Capital One 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketing

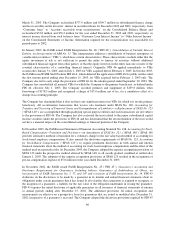

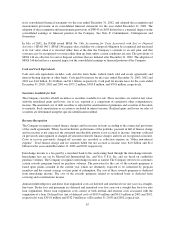

The Company expenses marketing costs as incurred. Television advertising costs are expensed during the period

in which the advertisements are aired.

Credit Card Fraud Losses

The Company experiences fraud losses from the unauthorized use of credit cards. Transactions suspected of

being fraudulent are charged to non-interest expense after a sixty-day investigation period.

Income Taxes

Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax

bases of assets and liabilities, and are measured using the enacted tax rates and laws that will be in effect when

the differences are expected to reverse.

Segments

The accounting policies of operating and reportable segments, as defined by the Statement of Financial

Accounting Standard No. 131, Disclosures about Segments of an Enterprise and Related Information, (“SFAS

131”) are the same as those described elsewhere in this footnote. Revenue for all segments is derived from

external parties. Performance evaluation of and resource allocation to each reportable segment is based on a wide

range of indicators to include both historical and forecasted operating results. See Note B, Segments, for further

discussion of the Company’s operating and reportable segments.

Derivative Instruments and Hedging Activities

The Company recognizes all of its derivative instruments as either assets or liabilities in the balance sheet at fair

value. The accounting for changes in the fair value (i.e., gains and losses) of a derivative instrument depends on

whether it has been designated and qualifies as part of a hedging relationship and, further, on the type of hedging

relationship. For those derivative instruments that are designated and qualify as hedging instruments, a company

must designate the hedging instrument, based upon the exposure being hedged, as a fair value hedge, a cash flow

hedge or a hedge of a net investment in a foreign operation.

For derivative instruments that are designated and qualify as fair value hedges (i.e., hedging the exposure to

changes in the fair value of an asset or a liability or an identified portion thereof that is attributable to a particular

risk), the gain or loss on the derivative instrument as well as the offsetting loss or gain on the hedged item

attributable to the hedged risk is recognized in current earnings during the period of the change in fair values. For

derivative instruments that are designated and qualify as cash flow hedges (i.e., hedging the exposure to

variability in expected future cash flows that is attributable to a particular risk), the effective portion of the gain

or loss on the derivative instrument is reported as a component of other comprehensive income and reclassified

into earnings in the same period or periods during which the hedged transaction affects earnings. The remaining

gain or loss on the derivative instrument in excess of the cumulative change in the present value of future cash

flows of the hedged item, if any, is recognized in current earnings during the period of change. For derivative

instruments that are designated and qualify as hedges of a net investment in a foreign operation, the gain or loss

is reported in other comprehensive income as part of the cumulative translation adjustment to the extent it is

effective. For derivative instruments not designated as hedging instruments, the gain or loss is recognized in

current earnings during the period of change in the fair value.

The Company formally documents all hedging relationships, as well as its risk management objective and

strategy for undertaking the hedge transaction. The hedge instrument and the hedged item are designated at the

execution of the hedge instrument or upon re-designation during the life of the hedge. At inception, at least

quarterly or upon re-designation, the Company also formally assesses whether the derivatives that are used in

69