Capital One 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We proved that our approach is a winner far and wide.

We’ve been extending the reach of Capital One in two directions—

broadening our product portfolio and expanding beyond the

United States.

In auto finance and other areas, we’ve diversified by acquisition,

but in installment loans and other sectors closely resembling credit

cards, we’ve built our businesses from the ground up. Our typical

installment loan customer has a high income and an excellent credit

history, factors that allow us to offer low fixed rates and still produce

superior returns.

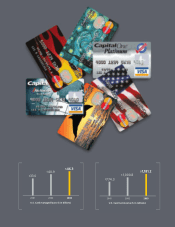

Our Capital One Business MilesOne®card serves the needs of

small-business owners, offering credit lines tailored to the enterprise,

discounts on purchases from Visa®Business Platinum partners and the

country’s best airline miles plan. Our recently introduced Small Business

Administration (SBA) loans feature low rates and are designed to

minimize the paperwork of obtaining these government-backed

loans. Capital One’s managed loans now include $3.3 billion to small-

business owners.

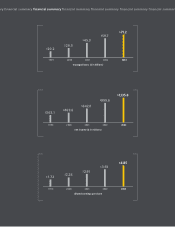

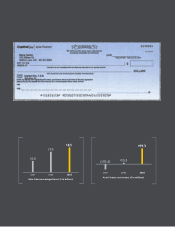

By marketing certificates of deposit and other savings instruments,

Capital One is attracting new customers, deepening its relationship

with existing customers and providing the Company with another

source of stable, low-cost funding. During 2003, deposits in Capital One

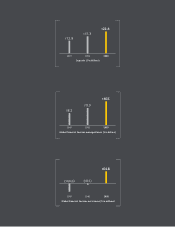

Bank and Capital One F.S.B. rose from $17.3 billion to $22.4 billion.

Outside the United States, the credit card market is entering an

era of tremendous opportunity. The international consumer credit

market is three times the size of the U.S. market, and credit card

lending abroad is growing three times faster than in the United States.

During 2003, our 2,200 international associates delivered their

first profits, increasing the Company’s net income by $58.6 million.

International loans outstanding reached $7.6 billion, up 43% for

the year. In the UK, Capital One is the sixth-largest card issuer, with

3 million accounts. We’re also one of the top 10 credit card

companies in Canada, where we have nearly 1 million accounts.

bal financial services global financial services global financial services global financial services global financial servic

12