Capital One 2003 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

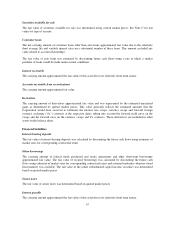

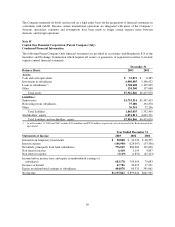

Year Ended December 31

Statements of Cash Flows 2003 2002 2001

Operating Activities:

Net income $1,135,842 $ 899,644 $ 641,965

Adjustments to reconcile net income to net cash provided by operating

activities:

Equity in undistributed earnings of subsidiaries (404,878) (69,531) (545,061)

Amortization of discount of senior notes 12,518 ——

Stock plan compensation expense 49,449 27,749 (11,134)

Decrease (increase) in other assets 53,197 50,788 (36,567)

Decrease (increase) in other liabilities 4,135 (33,328) (22,118)

Net cash provided by operating activities 850,263 875,322 27,085

Investing Activities:

Increase in investment in subsidiaries (350,000) (1,210,000) (653,202)

Increase in loans to subsidiaries (643,603) (559,774) (252,257)

Net cash used in investing activities (993,603) (1,769,774) (905,459)

Financing Activities:

(Decrease) increase in borrowings from subsidiaries (117,698) (376,598) 365,109

Issuance of senior notes 298,581 300,000 —

Issuance of mandatory convertible securities — 725,075 —

Maturities of senior notes (125,000) ——

Dividends paid (24,282) (23,457) (22,310)

Purchases of treasury stock (4,069) ——

Net proceeds from issuances of common stock 25,147 232,321 473,334

Proceeds from exercise of stock options 118,149 33,649 62,804

Net cash provided by financing activities 170,828 890,990 878,937

Increase (decrease) in cash and cash equivalents 27,488 (3,462) 563

Cash and cash equivalents at beginning of year 6,385 9,847 9,284

Cash and cash equivalents at end of year $ 33,873 $ 6,385 $ 9,847

100