Capital One 2003 Annual Report Download - page 84

Download and view the complete annual report

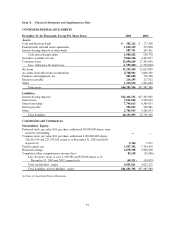

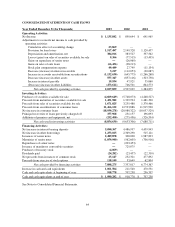

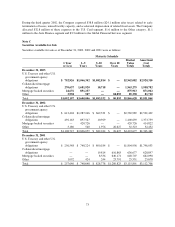

Please find page 84 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.March 31, 2003. The Company reclassified $577.0 million and $509.7 million in subordinated finance charge

and fee receivables on the investors’ interest in securitized loans for December 2003 and 2002, respectively, from

“Consumer loans” to “Accounts receivable from securitizations” on the Consolidated Balance Sheets and

reclassified $74.8 million and $76.2 million for the year ended December 31, 2003 and 2002, respectively, in

interest income derived from such balances from “Consumer Loan Interest Income” to “Other Interest Income”

on the Consolidated Statements of Income. Information required for the reclassification was unavailable for

periods prior to 2002.

In January 2003, the FASB issued FASB Interpretation No. 46 (“FIN 46”), Consolidation of Variable Interest

Entities, an Interpretation of ARB No. 51. This interpretation addresses consolidation of business enterprises of

variable interest entities (“VIEs”), which have certain characteristics. These characteristics include either that the

equity investment at risk is not sufficient to permit the entity to finance its activities without additional

subordinated financial support from other parties; or that the equity investors in the entity lack one or more of the

essential characteristics of a controlling financial interest. Originally, FIN 46 applied immediately to VIEs

created after January 31, 2003, and on July 1, 2003 for VIEs acquired before February 1, 2003. In October 2003,

the FASB issued FASB Staff Position FIN 46-6, which deferred the application of FIN 46 for public entities until

the first interim period ending after December 15, 2003, for VIEs acquired before February 1, 2003 only. The

Company elected to early adopt the provisions of FIN 46 for the interim period ended September 30, 2003. The

Company has consolidated all material VIEs for which the Company is the primary beneficiary, as defined under

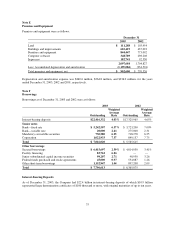

FIN 46, effective July 1, 2003. The Company recorded premises and equipment of $139.8 million, other

borrowings of $178.3 million and recognized a charge of $15.0 million, net of tax, for a cumulative effect of a

change in accounting principle.

The Company has determined that it does not have any significant interest in VIEs for which it is not the primary

beneficiary. All securitization transactions that receive sale treatment under SFAS No. 140, Accounting for

Transfers and Servicing of Financial Assets and Extinguishment of Liabilities—a Replacement of SFAS No. 125

(“SFAS 140”), are accomplished through qualifying special purpose entities and such transactions are not subject

to the provisions of FIN 46. The Company has also evaluated the trust related to the junior subordinated capital

income securities under the provisions of FIN 46 and has determined that the deconsolidation of the trust would

not have a material impact on the consolidated earnings or financial position of the Company.

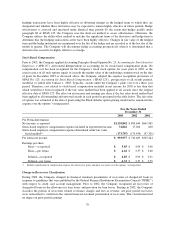

In December 2002, the FASB issued Statement of Financial Accounting Standard No. 148, Accounting for Stock-

Based Compensation—Transition and Disclosure—an Amendment of SFAS No. 123, (“SFAS 148”). SFAS 148

provides alternative methods of transition for a voluntary change to the fair value based method of accounting for

stock-based employee compensation. It also amends the disclosure requirements of SFAS No. 123, Accounting

for Stock-Based Compensation (“SFAS 123”), to require prominent disclosures in both annual and interim

financial statements about the method of accounting for stock-based employee compensation and the effect of the

method used on reported results. In December 2003, the Company adopted the expense recognition provisions of

SFAS 123 under the prospective method allowed by SFAS 148, to all awards granted, modified or settled after

January 1, 2003. The adoption of the expense recognition provisions of SFAS 123 resulted in the recognition of

pre-tax compensation expense of $5.0 million for the year ended December 31, 2003.

In November 2002, the FASB issued FASB Interpretation No. 45 (“FIN 45”), Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others, an

interpretation of FASB Statements No. 5, 57, and 107 and rescission of FASB Interpretation No. 34.FIN45

elaborates on the disclosures to be made by a guarantor in its interim and annual financial statements about its

obligations under certain guarantees that it has issued. It also clarifies that a guarantor is required to recognize, at

the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee.

FIN 45 requires the initial disclosure of applicable guarantees in all issuances of financial statements of interim

or annual periods ending after December 15, 2002. The additional provisions for initial recognition and

measurement are effective on a prospective basis for guarantees that are issued or modified after December 31,

2002, irrespective of a guarantor’s year-end. The Company adopted the disclosure provisions required by FIN 45

66