Capital One 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.marketing and for servicing our 47.0 million accounts as of December 31, 2003. As our business develops,

changes or expands, additional expenses can arise from asset purchases, structural reorganization, a reevaluation

of business strategies and/or expenses to comply with new or changes laws or regulations. Other factors that can

affect the amount of our expenses include legal and administrative cases and proceedings, which can be

expensive to pursue or defend. In addition, changes in accounting policies can significantly affect how we

calculate expenses and earnings.

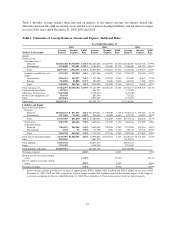

Statistical Information

The statistical information required by Item 1 can be found in Item 6 “Selected Financial Data”, Item 7

“Management Discussion and Analysis of Financial Condition and Results of Operations” and in Item 8,

“Financial Statements and Supplementary Data”, as follows:

I. Distribution of Assets, Liabilities and Stockholders’

Equity; Interest Rates and Interest Differential pages 37-38

II. Investment Portfolio page 73

III. Loan Portfolio pages 37-38; 41-42; 45-46; 59-60; 68

IV. Summary of Loan Loss Experience pages 45-46; 74

V. Deposits pages 50-51; 75-78

VI. Return on Equity and Assets page 29

VII. Other Borrowings pages 49-51; 75-78

Item 2. Properties.

We lease our new, 570,000 square foot, headquarters building at 1680 Capital One Drive, McLean, Virginia. The

building houses our primary executive offices and Northern Virginia staff, and is leased through December 2010,

with the right to purchase at a fixed cost at the end of the lease term.

Additionally, we own approximately 316 acres of land in Goochland County, Virginia for the construction of an

office campus to consolidate certain operations in the Richmond area. In 2002 two office buildings and a support

facility consisting of approximately 365,000 square feet, and in 2003 five buildings consisting of approximately

750,000 square feet were completed and occupied respectively.

Other owned facilities include 460,000 square feet in office buildings and a 120,000 square foot facility in

Tampa, Florida; 240,000 square feet in office and production buildings in Seattle, Washington; 460,000 square

feet in office, data and production buildings in Richmond, Virginia; a 484,000 square foot facility in Nottingham,

Great Britain; and 470,000 square feet in administrative offices and credit card facilities in Richmond, Virginia,

from which we conduct credit, collections, customer service and other operations.

We currently lease 2.5 million square feet of office space from which credit, collections, customer service and

other operations are conducted, in Virginia, Texas, Idaho, California, Massachusetts, the United Kingdom,

Canada, and insignificant space for business development in other locations. We are currently migrating out of

approximately 1 million square feet of leased office space and into our new campuses in McLean, Virginia and

Goochland County, Virginia.

Generally, we use our properties to support all three of our business segments, although our properties located

outside of the U.S. are used principally to support our Global Financial Services segment, and our properties in

Texas and California are used principally to support our Auto Finance segment.

Item 3. Legal Proceedings.

The information required by Item 3 is included in Item 8, “Financial Statements and Supplementary Data—Notes

to the Consolidated Financial Statements—Note P” on pages 89-90.

27