantly less than reported in Table 13. The Company utilizes deposits to fund loan and other asset growth

and to diversify funding sources.

Direct deposits are deposits marketed to and received from individual customers without the use of a third-party

intermediary. Other deposits are deposits generally obtained through the use of a third-party intermediary.

Included in the Company’s other deposits at December 31, 2003, were brokered deposits of $8.3 billion,

compared to $6.5 billion at December 31, 2002. These deposits represented 37% of total deposits at

December 31, 2003 and 2002. If these brokered deposits are not renewed at maturity, the Company would use its

investment securities and money market instruments in addition to alternative funding sources to fund increases

in loan receivables and meet its other liquidity needs. The Federal Deposit Insurance Corporation Improvement

Act of 1991 limits the use of brokered deposits to “well-capitalized” insured depository institutions and, with a

waiver from the Federal Deposit Insurance Corporation, to “adequately capitalized” institutions. At December

31, 2003, the Bank and Company were “well-capitalized” as defined under the federal bank regulatory

guidelines. Based on the Company’s historical access to the brokered deposit market, it expects to replace

maturing brokered deposits with new brokered deposits or with the Company’s direct deposits.

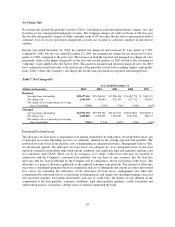

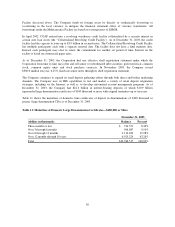

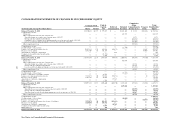

Other funding programs established by the Company include senior notes. At December 31, 2003, the Company

had $7.0 billion in senior notes outstanding that mature in varying amounts from 2004 to 2013, as compared to

$5.6 billion at December 31, 2002.

An additional source of funding for the Bank is provided by its global bank note program. Notes may be issued

under this program with maturities of one week or more from the date of issue. During 2003, the Bank issued

$2.2 billion (par value) of bank notes. There were no bank note issuances in 2002. At December 31, 2003, the

Bank had $5.3 billion in bank notes outstanding, as compared to $4.0 billion in bank notes outstanding at

December 31, 2002. The bank notes are included in long-term debt and bank notes in the Company’s balance

sheet.

The Company also held $5.9 billion in available-for-sale investment securities and $2.0 billion of cash and cash

equivalents at December 31, 2003, compared to $4.4 billion in investment securities and $918.8 million of cash

and cash equivalents at December 31, 2002. The investment securities consist of high-quality, AAA-rated

securities, which can be used as collateral under repurchase agreements. Of the investment securities at

December 31, 2003, $1.1 billion are anticipated to mature within 12 months. These investment securities, along

with cash and cash equivalents, provide increased liquidity and flexibility to support the Company’s funding

requirements.

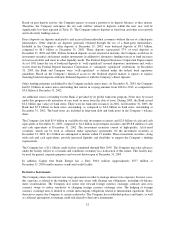

The Company has a $1.1 billion credit facility committed through May 2005. The Company may take advances

under the facility subject to covenants and conditions customary in a transaction of this nature. This facility may

be used for general corporate purposes and was not drawn upon at December 31, 2003.

In addition Capital One Bank Europe has a Euro 300.0 million (approximately $377 million at

December 31, 2003) multi-currency syndicated credit facility.

Derivative Instruments

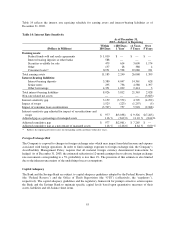

The Company enters into interest rate swap agreements in order to manage interest rate exposure. In most cases,

this exposure is related to the funding of fixed rate assets with floating rate obligations, including off-balance

sheet securitizations. The Company also enters into forward foreign currency exchange contracts and cross

currency swaps to reduce sensitivity to changing foreign currency exchange rates. The hedging of foreign

currency exchange rates is limited to certain intercompany obligations related to international operations. These

derivatives expose the Company to certain credit risks. The Company has established policies and limits, as well

as collateral agreements, to manage credit risk related to derivative instruments.

53