Capital One 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

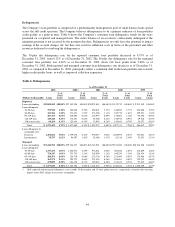

Reportable Segments

The Company manages its business by three distinct operating segments: U.S. Card, Auto Finance and Global

Financial Services. The U.S. Card, Auto Finance and Global Financial Services segments are considered

reportable segments based on quantitative thresholds applied to the managed loan portfolio for reportable

segments provided by SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information.

Management decision making is performed on a managed portfolio basis, and such information about reportable

segments is provided on a managed basis.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in

conformity with GAAP. The following table presents information prepared from the Company’s internal

management information system, which is maintained on a line of business level through allocations from legal

entities.

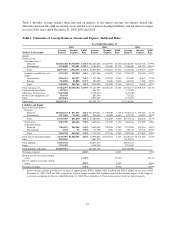

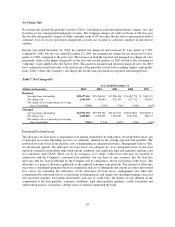

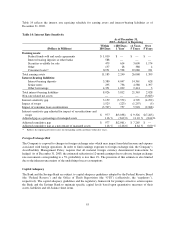

Table 9: Segments (Managed Basis)

U.S. Card Auto Finance Global Financial Services

(Dollars in thousands) 2003 2002 2003 2002 2003 2002

Loans receivable $46,278,750 $40,862,142 $8,466,873 $6,992,541 $16,507,937 $11,868,006

Net income 1,181,169 1,000,780 99,291 10,262 64,839 (8,131)

Net charge-off rate 6.88% 5.89% 4.62% 3.82% 3.83% 3.49%

30+ Delinquency rate 4.60 6.07 7.55 7.15 2.70 3.08

U.S. Card Segment

The U.S. card segment consists primarily of domestic credit card lending activities. Total U.S. Card segment

loans increased 13% to $46.3 billion at December 31, 2003, compared to $40.9 billion at December 31, 2002.

The loan growth in this segment reflects, among other things, the Company’s continued success in applying IBS.

The contribution to net income from the U.S. Card segment increased $180.4 million, or 18%, to $1.2 billion for

the year ended December 31, 2003.

Net charge-offs of U.S. Card segment loans increased $674.3 million, or 31%, while average U.S. Card segment

loans for the year ended December 31, 2003 grew $4.5 billion, or 12% compared to the same period in the prior

year. For the year ended December 31, 2003, the U.S. Card segment’s net charge-off rate was 6.88%, compared

to 5.89% for 2002. This increase was driven by the seasoning of loans in the portfolio during the first half of

2003 offset in part by the addition of higher quality credit loans to the portfolio throughout 2003.

The 30-plus day delinquency rate for the U.S. Card segment was 4.60% as of December 31, 2003, down 147

basis points from 6.07% as of December 31, 2002. The decrease in delinquencies is due to the addition of higher

credit quality loans to the portfolio in 2003 and improvements in collection experience.

During the third quarter of 2002, the Company expensed $38.8 million related to the early termination of leases,

unused facility capacity, and accelerated depreciation of related fixed assets. The Company allocated $32.8

million of these expenses to the U.S. Card segment.

Auto Finance Segment

The Auto Finance segment primarily consists of automobile financing activities. Total Auto Finance segment

loans outstanding increased 21% to $8.5 billion at December 31, 2003, compared to $7.0 billion at December 31,

2002. The increase in auto loans outstanding was the result of, among other things, expanded organizational

capabilities and increased reliance on proven IBS concepts. For the year ended December 31, 2003, the net

income contribution from the Auto Finance segment increased $89.0 million compared to 2002.

47