Capital One 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fair value of the investments in an unrealized loss position at December 31, 2003 was $1.6 billion. Individual

investments held at December 31, 2003, have not been in an unrealized loss position for more than twelve

months. The Company has determined that these investments have only temporary impairment based on a

number of criteria, including the timeframe of the unrealized loss position, the nature of the investments and the

Company’s intent to hold the fixed income securities to maturity.

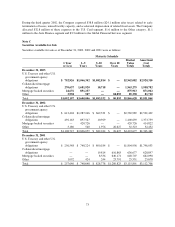

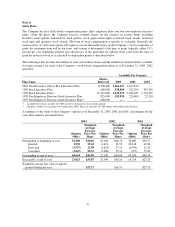

Weighted Average Yields

1Year

or Less

1–5

Years

5–10

Years

Over 10

Years

December 31, 2003

U.S. Treasury and other U.S. government agency obligations 2.05% 3.26% 4.44% —

Collateralized mortgage obligations 6.94 4.75 4.98 —

Mortgage backed securities 6.35 5.24 — —

Other 0.16 6.45 — 4.92%

Total 3.35% 4.42% 4.45% 4.92%

The distribution of mortgage-backed securities and collateralized mortgage obligations is based on average

expected maturities. Actual maturities could differ because issuers may have the right to call or prepay

obligations.

Weighted average yields were determined based on amortized cost. Gross realized gains on sales of securities

were $10.5 million, $96.9 million, and $19.1 million for the years ended December 31, 2003, 2002 and 2001,

respectively. Gross realized losses were $19.9 million, $19.4 million, and $5.6 million for the years ended

December 31, 2003, 2002 and 2001, respectively.

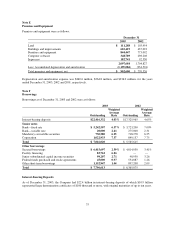

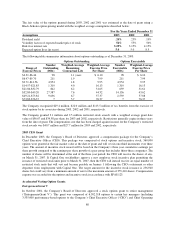

Note D

Allowance for Loan Losses

The following is a summary of changes in the allowance for loan losses:

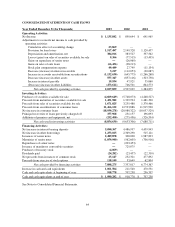

Year Ended December 31

2003 2002 2001

Balance at beginning of year $ 1,720,000 $ 840,000 $ 527,000

Provision for loan losses 1,517,497 2,149,328 1,120,457

Other 3,863 (9,644) 14,800

Charge-offs (2,004,328) (1,490,841) (1,018,350)

Principal recoveries 357,968 231,157 196,093

Net charge-offs (1,646,360) (1,259,684) (822,257)

Balance at end of year $ 1,595,000 $ 1,720,000 $ 840,000

Loans totaling approximately $454.8 million and $567.4 million, representing amounts which were greater than

90 days past due, were included in the Company’s reported loan portfolio as of December 31, 2003 and 2002,

respectively.

74